While several countries around the globe are opening their borders to crypto trading, Honduras regulators have taken a decisive step to curb these activities within its jurisdiction.

Honduras’ National Banking and Securities Commission (CNBS) issued a ban prohibiting financial institutions in the country from engaging in crypto trading or holding digital assets.

Why Honduras Banned Crypto Trading

The regulatory landscape in Honduras currently lacks provisions specifically addressing crypto assets. This absence poses risks for users, leaving them vulnerable to fraud, operational pitfalls, and legal uncertainties. Moreover, there is growing concern that these assets might be exploited for illicit activities like money laundering and terrorist financing.

The CNBS further cited concerns over the decentralized nature of many crypto-related businesses operating within the country, often registered in jurisdictions outside Honduras. This decentralization poses challenges for regulatory oversight, potentially enabling unmonitored activities.

“In Honduran legislation, there is no specific regulation on cryptocurrencies, virtual currencies or any financial service based on blockchain technology, for which financial consumers of these virtual assets are exposed to fraud, operational and legal risks due to their use, including that their acceptance could cease at any time, since people do are not legally obliged to transact or recognize them as a means of payment,” the regulator stated.

Consequently, the CNBS directive explicitly forbids Honduras-based financial entities from any association with crypto assets, virtual currencies, tokens, or similar digital assets not authorized by the Central Bank of Honduras. The CNBS emphasized the need to maintain strict control over financial activities to safeguard the integrity of the country’s financial sector.

Read more: Crypto vs. Banking: Which Is a Smarter Choice?

Honduras’ ban on crypto is coming at a time when institutional interest in the industry is booming following the launch of several Bitcoin exchange-traded funds (ETFs) in the US.

According to Bloomberg analyst Eric Balchunas, several banking groups in the US urged the Securities and Exchange Commission (SEC) to reevaluate a rule that made it costly for them to provide custodial services for these ETFs.

“US banks, left off key Bitcoin ETF roles, are pushing SEC to tweak guidance around holding digital assets. A bank trade gp coalition sent SEC letter asking them exclude ETFs from broad crypto umbrella. They want a piece of the action. I don’t blame them, it isn’t fair,” Balchunas said.

Meanwhile, Bitwise’s Chief Investment Officer Matt Hougan, emphasized that this request reflects how the Bitcoin ETFs have changed the “tone around crypto regulation in Washington.”

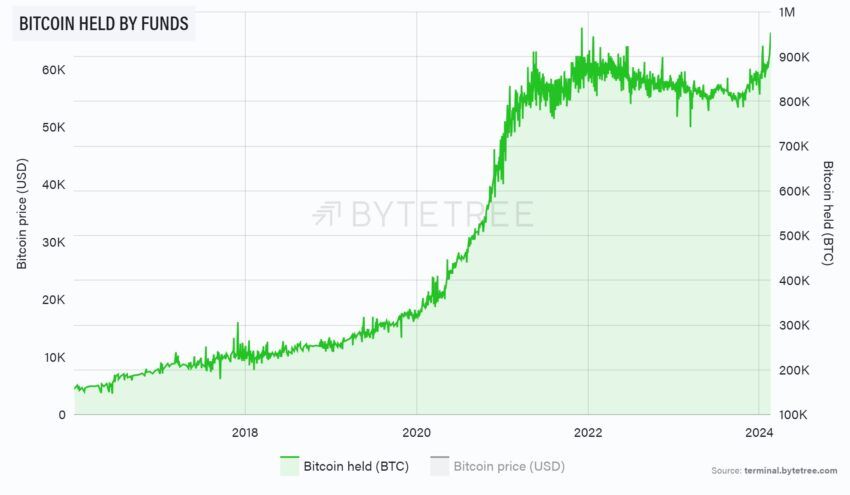

Data from ByteTree shows that investment vehicles holding Bitcoin now have more than 955,000 BTC, estimated to be worth nearly $50 billion. Aside from the US, other jurisdictions like Hong Kong are opening up their region to allow crypto trading activities to thrive.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.