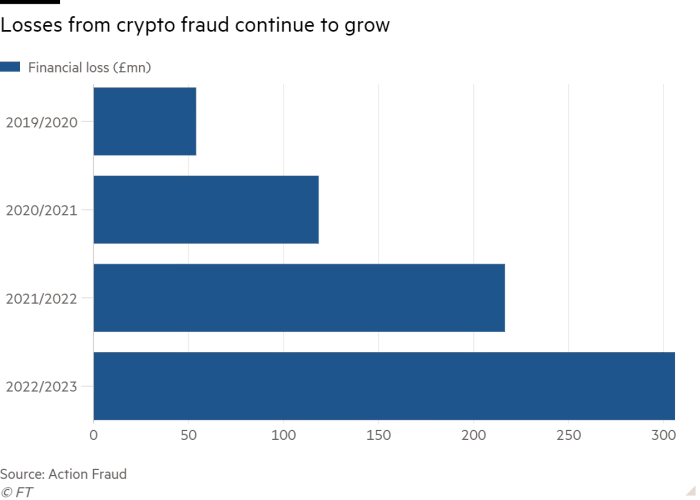

The losses from crypto fraud in the U.K. have increased by more than 40% in the last year, according to Britain’s fraud reporting agency.

According to figures from Action Fraud, the losses have surpassed £300 million ($370 million). This is reportedly due to an upsurge in crypto scams and multiple bankruptcies brought on by the FTX fiasco.

Millions Lost in Crypto Scams

In the 12 months until March 2023, crypto fraud losses were $370 million. According to data analysis by the law firm RPC, this is an upsurge from about $250 million the year prior. More than a third of the overall losses occurred in November 2022, when the exchange filed for bankruptcy. Notably, the fall of FTX significantly contributed to these losses.

Jennifer Craven, a fraud expert at law firm Pinsent Masons, told the paper that the figures underscore the prevalence of crypto crime.

The figures also highlight the dire need for a standardized crypto framework for global investors. In February, the U.K. Treasury drafted recommendations proposing new crypto asset rules. Meanwhile, the U.K. House of Commons Committee proposed that trading and investment in unbacked crypto assets resembles gambling in a report dated May 17.

UK Crypto and Finance Regulations Take Priority

Several of the U.K.’s conventional financial (TradFi) institutions have cautioned the government about potential hazards in crypto regulation. This comes when the U.K. intends to implement specific crypto legislation within the next 12 months. As reported by BeInCrypto, many of these institutions have cautioned the government about the hazards associated with cryptocurrencies regarding accuracy, taxation, and consumer protection. They have also warned the government that regulating cryptocurrencies could result in consumers having a false feeling of trust.

Overall, the U.K. government is cautiously approaching crypto asset regulation. They seek to support industrial innovation while safeguarding consumers from related risks. The national fraud strategy of the U.K. government recently forbade cold calling in the region concerning financial and investment items.

In the meantime, the U.S. Attorney’s Office may be starting a civil forfeiture case for cryptocurrency-related fraud cases. In a statement, the government stated that it sought to forfeit the crypto taken from seven accounts at Binance, creating a precedent for handling cryptocurrencies in fraud cases.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.