Oregon’s Division of Financial Regulation (DFR) has partnered with several states in a settlement against crypto trading app Robinhood.

The agreement entails a $10.2 million penalty, pinpointing Robinhood’s operational and technical lapses detrimental to its users.

Oregon Joins Robinhood’s $10.2 Million Settlement

The settlement’s roots trace back to a coordinated effort by state securities regulators representing Alabama, Colorado, California, Delaware, New Jersey, South Dakota, and Texas. Indeed, these states, united under the North American Securities Administrators Association (NASAA), probed Robinhood’s operational failures in the retail market.

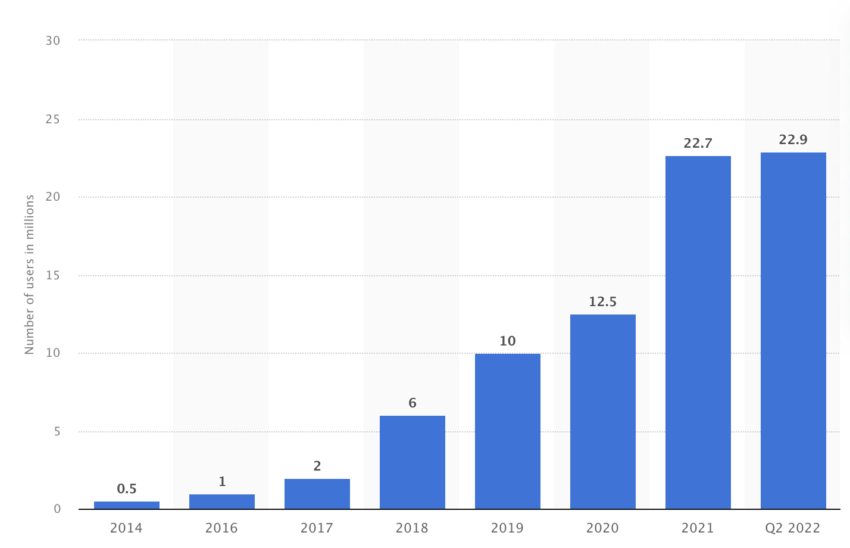

Key events triggering this intervention were Robinhood’s extensive outages in March 2020. During this period, a massive user base relied on the Robinhood app for trading activities.

Read more: 9 Best Crypto Futures Trading Platforms in 2023

To compound the challenges, Robinhood had glaring deficiencies up until March 2021. These ranged from poor review protocols for options, margin accounts, and subpar monitoring systems to slow customer service responses.

DFR Administrator TK Keen weighed in on the issue, emphasizing the collective regulatory action.

“This multi-state settlement is another example of states working together to protect investors. DFR is committed to holding companies like Robinhood accountable when it failed to protect those who have entrusted them,” Keen said.

Robinhood’s alleged missteps included inaccurate dissemination of client data, an ineffective customer identification process, and insufficient technological supervision. While Robinhood has not directly acknowledged these findings, the company has agreed to provide a Financial Industry Regulatory Authority (FINRA)-ordered compliance report to the settling states.

“Robinhood repeatedly failed to serve its clients, but this settlement makes clear that Robinhood must take its customer care obligations seriously and correct these deficiencies,” Andrew Hartnett, the president of the NASAA, said.

Read more: How to Buy and Sell Crypto on Robinhood: A Step-by-Step Guide

Moreover, Robinhood has initiated several remedial actions based on recommendations from an independent consultant. As the settlement’s aftermath unfolds, the crypto trading app must confirm compliance with the prescribed remedial measures to Alabama, the settlement’s lead state.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.