VanEck, a leading asset manager, has boldly predicted that Ethereum (ETH) will reach $22,000 per coin by 2030. This projection stems from the anticipated approval of spot Ethereum exchange-traded funds (ETFs).

According to the firm, such approval would enable financial advisors and institutional investors to hold Ethereum securely and benefit from improved pricing and liquidity. This potential market development shows cryptocurrencies’ growing acceptance and integration into traditional financial systems.

Ethereum’s Growth and Value Proposition According to VanEck

VanEck has updated its financial model to evaluate ETH’s investment case. It highlights Ethereum’s impressive value proposition. The model points to significant contributions from various sectors, including finance, banking, payments, marketing, advertising, social gaming, infrastructure, and artificial intelligence.

Ethereum’s open-source nature fosters innovation and connectivity among applications, offering unique value propositions not found in traditional platforms. This advantage positions Ethereum as a disruptive force capable of attracting substantial market share from established financial and tech giants.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

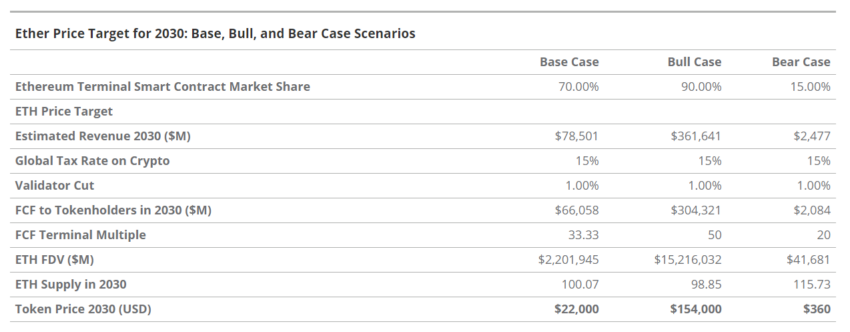

“Should [Ethereum] do so while maintaining its dominant position among smart contract platforms, we see a credible path to $66 billion in free cash flow to token holders supporting a $2.2 trillion asset by 2030,” VanEck wrote.

Moreover, VanEck sees ETH offering investors exposure to a high-growth, internet-native commercial system. The firm analyzed key Ethereum metrics, including 20 million monthly active users and $4 trillion in transactions. Over the past year, Ethereum also facilitated $5.5 trillion in stablecoin transfers.

“The centerpiece asset of this financial system is the ETH token, and in our updated base case, we believe it to be worth $22,000 by 2030, representing a total return of 487% from today’s ETH price, a compound annual growth rate (CAGR) of 37.8%,” the firm stated.

The $22,000 price prediction is based on the base case. VanEck’s analysts estimate that Ethereum could reach $154,000 in a bull case and $360 in a bear case.

However, ETH’s valuation remains susceptible to several risks. These include speculation, regulatory changes, interest rate fluctuations, competition from other blockchain platforms, and geopolitical factors.

Indeed, the potential approval of spot Ethereum ETF has sparked fresh interest in the crypto market. In late May, the British banking giant Standard Chartered also made a bullish prediction on Ethereum’s future price.

Geoff Kendrick, Head of FX Research and Digital Assets Research at Standard Chartered, predicted that ETH could reach $8,000 by the end of 2024. Assuming the bank’s estimated Bitcoin (BTC) price level of $200,000 by the end of 2025, this could imply an Ethereum price of $14,000 by then. Kendrick further predicted that spot ETFs could attract an influx of 2.39 – 9.15 million ETH in the first 12 months following approval.

Read more: Ethereum ETF Explained: What It Is and How It Works

“In US dollar terms, that equates to roughly $15 billion to $45 billion,” he said.

It is important to note that the US Securities and Exchange Commission’s (SEC) May approval was only for 19b-4 filings. To officially launch in the market, ETF issuers need approval of both 19b-4 and S-1 filings. Bloomberg analysts anticipate that the SEC could give final approval to spot Ethereum ETFs between the end of June and early July.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.