The US Securities and Exchange Commission (SEC) has mandated First Trust Advisors and SkyBridge Capital to declare their Bitcoin exchange-traded fund (ETF) application defunct.

The First Trust-Skybridge Bitcoin ETF was among the first the SEC rejected after it approved futures-based Bitcoin products.

Analysts Baffled By SkyBridge Reluctance

The SEC’s directive comes after First Trust and SkyBridge failed to respond to the Commission’s communication in time. The agency’s order revealed that it informed the applicants that the applicant must be declared abandoned after nine months.

First Trust Advisors and SkyBridge Capital initially filed in March 2021, with the SEC’s initial rejection coming roughly ten months later.

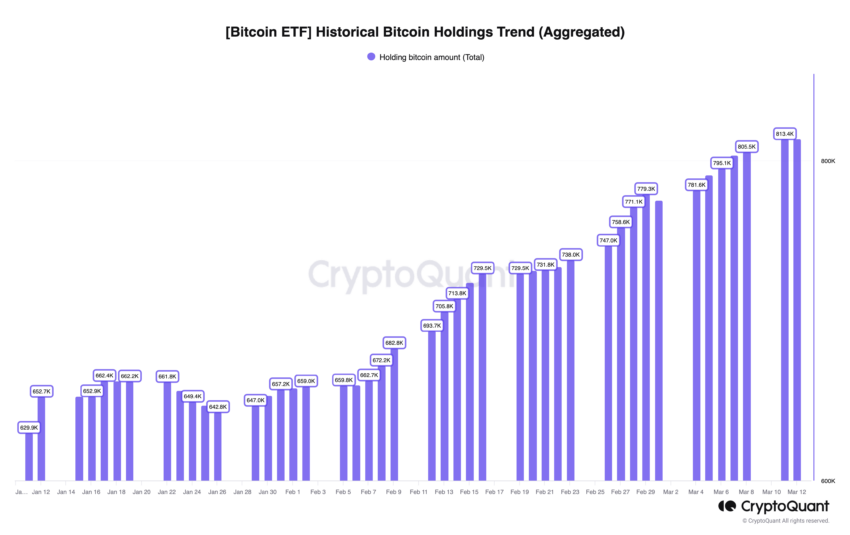

Bloomberg ETF analyst Eric Balchunas and Nate Geraci, the CEO of the ETF Store, expressed confusion over the firms’ decisions not to re-file. The reluctance is especially puzzling, given Bitcoin’s bullish price around $72,000. Record inflows into Bitcoin ETFs also demonstrate the growing investor interest in cryptocurrency as a legitimate asset class.

“IMO, could have charged fairly significant premium to market & still would have vacuumed-up assets. Just gravy on top of FT distribution machine (which comes complete w/ filet & cab and attracts perfect audience for spot btc ETFs),” Geraci said.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Due to market volatility, investor protection, and regulatory compliance concerns, the SEC had rejected Bitcoin ETF applications from Ark Invest and others. At least seven applicants, including BlackRock and Cboe, entered into surveillance-sharing agreements with Coinbase to allay market manipulation concerns.

The SEC approved BlackRock’s iShares Bitcoin Strategy ETF (IBIT) after the company made the required changes. This created a blueprint for future applicants that First Trust SkyBridge ETF could have followed.

While following BlackRock would not have guaranteed approval, it could have allowed the companies a chance to increase revenues in the current bull market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.