In a recent interview, Sergey Nazarov, co-founder of Chainlink, highlighted that banks, in contrast to startups, didn’t initiate with blockchain technology, which places them at a disadvantage when it comes to its adoption.

“Banks have made a very large investment in the security of their existing infrastructure and they have trained a lot of people to use that infrastructure, which is very different from start-ups,” he declared.

Banks Exercise Caution in Blockchain Adoption Due To SWIFT Investment

In a September 19 interview, Chainlink co-founder Sergey Nazarov spoke on how banks across the world significant investment in the SWIFT infrastructure makes it a more complicated process to adopt blockchain into its systems.

SWIFT dominates the banking world as the most straightforward method for international payments and settlements.

“So banks rely on these systems, put huge amounts of value on them, and they are not getting rid of them…the only way banks are going to be able to use blockchain efficiently is from their existing infrastructure.”

He explains that Chainlink’s Cross-Chain Interoperability Protocol (CCIP) experiment with several prominent banks demonstrated three key findings.

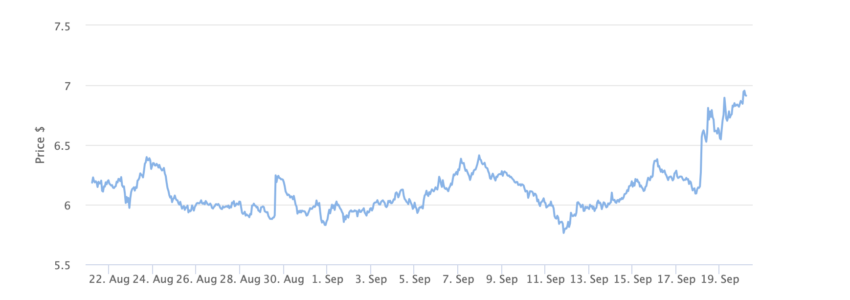

At the time of publication, Chainlink’s price stands at $6.90.

The experiment demonstrated that banks can easily link to numerous blockchain networks using their existing infrastructure SWIFT, requiring minimal effort. This enables efficient interaction with many chains, both public and private.

Blockchain Streamlines Banking and Blockchain Collaboration

Moreover, it facilitates effective interbank transactions across various chains, and private chains can now smoothly connect with public ones.

According to Nazarov, this enables the transfer of value from the private banking sector to the public blockchain industry, significantly impacting both sectors.

On September 15, BeInCrypto reported that Australian Bank ANZ utilized Chainlink’s CCIP. ANZ employed this to rigorously test a tokenized asset purchase.

Nigel Dobson, ANZ’s Portfolio Lead, declared the bank’s proactive exploration of decentralized networks. He pointed out the surging confidence among institutional investors.

“Banks are increasingly exploring use cases involving tokenized assets, with 93 per cent of institutional investors believing in their long-term value, according to a recent EY report.”

In a July 17 statement, Chainlink announced the launch of CCIP. It noted that providing a solution for the global banking industry is tough.

The statement explains that is not just about the right product; it’s about a universal standard for the industry to work together securely and flexibly.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.