Binance has dropped support for peer-to-peer (P2P) payments from five sanctioned Russian banks. The news follows reports earlier in the week that the firm’s P2P crypto exchange had failed to implement international Sanctions against certain banks.

After many crypto exchanges terminated or severely curtailed Ruble-based services under the pressure of international sanctions, in recent times, Russian crypto traders have often turned to P2P alternatives.

Binance Cuts Ties With Rosbank, Tinkoff, and Other Russian Banks

But platforms that enable ruble-for-crypto swaps between individuals are increasingly toeing the line on sanctions.

Earlier this week, the Wall Street Journal reported that Binance was enabling peer-to-peer trades of rubles for cryptocurrencies that involved sanctioned Russian banks. Among them were the country’s second-largest credit card provider, Tinkoff Bank, and former Société Générale subsidiary Rosbank.

According to the report, until this week, account holders with sanctioned banks could still purchase crypto with their cards.

Banks were referred to by color rather than by name in what looks suspiciously like a deliberate attempt to obscure the actual payment methods used. For example, bank cards issued by Sber and Tinkoff were listed as ‘green’ and ‘yellow’ payment options on the P2P platform.

Currently, Binance is under investigation in the US for the very crime of facilitating sanctions violations. In light of such allegations, the recent revelations threaten to worsen an already challenging situation for the exchange.

However, on August 25, Binance blacklisted payments made with cards issued by five sanctioned banks. At the same time, the platform has also banned Russian users from conducting P2P transactions with non-ruble currencies.

Read more: 7 Best Binance Alternatives in 2023

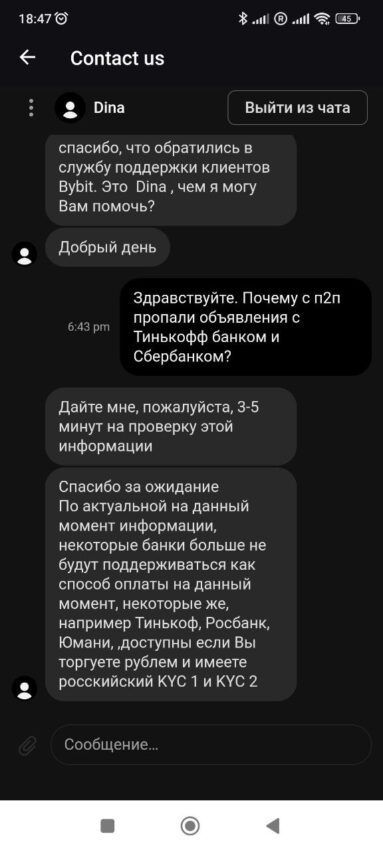

ByBit Also Responds to Russian Sanctions

As BeInCrypto’s Russian news team uncovered, Binance isn’t the only exchange that has recently cut ties with sanctioned institutions. In recent days, the offshore exchange ByBit has also delisted cards held with certain Russian banks as P2P payment options.

The report notes that it is now impossible to make or receive P2P payments on ByBit with cards issued by several banks. The platform has also imposed stricter limits on Tinkoff and Sberbank cards.

Upon inquiry, ByBit support staff confirmed that the platform no longer facilitates payments from some banks. Meanwhile, Tinkoff and Sberbank-issued cards can only be used by people who have passed enhanced Know Your Customer (KYC) vetting.

The enhanced KYC rules also apply to other payment services, including YuMoney.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.