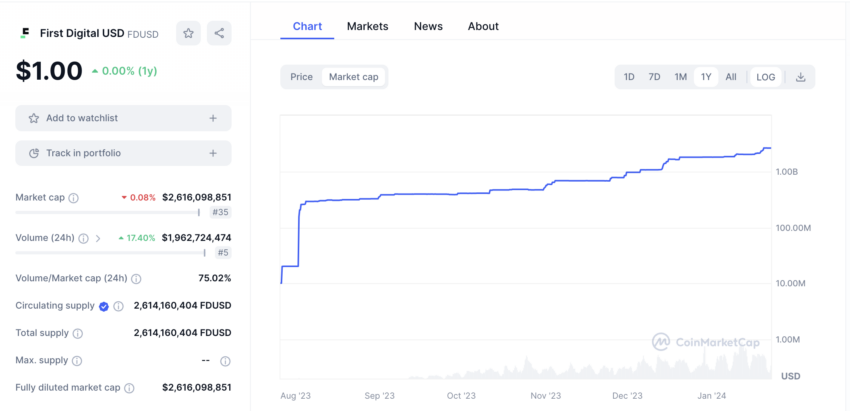

First Digital USD (FDUSD) has secured its position as the fourth-largest stablecoin by market cap. As of January 22, 2024, its market cap reached a significant $2.6 billion, up from $1.8 billion at the start of the year.

In a remarkable six-month surge, First Digital USD (FDUSD) has risen to become the fourth-largest stablecoin.

What Contributed to FDUSD’s Adoption?

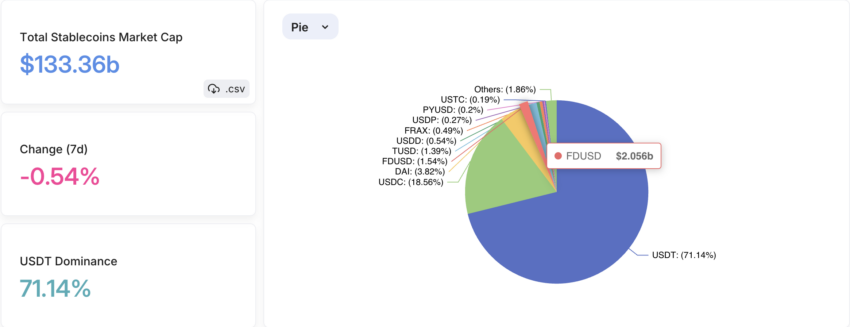

Beginning its journey in June 2023, FDUSD started with a modest market cap of less than $100 million. Within six months, it has outpaced competitors like TUSD, USDD, and FRAX. It ranks just below giants USDT, USDC, and DAI.

Read more: A Guide to the Best Stablecoins in 2024

FDUSD is a reserve-backed stablecoin, initially launched on Ethereum and BNB Chain networks. Its transparent reserve management, confirmed by a third-party auditor, underpins its rapid adoption. The reserves include US Treasury Bills, repos, and cash, ensuring full collateralization and stable value.

Another key to FDUSD’s growth is its expansion across multiple blockchain networks. This strategy boosts its interoperability and appeal.

Binance’s recent pivot from BUSD to FDUSD also influenced the market. After Paxos, BUSD’s issuer received a Wells Notice from the SEC, Binance urged users to switch to alternatives like FDUSD. This shift has been crucial in raising FDUSD’s market share to 1.54%.

USDT, the largest cryptocurrency by market cap, has also grown significantly. From January 1, its market cap increased from $91.69 billion to $94.84 billion, maintaining the position of stablecoin with the largest dominance.

The market has reacted interestingly to FDUSD’s rise, especially compared to other stablecoins. For example, the depegging of TrueUSD, linked to Justin Sun, to below $0.97 occurred as FDUSD’s market cap surged.

Read more: What Is a Stablecoin? A Beginner’s Guide

“Isnt THAT interesting TUSD started going down in MCAP when FDUSD starting to go up in MCAP. aint that SOMETHING,” a crypto trader under the pseudonym BareNakedCrypto asked.”

In summary, FDUSD’s ascent to the fourth-largest stablecoin was supported by solid financial practices and major exchanges like Binance.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.