The Ethereum Foundation, the organization behind the second-largest cryptocurrency by market capitalization, has reportedly sold a substantial amount of ETH.

Despite the rising selling pressure, it appears that some crypto whales took advantage of the recent dip to accumulate more ETH at discounted prices.

Ethereum Foundation Sold Millions

Blockchain analytics firm Spot on Chain reported that the Ethereum Foundation offloaded approximately 700 ETH. This transaction was for 1.68 million DAI, a stablecoin pegged to the US dollar, at about $2,406 per ETH.

This sale occurred through two different wallet addresses, 0xbc9 and 0xd77, within a remarkably short span of 40 minutes. This action is part of a larger trend observed over the past week, wherein the Ethereum Foundation has sold a total of 800 ETH for $1.94 million DAI at an average rate of $2,422.

These funds were subsequently transferred to the Ethereum Foundation for the purpose of funding disbursement.

The sale was notable amid a fluctuating market with increased selling pressure on Ethereum. In this context, Spot On Chain also highlighted the actions of crypto whales. Specifically, one whale who capitalized on the recent dip in Ethereum’s value.

This anonymous investor, referred to by their wallet address 0x55c, withdrew 7,779 ETH, valued at approximately $18.9 million, from the cryptocurrency exchange Binance. This whale’s activity, including a prior deposit of 90 million USDT to Binance, raises questions about the investment strategy towards ETH.

“Notably, the whale deposited 90.6M USDT to Binance 5 days ago and has yet to trade any other token rather than ETH since his/her wallet creation, suggesting that the whale may be truly buying ETH,” Spot on Chain said.

ETH Price Sits on Key Support Level

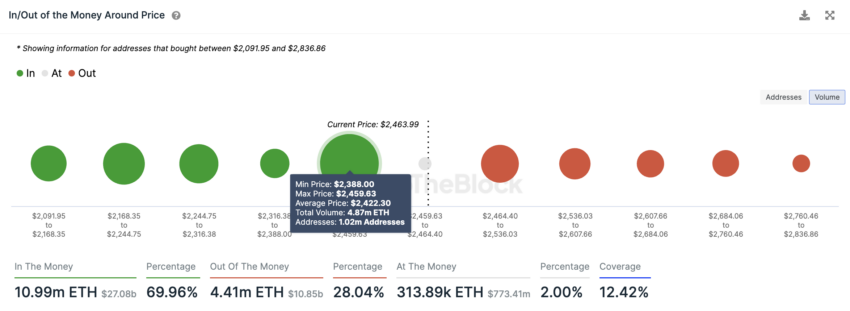

Ali Martinez, an on-chain analyst and the Global Head of News at BeInCrypto, provided insight into Ethereum’s current market position. Martinez noted that ETH is currently in a key demand zone, ranging between $2,388 and $2,460.

If this support level holds, Ethereum could see minimal resistance ahead, potentially leading to an upward price movement.

Read more: How to Buy Ethereum (ETH) and Everything You Need to Know

However, Martinez also cautioned that a failure to maintain this level might lead to a pullback, with the next significant support area around $2,000.

“ETH support continues to get weaker and weaker. Seems like any upside might be a good idea to short hedge into to help offset any spot holdings you have. Momentum is just completely flushed right now,” Castillo Trading said.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.