The US Securities and Exchange Commission (SEC) has delayed decisions regarding options trading on spot Bitcoin exchange-traded funds (ETFs) and is expected to deny the proposals for Ethereum ETFs.

These decisions reflect the cautious approach of the regulatory body towards cryptocurrency products in the financial markets.

SEC Might Delay Bitcoin and Ethereum ETFs

The SEC has postponed its decision on the approval of options trading for spot Bitcoin ETFs. This delay, announced in a recent filing, calls for further public input on the matter.

Industry participants and observers are now invited to submit comments within a 21-day period, with rebuttals due in 35 days.

The SEC is specifically questioning whether these options should adhere to the same regulatory framework as traditional stock options. This includes considerations on position limits and the overall availability of Bitcoin in the market, which could influence these limits.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

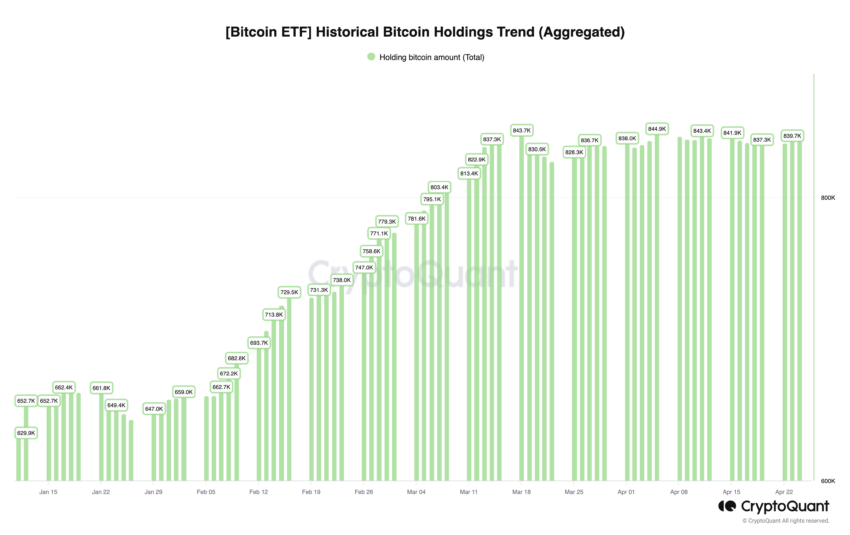

The proposal was put forward by several major exchanges such as Cboe Exchange and Nasdaq ISE. It marks a critical point in the regulatory environment of cryptocurrency options. This development follows the SEC’s January approval of 11 spot Bitcoin ETFs. These have since seen substantial financial inflow, totaling $12.38 billion.

Concurrently, the outlook for spot Ethereum ETFs appears grim. Following a series of discouraging meetings with the SEC, industry insiders anticipate a rejection of the pending applications for Ethereum ETFs.

“It seems more likely that approval will be delayed until later in 2024, or longer. The regulatory picture still seems cloudy,” Todd Rosenbluth, Head of Research at VettaFi, said.

This sentiment stems from discussions that lacked substantial engagement from SEC staff. Therefore, contrasting sharply with the dialogues that preceded the approval of Bitcoin ETFs.

Read more: Ethereum ETF Explained: What It Is and How It Works

Experts suggest that the SEC’s hesitation is likely tied to a need for more comprehensive data on the Ethereum market, which remains less observed compared to Bitcoin. The potential rejection of Ethereum ETFs could delay broader acceptance of Ethereum as a mainstream financial asset and might provoke legal challenges, similar to those that previously influenced Bitcoin ETF approvals.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.