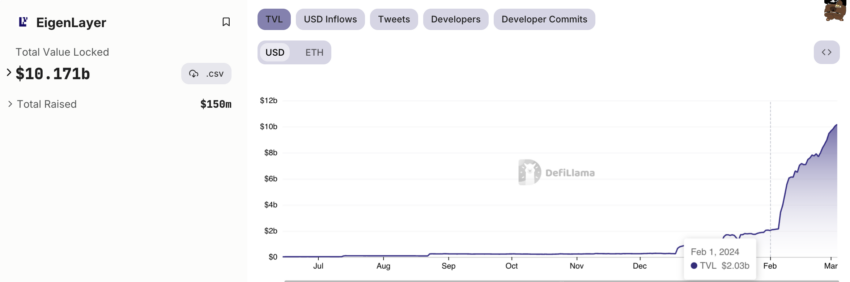

EigenLayer’s total value locked (TVL) has surged to $10 billion, marking a significant uptick from its $1.1 billion valuation at the start of the year. This growth, equating to 2.93 million Ethereum (ETH), underscores the protocol’s expanding influence within the decentralized finance (DeFi) sector.

EigenLayer allows users to deposit and restake ETH through various liquid staking tokens. This process aims to enhance the security of third-party networks.

How DeFi Protocol EigenLayer’s TVL Surged 5X Since February

Recent weeks have witnessed remarkable growth in EigenLayer’s TVL, particularly over the last 30 days. On February 2, 2024, the TVL stood at around $2 billion but has since grown five times.

This increase coincides with EigenLayer’s decision to temporarily lift restrictions on token restaking and remove TVL caps for each token. The protocol anticipates making these changes permanent in the near future, signaling a strategic shift in its operational framework.

EigenLayer’s rise in TVL has propelled it to become the third-largest DeFi protocol, overtaking Maker. Now, it lags behind AAVE by a margin of approximately $92 million. This growth can be attributed to a consistent influx of ETH deposits, facilitated primarily by liquid restaking protocols and the appreciating value of Ethereum itself.

Read more: What Is EigenLayer?

The anticipation of an EigenLayer airdrop has also played a crucial role, attracting significant attention from the DeFi community. Many users deposit their staked Ethereum into EigenLayer to enhance their chances of receiving airdrop benefits. Currently, the protocol exclusively supports native restaking with EigenPod.

EigenLayer’s approach to restaking has garnered widespread attention. This model allows Ethereum or ERC-20 token holders to contribute to the security of other projects or applications on the network.

In exchange, participants receive additional rewards, thereby enhancing the overall security and efficiency of the Ethereum ecosystem without necessitating the locking up of more assets.

DeFi Sector Booming

The project’s success and innovative solutions have not gone unnoticed by investors. In March 2023, EigenLabs secured a $50 million Series A funding round led by Blockchain Capital.

Read more: Ethereum Restaking: What Is It And How Does It Work?

This was followed by a substantial $100 million investment from Andreessen Horowitz in a Series B round last month. Furthermore, Binance Labs’ recent investment in Renzo, a Liquid Restaking Token (LRT) and Strategy Manager for EigenLayer, highlights the growing interest in the protocol’s restaking solutions.

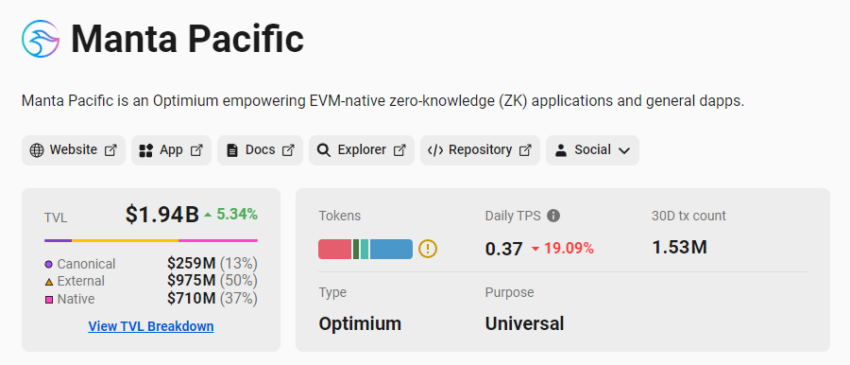

At the same time, the Manta Pacific Ethereum L2 network has seen its own TVL pump to a new high of $1.94 billion. The network had a rocky period earlier this year after many users complained of being shortchanged on an airdrop initiative.

These frustrations were short-lived, however, as its TVL has grown by nearly 120% since then.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.