A massive amount of leverage has been flushed out in the largest crypto and Bitcoin market move for months. As a result, liquidations have surged, and market capitalization has crashed by around $100 billion over the past 24 hours or so.

Following months of record low volatility and tight range-bound trading, Bitcoin has made a major move, and it has been downwards.

Bitcoin Dumps to 9-Week Low

BTC plunged 10% to a nine-week low of $25,649 during the Friday morning Asian trading session. Bitcoin has not seen these price levels since the middle of June when markets tanked following multiple SEC lawsuits.

Furthermore, the asset is now trading at $26,426, following a 24-hour decline of 7.5%.

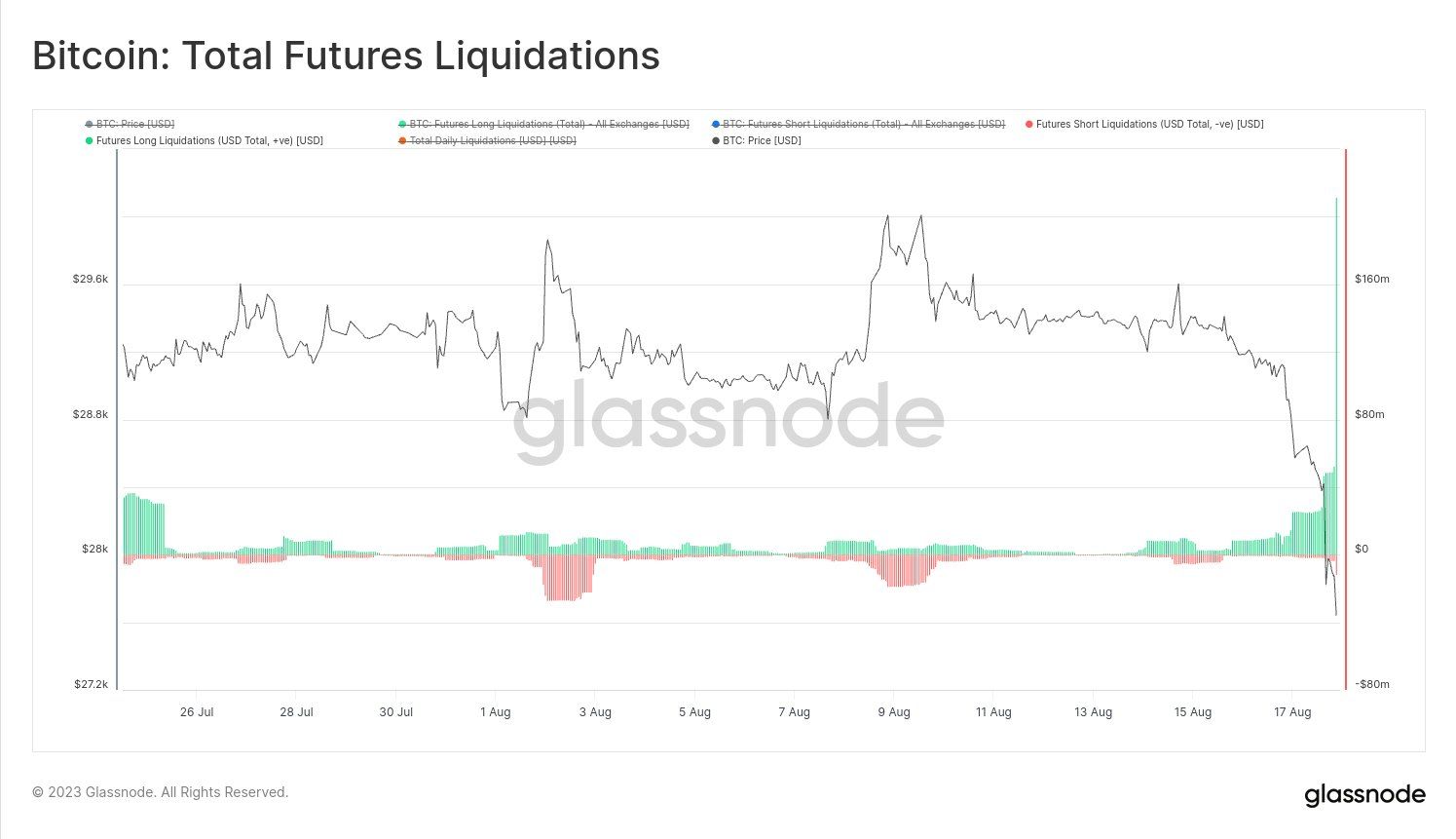

Glassnode reported that Bitcoin futures markets have seen an “extraordinary flush out of leverage.”

“Over $220M in Bitcoin long liquidations have taken place and Options Implied Volatility has more than doubled from 24% to over 55%.”

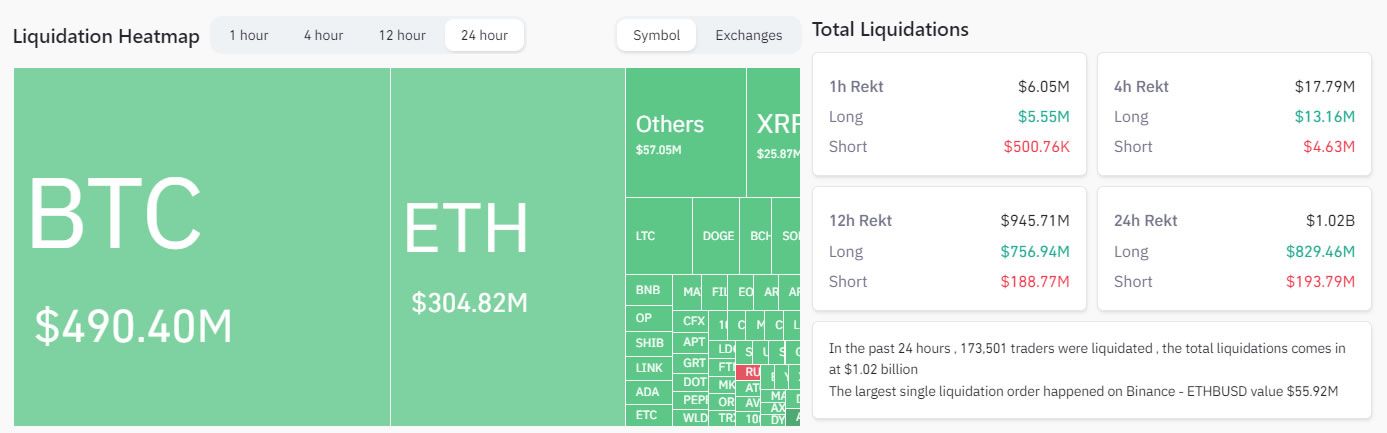

According to Coinglass, there have been more than $1 billion in liquidations over the past 24 hours.

Over 80% of the crypto liquidations have been long positions at $829 million as 173,500 traders were liquidated.

Total market capitalization is down 6.7% to $1.09 trillion, its lowest level since the mid-June slump. However, zooming out on the chart shows that markets are still within their range-bound channel that has been going sideways since mid-March.

Analysts have observed that Bitcoin usually dumps at this time in the year before its halving. “As mentioned, the average return of BTC in August of its pre-halving years in -21.3,” said ITC’s Benjamin Cowen.

Why Have Crypto and Bitcoin Markets Tanked?

There are a number of potential catalysts circulating on crypto social media regarding the market crash. One of which is that Elon Musk’s Space X has sold its BTC holdings.

On Aug. 17, the Wall Street Journal reported that SpaceX recorded $373 million worth of Bitcoin holdings on its balance sheet last year but has since written down its value and has sold the assets.

Other factors are this week’s Fed minutes which suggested that the central bank wants to keep rates higher for longer. This would be fuel for a market correction which is also happening to US and Asian stocks.

There are several other market influencing factors, such as the completion of institutional accumulation. Moreover, miners have been selling their BTC holdings at an increasing rate.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.