The International Monetary Fund’s (IMF) Managing Director, Kristalina Georgieva, has stated unequivocally that cryptocurrencies like Bitcoin do not constitute “money” in the traditional sense.

This assertion aligns closely with recent crypto market developments and key financial leaders’ perspectives.

Bitcoin Is Not Money

Kristalina Georgieva emphasized the need to differentiate between assets such as Bitcoin and money. She described cryptocurrencies as an asset class, potentially secure if backed but notably distinct from conventional money.

“Our view is that we have to differentiate between money and assets. When we talk about crypto, we are actually talking about an asset class. It could be backed up and in that sense, more secure and less risky, or it could be not backed up and therefore a riskier investment. But it is not exactly money. It’s more like a money management fund,” Georgieva said.

This statement came shortly before the US Securities and Exchange Commission (SEC) greenlit the spot Bitcoin ETFs (exchange-traded funds). Financial giants like Fidelity and BlackRock were among the first to launch these ETFs, offering average investors a gateway to the world’s largest cryptocurrency without direct ownership.

According to MicroStrategy CEO Michael Saylor, this development, marking a significant moment for the crypto industry, is poised to draw more mainstream investment into the sector.

“Mainstream institutions have not had a high bandwidth compliant channel to invest in this asset class until the spot ETFs. I think the approval of the spot [Bitcoin] ETFs is going to be a major catalyst that’s going to definitely drive a demand shock,” Saylor said.

Read more: This Is How to Invest in Spot Bitcoin ETFs

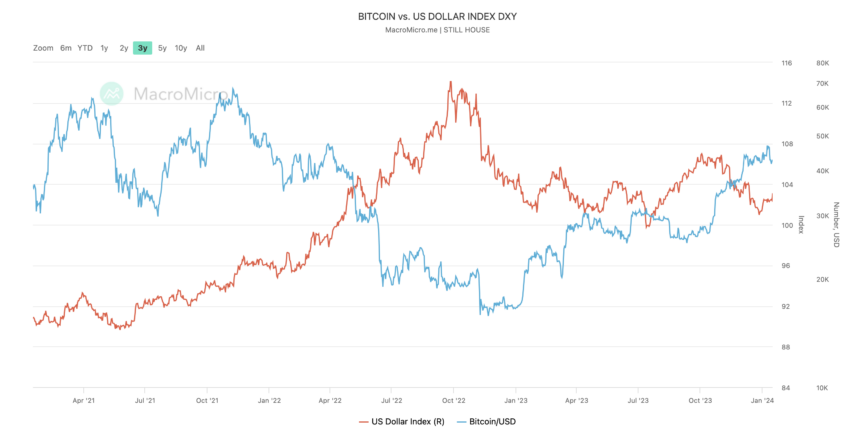

Despite these advancements, Georgieva remains unconvinced about Bitcoin rivaling the US dollar. She highlighted the dollar’s dominance, underpinned by the vastness of the US economy and the depth of its capital markets.

The IMF chief’s stance reflects a broader skepticism about cryptocurrencies replacing established national currencies. This sentiment was echoed by BlackRock CEO Larry Fink.

Fink cast doubt on the practicality of Bitcoin for everyday transactions, viewing it primarily as an asset class. While acknowledging the potential of Central Bank Digital Currencies (CBDCs), Fink downplayed the likelihood of Bitcoin supplanting traditional currencies.

His focus remains on the newly approved spot Bitcoin ETFs. He believes they have the potential to enhance the legitimacy and safety of the crypto industry.

“I don’t believe it’s ever going to be a currency. I believe it’s an asset class,” Fink explained.

Although the approval of spot Bitcoin ETFs symbolizes the increasing acceptance of digital currencies in mainstream finance, Fink’s and Georgieva’s remarks underscore a prevailing view within the financial community. Bitcoin and other cryptocurrencies, while valuable as assets, fall short of challenging the entrenched status of currencies like the US dollar.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.