The launch of Bitcoin exchange-traded funds (ETFs) in January marked a significant milestone. However, financial advisors are approaching these new investment vehicles with caution.

BlackRock’s Chief Investment Officer of ETF and Index Investments, Samara Cohen, provided insights during the Coinbase State of Crypto Summit in New York City.

Why Financial Advisors Shun Bitcoin ETFs

Cohen explained that about 80% of Bitcoin ETF purchases are currently made by self-directed investors using online brokerage accounts. According to last quarter’s 13-F filings, hedge funds and brokerages have also been active buyers. However, registered investment advisors remain hesitant.

Cohen stated, “I would call them wary… That’s their job.” She emphasized the fiduciary responsibility that advisors have to their clients, noting that Bitcoin’s historical price volatility, which has reached 90% at times, necessitates thorough risk analysis and due diligence.

Financial advisors meticulously evaluate data and risk analytics to determine Bitcoin’s appropriate role in investment portfolios, considering factors such as risk tolerance and liquidity needs.

“This is a moment, in terms of really putting forward important data, risk analytics [and determining] the role Bitcoin can play in a portfolio, what sort of allocation is appropriate given an investor’s risk tolerance, their liquidity needs. That’s what an advisor is supposed to do, so I think this journey that we’re on is exactly the right one and they’re doing their jobs,” Cohen added.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

While financial advisors remain cautious, some analysts hold a bullish outlook on Bitcoin’s future.

Bernstein, a major asset manager with $725 billion in assets, predicts that Bitcoin’s price could reach $1 million by 2033. The new forecast suggests a cycle-high of $200,000 by 2025. This prediction is driven by unprecedented demand from spot ETFs and Bitcoin’s limited supply.

Bernstein’s previous estimate was $150,000 for 2025, reflecting their growing optimism about Bitcoin’s potential.

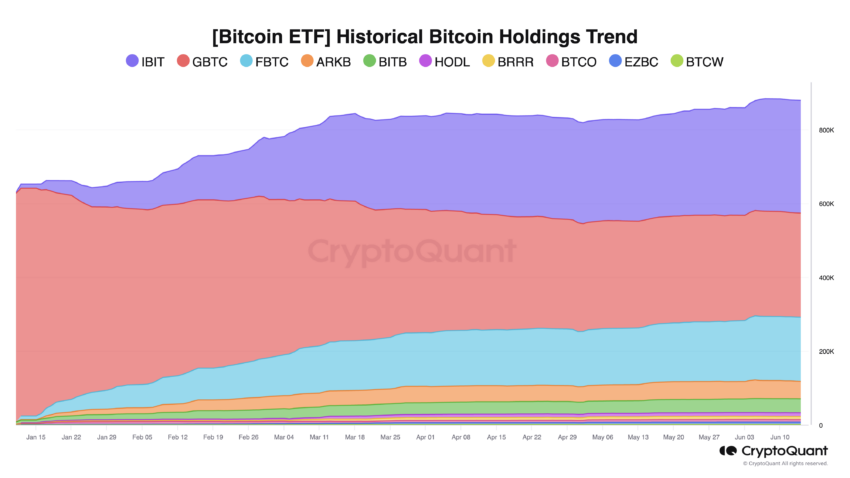

“Around $15 billion of net new flows have been brought in by the ETFs combined. We expect Bitcoin ETFs to be equivalent to approximately 7% of Bitcoin in circulation by 2025 and nearly 15% of Bitcoin supply by 2033,” Bernstein analysts wrote.

Read more: Bitcoin (BTC) Price Prediction 2024 / 2025 / 2030

WAX co-founder William Quigley also commented on the proliferation of ETFs for other cryptocurrencies like Solana. “Wall Street is greedy,” Quigley said, suggesting that the success of Bitcoin ETFs will spur similar products.

However, he cautioned that if the momentum slows, ETF providers might shift focus or shut down underperforming ETFs due to a lack of demand.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.