The defunct crypto exchange Mt. Gox has initiated a transaction involving over 75,000 Bitcoin (BTC), valued at approximately $5 billion. This marks the first movement of these funds in more than five years, causing ripples across crypto markets.

The recent developments regarding Mt. Gox have attracted considerable attention, not just because of the magnitude of the funds involved but also due to potential impacts on crypto markets.

Will Mt. Gox Creditors Continue Holding Bitcoin?

According to Arkham Intelligence, A wallet labeled “Mt. Gox” transferred BTC to a new address, 1Jbez. The crypto exchange has transferred BTC in batches of around 2,000 BTC in the past 4 hours.

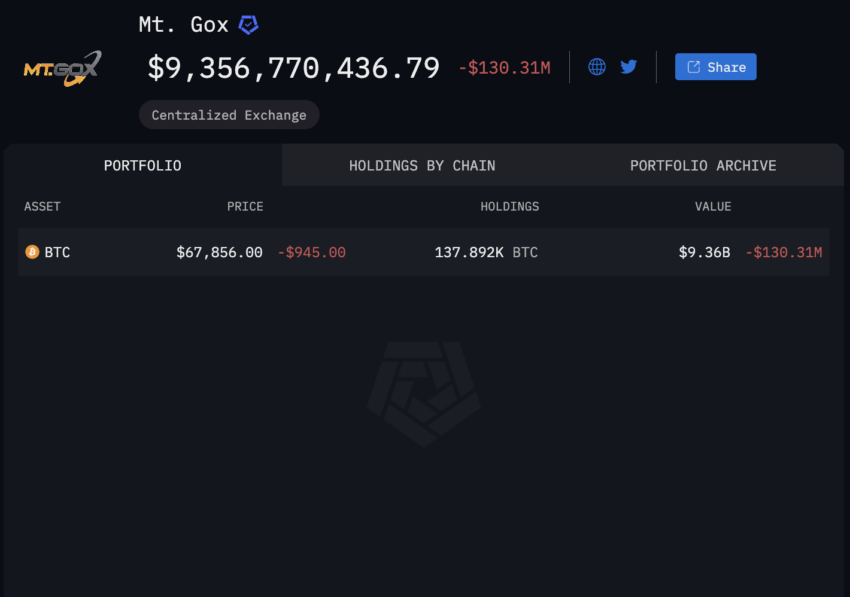

Despite this substantial transfer, the Mt. Gox wallet retains BTC assets worth around $9.3 billion.

Read more: Who Owns the Most Bitcoin in 2024?

This transaction comes ahead of the October 31 deadline by which Mt. Gox plans to repay its creditors. The settlement plan includes 142,000 BTC, 143,000 Bitcoin Cash (BCH), and 69 billion Japanese yen.

The repayment process follows the Tokyo District Court’s approval of a rehabilitation petition. In 2021, 99% of creditors voted in favor of the rehabilitation plan.

The crypto community speculates that this significant transfer could prompt a market sell-off due to the prolonged anticipation surrounding Mt. Gox’s creditor repayments. The concern is that a substantial portion of these transferred assets might be sold on the open market.

However, not all industry leaders are pessimistic. Alex Thorn, Head of Research at Galaxy Digital, believes that creditors will continue holding Bitcoin after receiving it from Mt. Gox.

“BTC from Mt Gox has moved in the last hour, likely the beginning of distributions to creditors. I personally expect most BTC gets hodl’d, but I can’t say the same for the BCH,” Thorn said.

The market reacted swiftly to this news. Bitcoin’s value declined by nearly 4% from the previous day’s high of $70,600, now trading at approximately $67,800. Similarly, Bitcoin Cash experienced a drop of about 7% from its peak of $503.7, currently trading around $468.

Read more: Top Crypto Bankruptcies: What You Need To Know

Founded in 2010, Mt. Gox once handled 70% of all Bitcoin transactions globally. However, a massive cyberattack in 2014 severely impacted its operation, resulting in the loss of approximately 850,000 BTC from both customer and company funds.

Although 200,000 BTC were recovered later, legal battles in Japan have delayed restitution to the affected parties.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.