Bitcoin’s allure is growing as investors increasingly recognize its unique traits. The spot Bitcoin exchange-traded funds (ETFs) simplify the process for investors, potentially leading to a significant increase in Bitcoin’s price.

The Motley Fool analysts highlight that the approval of Bitcoin ETFs is a major step in cryptocurrency acceptance. They believe this could drive Bitcoin’s price to $400,000 or even $1 million.

Bitcoin’s Path to $400,000 and Beyond

The ETFs allow retail investors to bypass complex crypto exchanges and digital wallets, making Bitcoin more accessible.

However, the potential for substantial growth lies with institutional investors entering the Bitcoin market. These include pension funds, retirement plans, and hedge funds, which manage vast sums of money. Previously deterred by the complexities of digital assets, these institutions can now incorporate Bitcoin into their portfolios with ease, thanks to ETFs.

Read more: Bitcoin Price Prediction 2024/2025/2030

As of now, about 700 professional investment firms have invested around $5 billion in these ETFs. Leading investors include Millennium Management, which has allocated about 3% of its $64 billion portfolio to Bitcoin ETFs. Others, such as Morgan Stanley and Bracebridge Capital, along with the State of Wisconsin Investment Board, are also significant participants.

Despite this growth, institutional investors still represent only about 10% of the total ETF ownership. This figure is increasing, indicating a rising institutional interest that could significantly boost demand for Bitcoin. Institutional investors often conduct extensive due diligence before diversifying into new assets like Bitcoin.

“Yet, after conducting their research, I think they will all likely arrive at the same conclusion: Bitcoin’s inherent characteristics make it a necessity in portfolios. Eventually, widespread adoption among institutional investors will occur, leading to a tsunami of capital flowing in,” a Motley Fool analyst said.

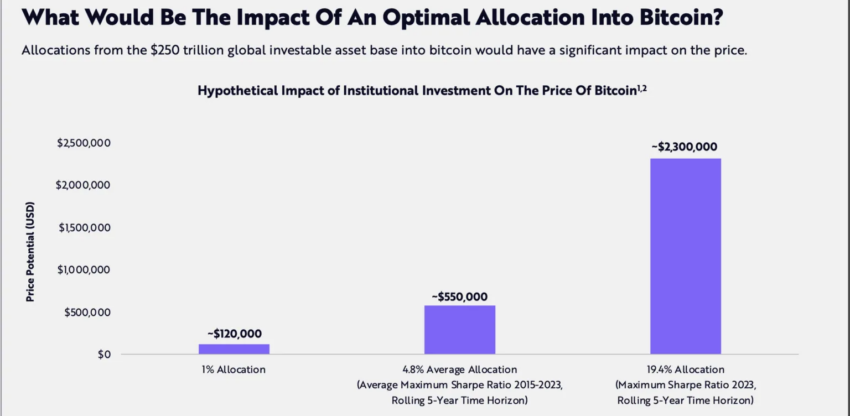

This shift in investment isn’t just about increasing Bitcoin ownership; it involves strategic financial planning. With the vast sums managed by these institutions, even a small allocation to Bitcoin could have a major impact. If institutions allocate 5% of the $129 trillion assets they manage to Bitcoin, its market cap could exceed $7 trillion, pushing its price beyond $400,000.

Some analysts believe a 5% allocation might be too conservative. ARK Invest suggests an optimal portfolio could include up to 19% Bitcoin for the best risk-adjusted returns.

Read more: 7 Best Crypto Exchanges in the USA for Bitcoin (BTC) Trading

Their recommendation is based on a rolling 5-year analysis, which supports a higher allocation to maximize portfolio performance.

As investment strategies evolve, Bitcoin’s role in future financial portfolios appears increasingly significant. Observing the benefits reaped by their peers, more institutions might feel compelled to increase their Bitcoin investments.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.