Polkadot (DOT), a pioneering layer-0 blockchain, is making significant strides in tokenizing real-world assets (RWA).

Amid the growing buzz surrounding RWA tokenization, industry experts believe Polkadot has the potential to be a market leader. Several projects in its ecosystem also support this view.

Key Insights into Polkadot’s Role in Real-World Asset Tokenization

Polkadot’s architecture, designed for interoperability and scalability, is ideal for tokenizing assets like real estate, commodities, and intellectual property. The JAM Whitepaper (Polkadot 2.0) could further solidify Polkadot’s position in the RWA tokenization market. This initiative bridges traditional finance with the crypto economy, providing a compliant, secure, and scalable solution for asset tokenization.

Crypto analyst Michaël van de Poppe recently discussed Polkadot’s impact on the sector. He highlighted Polkadot’s Software Development Kit (SDK) as a highly popular tool in the crypto ecosystem.

Read more: RWA Tokenization: A Look at Security and Trust

The SDK allows developers to build projects with minimal investment in blockchain technology. Consequently, this ease of use facilitates RWA integration into the Polkadot network, using the SDK to establish a strong framework for asset tokenization.

“In the meantime, Polkadot has been providing some interesting RWA integrations, as the SDK has been used for those,” he noted.

Echoing Van de Poppe, Jean-Hugues Gavarini, Co-Founder and CEO of Web3 firm LAKE, further emphasizes Polkadot’s SDK role in paving the way for the blockchain to enter the RWA segment. He also highlights the potential of the JAM Whitepaper.

“Polkadot’s foray into the RWA segment brings substantial benefits to the blockchain ecosystem, particularly through its advanced interoperability and scalability features. The JAM Whitepaper’s advancements in SDK and RWA integrations are set to drive broader adoption in traditional markets such as real estate and renewable energy,” Gavarini explained.

Polkadot’s Key Projects in Real-World Asset Tokenization

Polkadot’s ecosystem includes several noteworthy projects focused on RWA tokenization. Energy Web, for instance, tokenizes green and renewable energy assets. The project aims to accelerate the energy transition by deploying open-source Web3 technologies and integrating distributed energy resources into the grid.

One standout project in Polkadot’s RWA ecosystem is Xcavate, which democratizes real estate investment and makes it more accessible to a broader audience. Using the Polkadot SDK, Xcavate automates token transfers and mitigates counterparty risks. Furthermore, the project ensures global access to early-stage real estate investments with low entry barriers.

Another significant project is the layer-1 (L1) application chain Phyken Network. Phyken focuses on bringing green and renewable energy assets on-chain, fractionalizing them, and making them accessible to millions of investors. The project employs a novel know-your-customer (KYC) mechanism using decentralized identities and institutional-grade verifiable credentials to ensure asset authenticity and ownership.

Additionally, Centrifuge, one of the most popular RWA tokenization projects within the Polkadot ecosystem, ranks seventh in market capitalization among similar projects. Centrifuge provides liquidity to small and medium-sized enterprises (SMEs) by enabling them to tokenize real-world assets like invoices, which can be used as collateral for financing.

In addition to these projects, a representative from Parity Technologies, the leading technical contributor to Polkadot, told BeInCrypto that other teams like Agrotoken are already using the Polkadot platform to build innovative solutions in the RWA industry. He believes these projects feel Polkadot’s current technology stack offers scope for further RWA opportunities.

“New teams from the RWA sector are also joining Polkadot. Partnerships, many of which have previously involved Parity, remain critically important as a means to facilitate adoption and encourage further interest in Web3,” he added.

Despite Polkadot’s huge potential in the real-world asset tokenization industry, Gavarini noted that some challenges might occur.

“Nonetheless, Polkadot will need to navigate regulatory landscapes and ensure seamless integration with existing financial systems to realize this potential and fully maximize these opportunities,” he said.

Industry Insights and Future Prospects

Real-world asset tokenization involves converting tangible and intangible assets into digital tokens tradable on a blockchain. This process simplifies transactions, adds liquidity to traditionally illiquid assets, and ensures transparency and security. Therefore, industry experts believe tokenizing real-world assets is crucial for the mass adoption of blockchain technology.

Larry Fink, CEO of BlackRock, has emphasized the potential of tokenization to revolutionize financial instruments. He envisions a future where every stock and bond has a unique identifier on a blockchain. This would allow for customized investment strategies and instantaneous settlements.

Jenny Johnson, CEO of Franklin Templeton, also highlighted the transformative potential of tokenizing real-world assets. She cited examples such as Rihanna’s NFT royalties and loyalty programs at St. Regis in Aspen.

These examples demonstrate the technology’s ability to lower entry points and operational costs. They also make professional asset management more accessible to younger investors.

Read more: What is Tokenization on Blockchain?

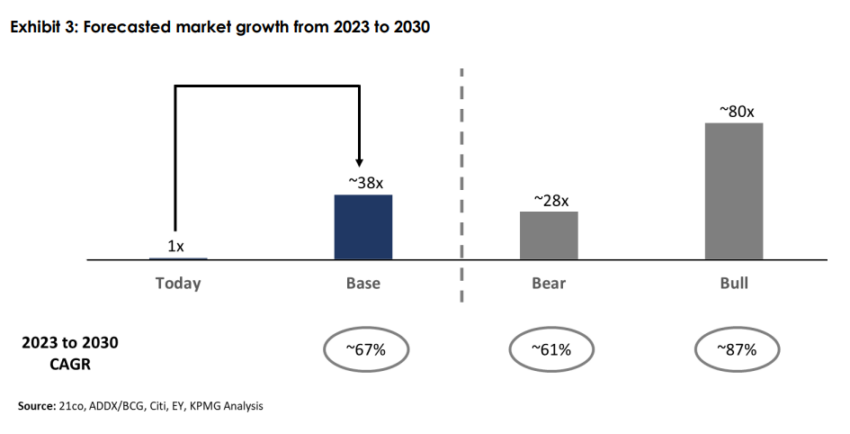

According to a report by KPMG, the potential to tokenize global illiquid assets is a multi-trillion-dollar opportunity. The market is expected to grow significantly by 2030, with forecasts suggesting an increase from the 2023 baseline by at least 28 to 80 times. Expanding adoption and positive regulatory discussions will also further drive this growth.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.