MetaComp, a fintech company based in Singapore, and asset manager Bosera International have expanded their collaboration. They now introduce Bosera’s crypto ETFs based in Hong Kong to global investors. These include the Bosera HashKey Bitcoin ETF (BOS HSK BTC / 3008.HK) and the Bosera HashKey Ethereum ETF (BOS HSK ETH / 3009.HK).

This effort is part of a broader strategy to bridge the gap between traditional financial services and digital asset markets.

The Global Impact of Hong Kong’s ETF Offerings

Under this partnership, both parties consider integrating Bosera International’s asset management solutions into MetaComp’s CAMP platform. They aim to give investors a wider range of financial tools.

Moreover, MetaComp plans to offer its digital payment token services to Bosera International. This move could enhance Bosera’s digital asset management capabilities.

Dr. Bai Bo, co-founder of MetaComp, commented on expanding their partnerships. He notes the strategic importance of these collaborations.

Read more: Why do Hong Kong Spot Crypto ETFs Matter?

“We are thrilled to deepen our partnership with Bosera International, as we jointly launch a series of innovative solutions in both traditional and cryptocurrency finance,” he stated.

Before its partnership with Bosera, MetaComp has partnered with Harvest Global Investments. The collaboration also aims to extend the reach of Harvest’s crypto spot ETFs to investors in Singapore and other regions.

The international collaboration involving Hong Kong spot crypto ETFs extends beyond offerings. Recently, Wintermute, a prominent crypto market maker, announced that it will provide liquidity for sub-custodian platforms that facilitate the operation of Bitcoin and Ethereum ETFs in Hong Kong.

Evgeny Gaevoy, Wintermute’s CEO, sees this support as essential for the seamless trading of these ETFs. Furthermore, he thinks such support will enable regulated access to digital assets.

“Crypto ETFs provide a means for investors at all levels to enter into the world of digital assets through a regulated and government-endorsed investment vehicle,” Gaevoy said.

Additionally, Wintermute will assist OSL and HashKey with buying, selling, and delivering BTC and ETH. This assistance ensures a smooth creation and redemption process for the ETFs.

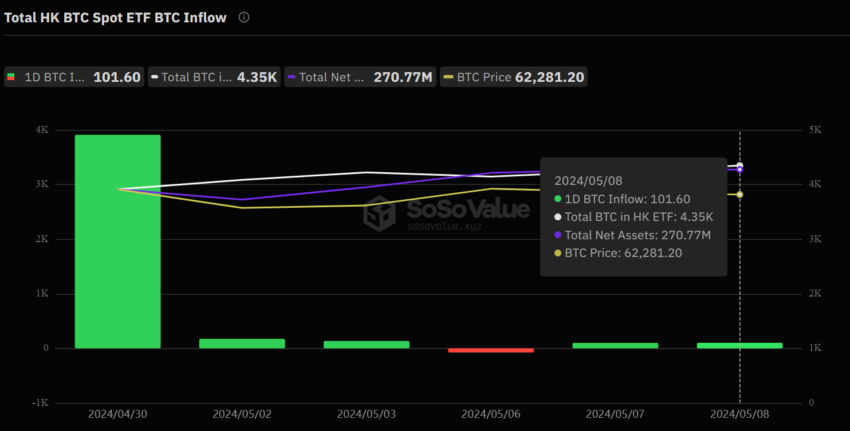

BeInCrypto reported that Hong Kong began trading spot Bitcoin and Ethereum ETFs on April 30. Initially highly anticipated, these ETFs have received mixed market receptions after launching.

Some believe that Hong Kong’s spot crypto ETFs’ performance is modest compared to their US counterparts. However, Bloomberg Intelligence’s senior ETF analyst Eric Balchunas thinks the performance is significant on local scales.

Nonetheless, many see that Hong Kong’s spot crypto ETFs will provide a bullish outlook in the long term since they are available for overseas investors to purchase. Furthermore, they believe these crypto investment products can open doors for investors from mainland China. Although mainland Chinese investors are still prohibited from investing in these ETFs, experts predict they will try to find ways around local restrictions to seize investment opportunities.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

According to SoSo Value data, Hong Kong spot Bitcoin ETFs recorded an inflow of 101.6 BTC (approximately $6.32 million) on May 8. On the same day, spot Ethereum ETFs in Hong Kong saw an outflow of 644.78 ETH (roughly $1.91 million).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.