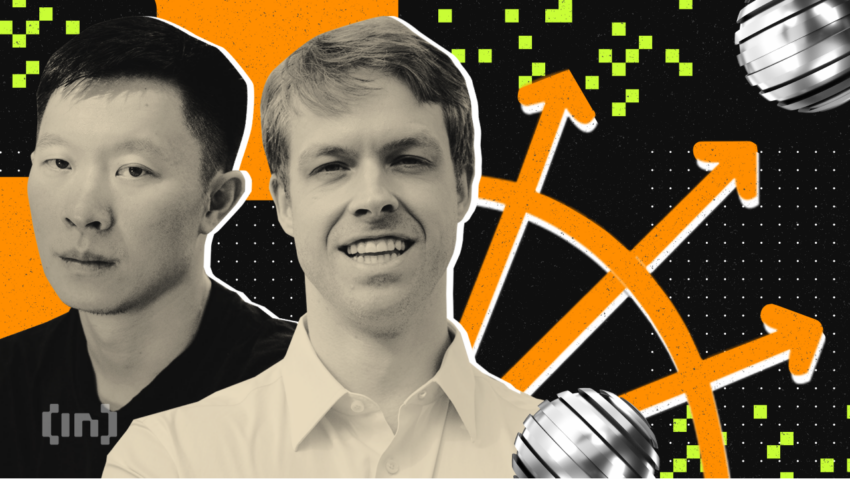

The Monetary Authority of Singapore (MAS) has issued 9-year prohibition orders against Zhu Su and Kyle Davies of Three Arrows Capital. The authorities punished the pair for violating Singapore’s Securities and Futures Act.

On September 14, Singapore’s central bank issued prohibition orders against Three Arrows Capital’s (3AC) Zhu Su and Kyle Livingston Davies.

Nine-Year Ban in Singapore

Under the orders, 3AC’s Zhu and Davies are prohibited from performing any regulated financial activities in Singapore. Moreover, Singapore’s capital market services firms have banned the pair from participating in management or leadership roles.

Zhu was the Chief Executive Officer and Director of 3AC and Davies was the Chairman and Director of the defunct crypto lending firm. Media reports claim their whereabouts remain unknown.

MAS further investigated Three Arrows Capital after reprimanding it in June 2022. Furthermore, the central bank found additional violations related to false information, failure to notify MAS of new employees, and lack of proper risk management.

Furthermore, the financial authority stated:

“As directors of TACPL (3AC), Mr. Zhu and Mr. Davies were primarily responsible for ensuring that TACPL complied with regulatory requirements under the SFA and SFR (Securities and Futures Act and Regulations).”

It added that its investigation showed that they had “failed to discharge their duties and were responsible for 3AC’s breaches.”

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

The central bank took particular umbrage over the failure to report the employment of portfolio manager Cheong Jun Yoong Arthur between August 2020 and September 2021.

Loo Siew Yee, MAS Assistant Managing Director, said that senior management of fund managers is required to implement “robust risk management measures” to protect the interest of investors. She added:

“MAS takes a serious view of Mr Zhu’s and Mr Davies’ flagrant disregard of MAS’ regulatory requirements and dereliction of their directors’ duties. MAS will take action to weed out senior managers who commit such misconduct.”

3AC Rebrand

In June, the bankrupt crypto firm reemerged as a rebranded 3AC Ventures.

Moreover, the announcement was made by OPNX (Open Exchange), a claims exchange co-founded by Zhu and Davies.

The 3AC crypto hedge fund filed for bankruptcy in June last year. It followed major losses in the wake of the Terra/Luna ecosystem collapse.

In late June, BeInCrypto reported that 3AC liquidators were looking to recover $1.3 billion from the co-founders.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.