Social media is undeniably integral to the promotion and success of cryptocurrencies. One proven instrumental platform is Twitter.

Still, amid all its utility lurks a darker truth – the presence of Twitter bots and their potential to upend crypto marketing strategies.

Twitter Bots to Boost Engagement

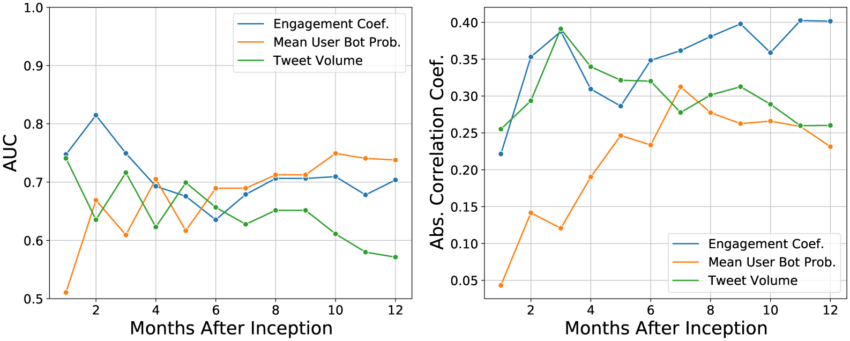

Research indicates a significant correlation between a crypto’s social media engagement and its returns. Engagement, measured through various factors from likes and retweets to the time of a currency’s creation, suggests how an online audience responds to a crypto asset.

However, a skewed engagement coefficient could lead to misguided investment decisions.

One alarming revelation from the study of cryptos and their social media engagement is the influence of Twitter bots. These automated accounts, constituting between 9% and 15% of active Twitter users, can inflate the perceived popularity of a cryptocurrency.

These bots often generate an illusion of widespread excitement, a tactic familiar in pump-and-dump schemes. Consequently, artificial inflation can drive engagement coefficients unusually high, misleading investors and distorting marketing strategies.

Fake Engagement Proves Costly

Cryptocurrencies with extremely high engagement coefficients have been found to yield lower returns.

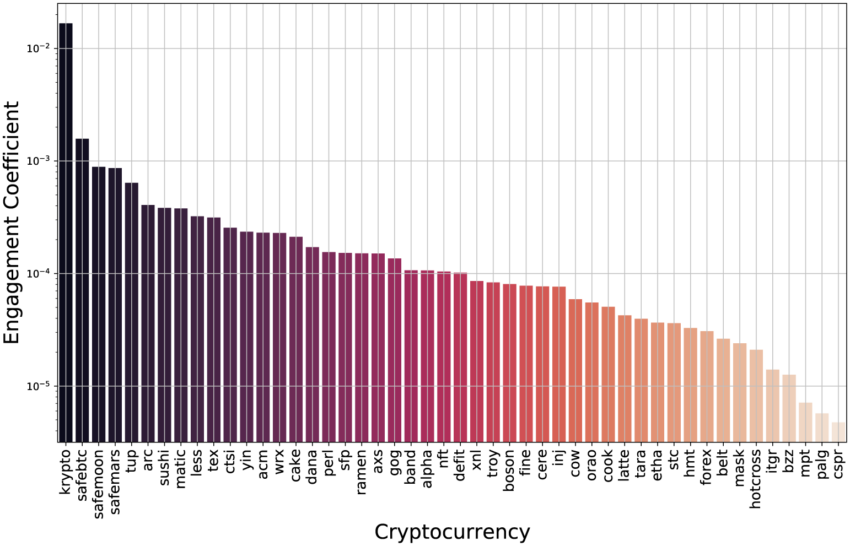

For instance, Krypto achieved impressive returns of up to 49% after two months. Then, it experienced a drastic dip to negative returns. The engagement coefficient for Krypto was almost an order of magnitude larger than other cryptos, suggesting possible bot interference.

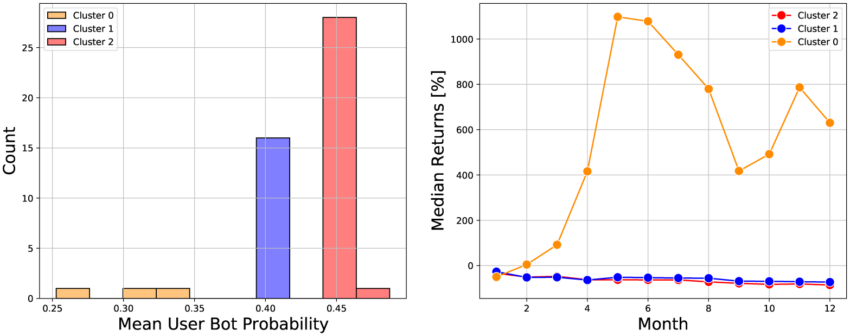

The study also analyzed the prevalence of bot activity in crypto discussions using a tool called Botometer. This algorithm calculates the probability of a Twitter account being a bot. Higher mean bot probabilities were associated with lower-performance cryptocurrencies.

Latte, a DeFi cryptocurrency, had the highest mean bot probability and saw a 95% price decrease within three months.

A Cautionary Tale for Investors

The research suggests potential caution when a cryptocurrency has an engagement coefficient exceeding 10−3, where manipulation might be suspected. Investment strategies based on this data have also shown that the engagement coefficient could be useful in selecting cryptocurrencies with short-term high returns.

However, this approach may not be optimal for those aiming at long-term growth.

Returns over the span of a year were negative for investments, and there was not a significant difference in returns regarding the feature threshold when the returns were negative.

This suggests long-term returns are less dependent on social media features than short-term ones.

Crypto Marketers Must Take Note

So, where does this leave your crypto marketing strategy? The research suggests vigilance. While social media is a powerful tool, it is crucial to understand that not all engagement is beneficial.

Twitter can harm the overall credibility of a cryptocurrency’s marketing efforts. If a coin’s apparent popularity is revealed to be driven by bots rather than genuine engagement, it can undermine the brand identity and trust in the project itself and its team.

Twitter bots can distort perceptions, potentially leading to a volatile and uncertain investment climate. For stable, long-term growth, a balanced marketing approach that includes, but does not solely rely on, social media engagement is advised.

It is not just about the numbers, but the genuine human interest with a loyal community and activity behind those numbers that truly matter in a successful crypto marketing strategy.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.