Getting fined more than $4 billion would be a bankruptcy-inducing nightmare for most companies, but this is unlikely to be the case for Binance. The news has rattled markets marginally today, but the big picture may not be so gloomy.

On November 21, news broke that Binance CEO Changpeng “CZ” Zhao was stepping down from his role as the head of the world’s largest crypto exchange.

Big Fine For Binance

Binance and CZ have agreed to settle with the US Department of Justice for a $4.3 billion penalty.

According to Reuters, the deal includes a $3.4 billion penalty from the US Treasury’s Financial Crimes Enforcement Network and another $968 million from the Office of Foreign Assets Control.

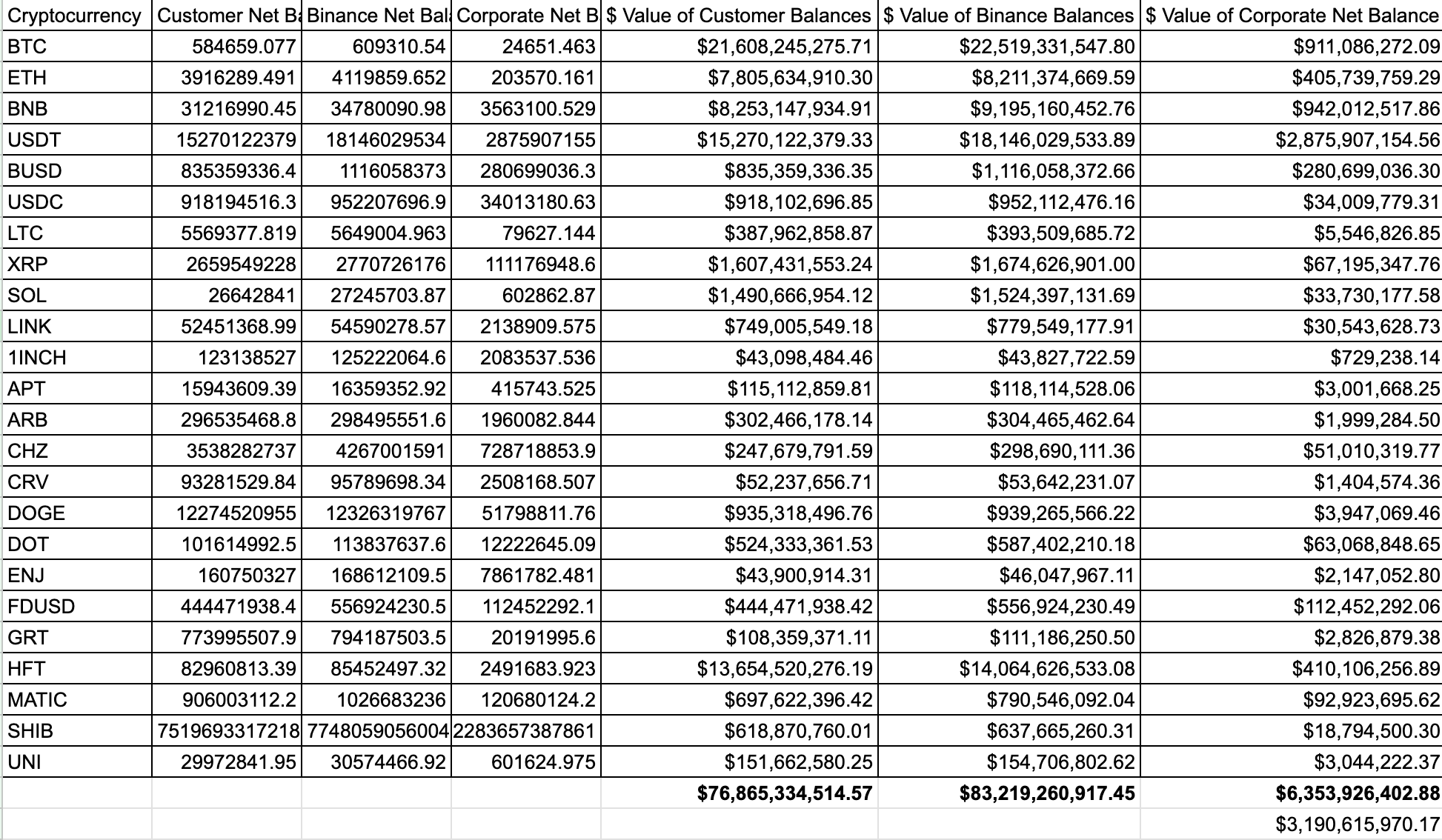

However, the fine is just a drop in the bucket compared to what Binance has in reserves. On Nov. 22, the director of product strategy and business operations at Coinbase, Conor Grogan, delved into Binance’s corporate crypto holdings from their Proof of Reserves.

Based on the firm’s latest proof of reserves report, the exchange holds approximately $6.35 billion in total corporate crypto assets, including $3.19 billion in stablecoins.

Learn more: Binance Review 2023: Is It the Right Crypto Exchange for You?

Moreover, this figure does not include off-chain cash balances or funds held in wallets not reported in proof of reserves.

Grogan concluded that Binance would likely be able to pay the full $4.3 billion fine with zero exchange crypto asset sales. According to the data, Binance has $76.8 billion in total customer asset balances.

CoinGecko reports a slightly lower figure of $67 billion in exchange token value. However, the Binance-owned CoinMarketCap has a figure of $72 billion in crypto assets held on the exchange.

This should alleviate any concerns about the company selling customer’s crypto to pay its fines.

Minor Market Reaction

By mid-morning in Asia on Wednesday, crypto markets had started to recover from their minor blip caused by this major news.

Total market capitalization declined by about 3% following the breaking news. Around $50 billion exited the market as the total cap fell to $1.41 trillion. However, this is a typical movement for crypto markets, which have largely been unaffected by the news.

Furthermore, markets started to recover during the Wednesday morning Asian trading session. The total cap was back up to $1.43 trillion and within November’s range-bound channel.

Bitcoin has dropped 2.6% on the day, while Ethereum lost 1.4% over the past 24 hours. Unsurprisingly, the biggest loser was BNB, shedding 9% in a fall to $235 at the time of writing.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.