Bitcoin (BTC) could fill the void left by the economies of BRICS regions Brazil, Russia, India, China, and South Africa, as they seek to boycott the US dollar as the common currency for international transactions.

BRICS leaders seek a US dollar replacement ahead of their next meeting in August.

BRICS Regions Must Find New Currency to Replace Dollar

Could the limitations of other national currencies leave Bitcoin as the only viable solution?

Recently, Coinbase CEO Brian Armstrong argued that China’s adoption of the digital yuan and Hong Kong’s crypto ambitions threaten US supremacy in the digital currency space.

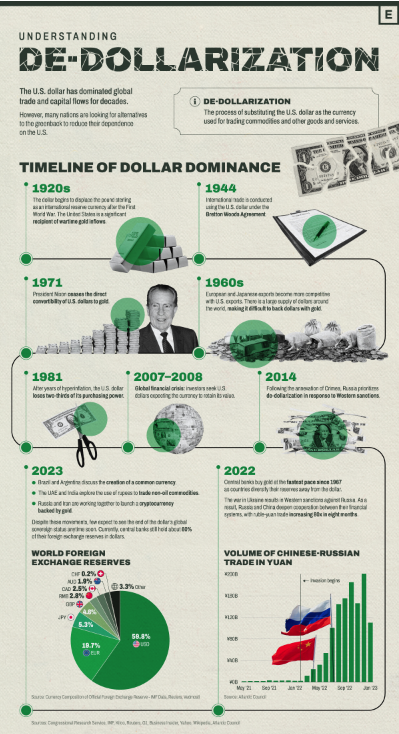

BRICS countries, particularly China, seek independence from the United States and its currency.

Goldman Sachs economist Jim O’Neill coined the BRICS acronym in 2001 to describe regional economies that will dominate the global economy by 2050.

BRICS regions also belong to the G20 and were originally intended to represent investment opportunities.

19 countries recently expressing interest in joining the alliance have increased the drive for a common currency. The inclusion of more countries would notably amplify BRICS’ efforts to dethrone the US dollar.

However, South Africa’s International Relations and Cooperation Minister Naledi Pandor said in May,

“I don’t think we should always assume the idea will work, because economics is very difficult and you have to have regard to all countries, especially in a situation of low growth when you are emerging from crises.”

Will Bitcoin Be the Official BRICS Currency?

BRICS leaders must make important decisions about a common currency and confirm their de-dollarization when they meet in August. No fiat currency other than the Chinese yuan appears as a feasible US dollar alternative.

For a run-down on the best Bitcoin exchanges, click here.

Though the idea initially may seem far-fetched, Bitcoin could unexpectedly emerge as a feasible option. BRICS members could use a currency they had no role in developing.

The antagonism US regulators recently showed the largest crypto by market capitalization means that BRICS nations could surpass US Bitcoin dominance with a few confident decisions.

Read here about the US SEC’s crypto crackdown.

Bitcoin proved its resilience and longevity by recovering well from recent headwinds. The asset has risen from $25,500 on June 10 to $26,389 at press time.

Moral of the story: The new world could revolve around Bitcoin.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.