In a significant milestone for decentralized finance (DeFi), Lido Finance has now reached one million validators on the Ethereum blockchain.

This achievement highlights a major advancement in making cryptocurrency staking accessible to a broader audience. Typically, staking requires substantial capital, as running a validator node on Ethereum necessitates holding at least 32 ETH.

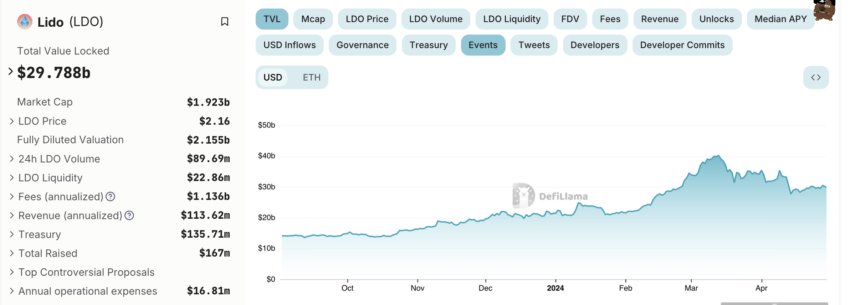

Lido Announces Major Achievement While Its TVL Slips

Announced in a recent post on X, Lido Finance has emerged as Ethereum’s largest liquid staking protocol. This platform facilitates staking for retail users with less than 32 ETH.

Data from Dune reveals that more than 27.16% of all Ethereum supply is currently being staked, primarily through protocols like Lido. This increase in staking participation is largely due to the liquidity benefits of liquid staking protocols.

Unlike traditional staking, where assets remain locked, liquid staking allows users to receive Lido Staked ETH (stETH), which can be utilized in various other DeFi protocols, enhancing liquidity.

With Lido, participants can engage in staking without locking large amounts of capital. Currently, Lido holds a command of 28.5% of the Ethereum stake. In comparison, the crypto exchange – Coinbase is responsible for 13.6% of the staked Ethereum.

Despite this landmark, Lido’s total value locked (TVL) has seen a notable decline. From a peak of $40.16 billion in mid-March, it has decreased to $29.78 billion, marking a drop of about 25%.

Read more: The Ultimate Guide to Lido Staked ETH (stETH)

This decline mirrors a broader trend within the DeFi sector, which, despite showing strong quarter-on-quarter growth, presents varying performances across different protocols.

The substantial growth in DeFi’s total value locked, which surged from $38 billion in late 2023 to a peak of $97 billion in April 2024, highlights the significant impact of liquid staking. Though there was a slight decrease to $92.22 billion, the sector’s growth trajectory remains robust, primarily driven by the adoption of protocols like Lido and restaking protocols such as EigenLayer.

However, Lido’s recent decline in TVL poses questions about the long-term sustainability of such rapid growth in DeFi. Forbes previously likened the DeFi staking mechanisms to Ponzi schemes in 2022, pointing out the reliance on continuous new investments to maintain value.

“Because the majority of participants are also staking, the staking rewards amount to token inflation, which drives the price down. [Therefore] the ecosystem must experience a significant increase in new investors to offset the increasing supply. Because it relies on new investors to maintain its value, it is similar to other Ponzi schemes,” Forbes analysts said.

Read more: 11 Best DeFi Platforms To Earn With Lido’s Staked ETH (stETH)

This comparison highlights the inherent risks where, despite technological innovations, financial stability depends heavily on constant investor interest.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.