Over the past three weeks, Cardano’s (ADA) price has consolidated within the $0.25 – $0.28 territory. But recent on-chain data trends could tilt the momentum in favor of the bears.

The pensive mood surrounding the global altcoin market has recently seen Cardano’s price stagnate around the $0.25 range. The recent on-chain activity among ADA price speculators and DeFi stakers raises even more bearish concerns.

Cardano Investors Have Unstaked $45 Million in September

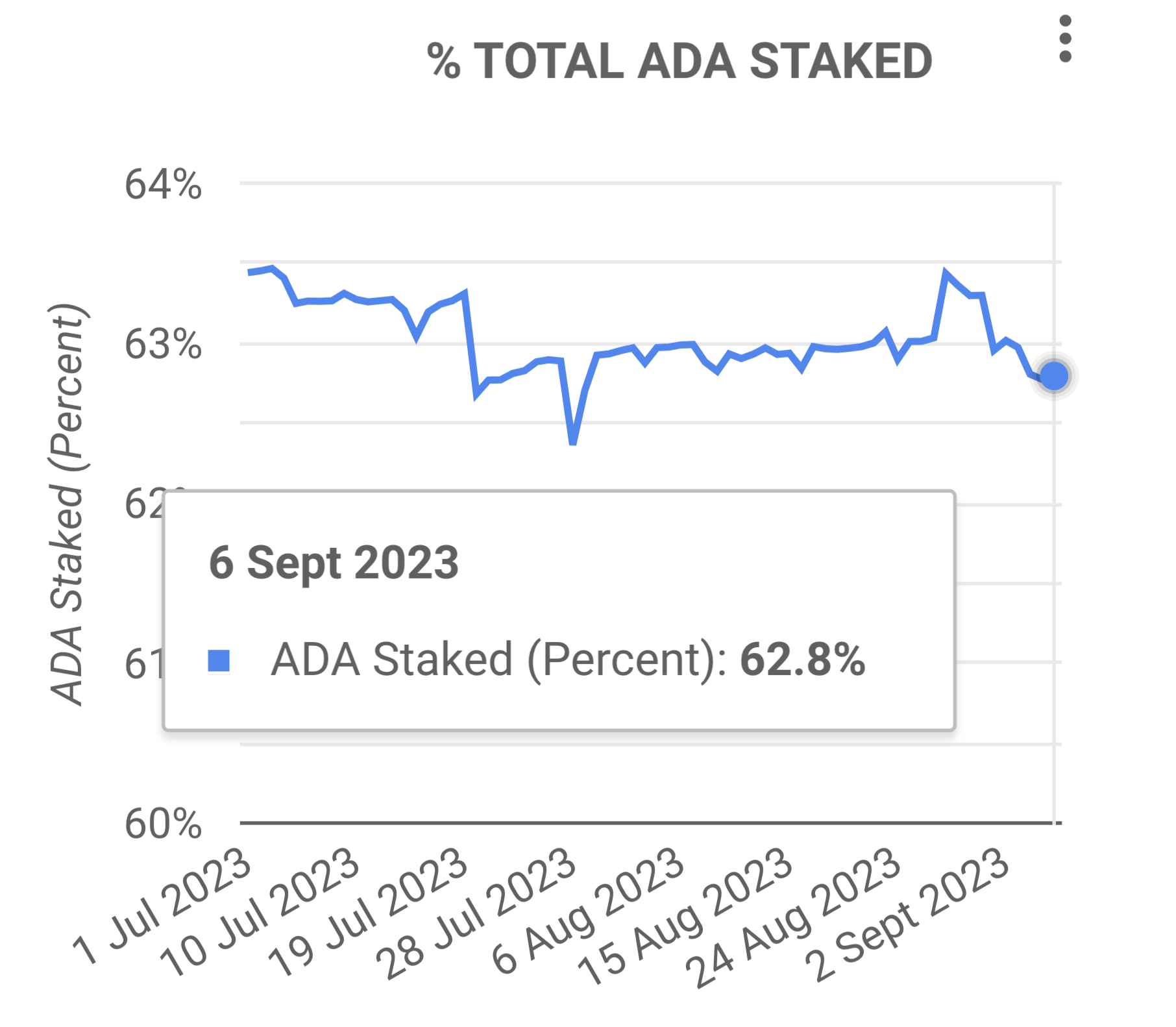

Toward the end of August, Grayscale scored an important victory over the SEC in its appeal to register a Spot Bitcoin ETF. Within days, Cardano staking experienced a noticeable bump as the news boosted investor confidence across the crypto markets. However, recent events show that the impact was short-lived.

The chart below shows that Cardano Staking has dropped sharply from 63.3% to 62.8% within the first week of September. In numerical terms, Cardano holders have unsaked 175.4 million ADA coins (0.50% of the total circulation supply) in smart contracts.

At the current price of $0.26, nearly $45.6 million worth of newly unstaked tokens could soon hit the markets.

The Total ADA Staked metric evaluates real-time changes in the number of coins investors have locked up in smart contracts. Notably, any lower than the current 62.8%, ADA staking activity will drop to a two-month low.

As a Proof-of-Stake network, Staking plays a critical role in the security and decentralization of the Cardano network. When fewer ADA tokens are staked, the network may become less secure, and newly unstaked tokens could increase the short-term market supply.

These factors could potentially discourage investors and lead to a decrease in ADA’s price in the coming weeks.

ADA is Attracting Demand, But Speculators are Anticipating Lower Prices

The Exchange On-chain Market Depth chart depicts the price distribution of current Cardano orders placed across recognized crypto exchanges. Aside from the staking withdrawals, the price distribution of the current exchange orders for ADA also raises concerns.

The chart below shows that within the +/-10% boundaries of the current ADA price, the sell orders outweigh the buy orders significantly. In specific terms, the bearish traders are looking to sell 166 million ADA against the bull’s 150 million ADA purchase orders.

When the “Ask/Buy” side of the market depth chart surpasses the “Bid/Sell” side, it often indicates impending bullish action. The volume of market demand for Cardano has exceeded supply by nearly 16 million ADA.

A closer look shows that most buyers have listed their purchase orders below the 10% boundary in anticipation that Cardano’s price will fall toward $0.24.

In summary, the drop in Cardano staking and price distribution of the current market orders both point toward a potential downswing below the $0.25 support level.

ADA Price Prediction: The $0.25 Support is at Risk

With most Cardano traders now anticipating a downswing, ADA price looks likely to dip below the $0.25 support territory.

The In/Out of the Money (IOMAP) data, which shows the price distribution of the current Cardano holders, also validates this prediction. The chart below shows that 21,780 addresses bought 100.28 million ADA at the minimum price of $0.24. If they cannot keep the bears at bay, Cardano’s price could drop as low as $0.21.

Conversely, if the negative sentiment among the holders subsides, the bulls could force an upswing above $0.35. However, 40,000 addresses bought 2 billion ADA coins at the maximum price of $0.29. They could slow down the ADA price rally if they close their positions early.

But if that resistance level does not hold, the Cardano price rally could hit $0.35 for the first time since mid-July.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.