The casinos on the Strip in the gambling capital of Las Vegas are reportedly undergoing adjustments that will increase casino revenues and decrease players’ chances of winning. Is the selective scrutiny on ‘crypto gambling’ really fair?

However, the absence of crypto rules in the U.S. and the administration’s general attitude towards equating cryptocurrency with gambling does not safeguard investors.

Gambling Rules Remain Lenient, But Not for Crypto

According to The Wall Street Journal, Las Vegas casinos on the Strip are implementing changes that make gambling more lucrative—for the house, that is.

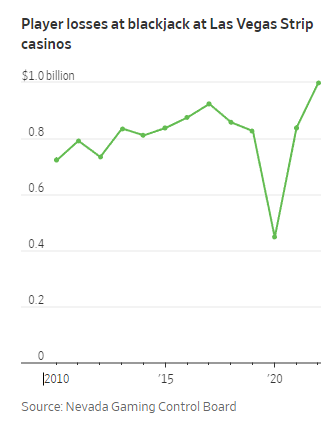

The report also includes information from the Nevada Gaming Control Board that indicates significant player losses. Notably, blackjack players lost nearly $1 billion last year. And this figure represents just one game, on one strip, in one city. This is the second-highest loss on record for gamblers.

Casinos are implementing new tactics like raising the minimum bet amounts during peak traffic hours. According to critics, this puts smaller players at an even greater disadvantage.

Some might point out that thefts, bankruptcies, and exploits in the cryptocurrency market swindled innocent users out of billions of dollars. This is especially true after the FTX debacle. The response only strengthens the need for safeguards in terms of regulations and cybersecurity.

Much like traditional finance, instances caused by bad actors are reduced with mainstream adoption and regulation.

Recently, a leaked memo circulated among Democratic Party officials in Washington, raising questions about the course of U.S. cryptocurrency legislation. BeInCrypto highlighted the community’s dissatisfaction with authorities’ inadequate knowledge. Many lawmakers still view cryptocurrency as purely speculative and equate it to gambling.

Why Crypto is Not Pure Speculation

Warren Buffett, a well-known investor and crypto skeptic, has previously referred to Bitcoin as a “gambling token.”

Meanwhile, the US SEC’s ongoing crackdown on cryptocurrencies is motivated by the desire to protect investors. Protection that it claims is possible under its existing securities regulations.

The action seems inadequate as the agency has failed to classify what constitutes a cryptocurrency as a security. SEC Chairman Gary Gensler has campaigned to bring the cryptocurrency market under the commission’s purview, and his description of the asset class as the “Wild West” became the benchmark for the rest of the business.

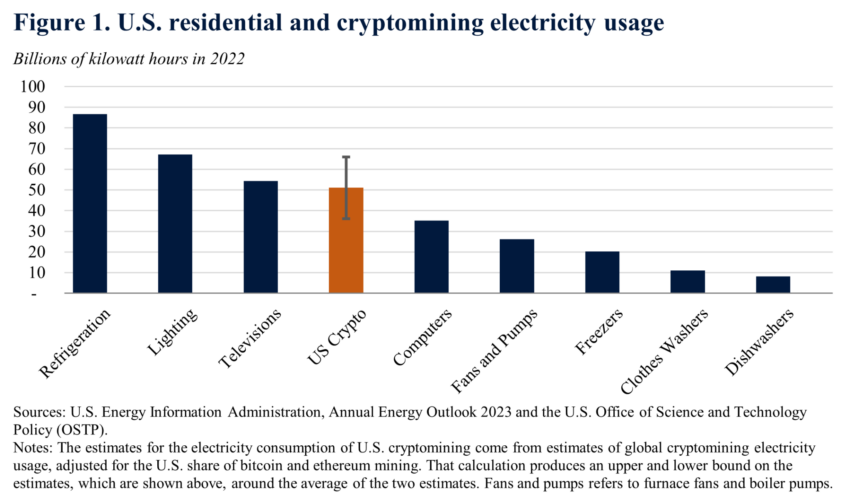

With the unclear regulatory direction in the jurisdiction, the previously announced idea to tax Bitcoin and cryptocurrency miners under the DAME Act was also recently shelved. The tax was designed to charge miners for their electricity at a 10% rate, possibly increasing to 30% by 2026.

But, a clarification from the Treasury Department is still awaited as the debt ceiling deal also remains in the works.

Recently, the U.K. House of Commons Committee also claimed that buying, selling, and holding unbacked crypto assets is similar to gambling. To safeguard consumers, they advised regulating it like gambling.

Many investors indeed rush in to capitalize on the volatile price swings of cryptocurrencies and engage in short-term speculation. Cryptocurrencies occasionally resemble gambling because of their volatility and potential for huge gains or losses. However, the market share of blue-chip assets, like Bitcoin and Ethereum, is not dependent solely on speculation.

This is unlike the gambling industry in Las Vegas and other states in the U.S.

Gambling Growth Calls For Nuanced Rules

Reports note that the Supreme Court judgment from May 2018 has substantially impacted the growth of sports betting over the years. As a result, numerous U.S. states have legalized sports betting, with at least 33 states and Washington, D.C., permitting it in some capacity.

Reportedly, six states presently permit online gambling.

Although each state has its own betting rules, individuals are mostly permitted to engage in some form of offline or internet casino.

BeInCrypto has reported that ‘cryptocurrency addiction‘ is becoming a serious problem. But, the laws also need to be more nuanced. As noted, there are similarities between cryptocurrency addiction and gambling addiction. Some contend that the addiction itself is a sign of a deeper problem.

The government must permit the cryptocurrency sector to inform users of the risks they may face, raise consumer awareness, attract investors, and win over regulators, especially when a competing gambling sector is thriving on the other side.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.