Ethereum’s (ETH) price is approaching a long-term ascending support line that has been in place for 450 days.

While the price action is bearish, the RSI gives a bullish signal that previously preceded a 145% increase and led to the yearly high.

Ethereum Price Approaches 450-Day Support

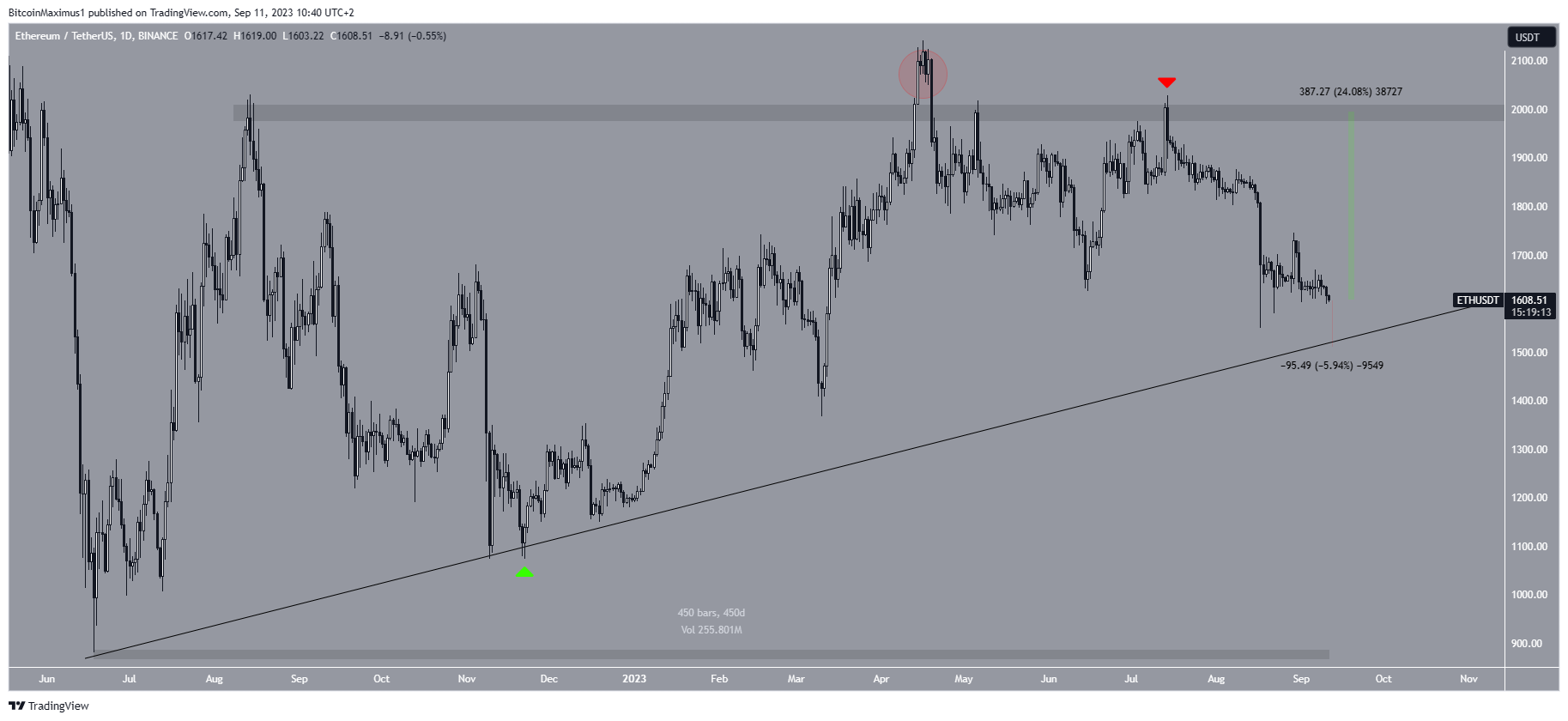

The daily time frame technical analysis for Ethereum shows a bearish price action. In April, the price deviated above the $2,000 horizontal resistance area (red circle). The failure to maintain this increase is a bearish sign. It means that buyers could not sustain the increase, and sellers took over.

In July, the price again validated the $2,000 area as resistance (red icon), initiating the ongoing downward movement. So far, ETH reached a low of $1,550 on August 17 before bouncing.

ETH is now approaching an ascending support line, which is at $1,500. The line has been in place since the entire upward movement began in June 2022. More specifically, it has measured the slope of the increase for 450 days.

However, the line has also not been touched since November 2022 (green icon). A drop to the line would amount to a decrease of 6%, measuring from the current price.

On the other hand, a retest of the $2,000 area would amount to an upward movement of 24%.

In the news, the Grayscale Ethereum trust has experienced a significant reduction in its discount. It reached the lowest point of the year at 26.64%. This occurred after a surge in applications for an Ethereum exchange-traded fund (ETF).

Ethereum’s founder Vitalik Buterin, stated that despite significant technical strides, the blockchain still has concerns with its privacy, security, and scalability.

Check out the 9 Best AI Crypto Trading Bots to Maximize Your Profits.

ETH Price Prediction: Will RSI Initiate Trend Reversal?

Even though the price action is bearish, the RSI provides a decisively bullish sign. With the RSI as a momentum indicator, traders can determine whether a market is overbought or oversold and decide whether to accumulate or sell an asset.

Bulls have an advantage if the RSI reading is above 50 and the trend is upward, but if the reading is below 50, the opposite is true. On August 17, the RSI fell to 21, the lowest it has been since June 2022.

Since then, it has increased and generated a bullish divergence (green line). This is a type of bullish development when a momentum increase accompanies a price decrease. It often leads to significant upward movements.

Moreover, the RSI has now moved outside of its oversold territory. The last time this occurred (green icon), it catalyzed a 145% increase, leading to the current yearly high.

Despite this bullish price prediction, a breakdown from the ascending support line will mean that the trend is still bearish. In that case, the price can fall by another 30% and reach the $1,100 horizontal support area.

Looking to be profitable? Learn How To Make Money in a Bear Market.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.