While the month of April ended bullishly for the cryptocurrency market, the entirety of May was bearish, solidifying that the market is in a corrective state.

While there is hope that a bullish reversal will begin in June, these four cryptocurrencies have bearish formations, indicating that the worst is yet to come.

Cardano (ADA) Price at Risk of Losing Critical Support

The Cardano (ADA) price has followed an ascending support line since the beginning of the year. While doing so, it reached a new yearly high of $0.46 on April 15. However, the price has fallen since.

After an initial bounce on May 11 (green icon), the price risked another breakdown on May 26. However, another bounce followed afterward.

Since the line has been in place for 151 days, its breakdown would likely cause a significant plunge. In that case, the closest support area will be at $0.30, a 19% drop from the current price.

However, if the bounce continues, the price can instead begin an increase toward the $0.45 resistance region.

The RSI readings are mixed. Market traders use the RSI as a momentum indicator to identify overbought or oversold conditions, and to decide whether to accumulate or sell an asset.

Readings above 50 and an upward trend indicate that bulls still have an advantage, whereas readings below 50 suggest the opposite. While the indicator fell below 50 (red icon) at the end of April, it is currently in the process of reclaiming the line again.

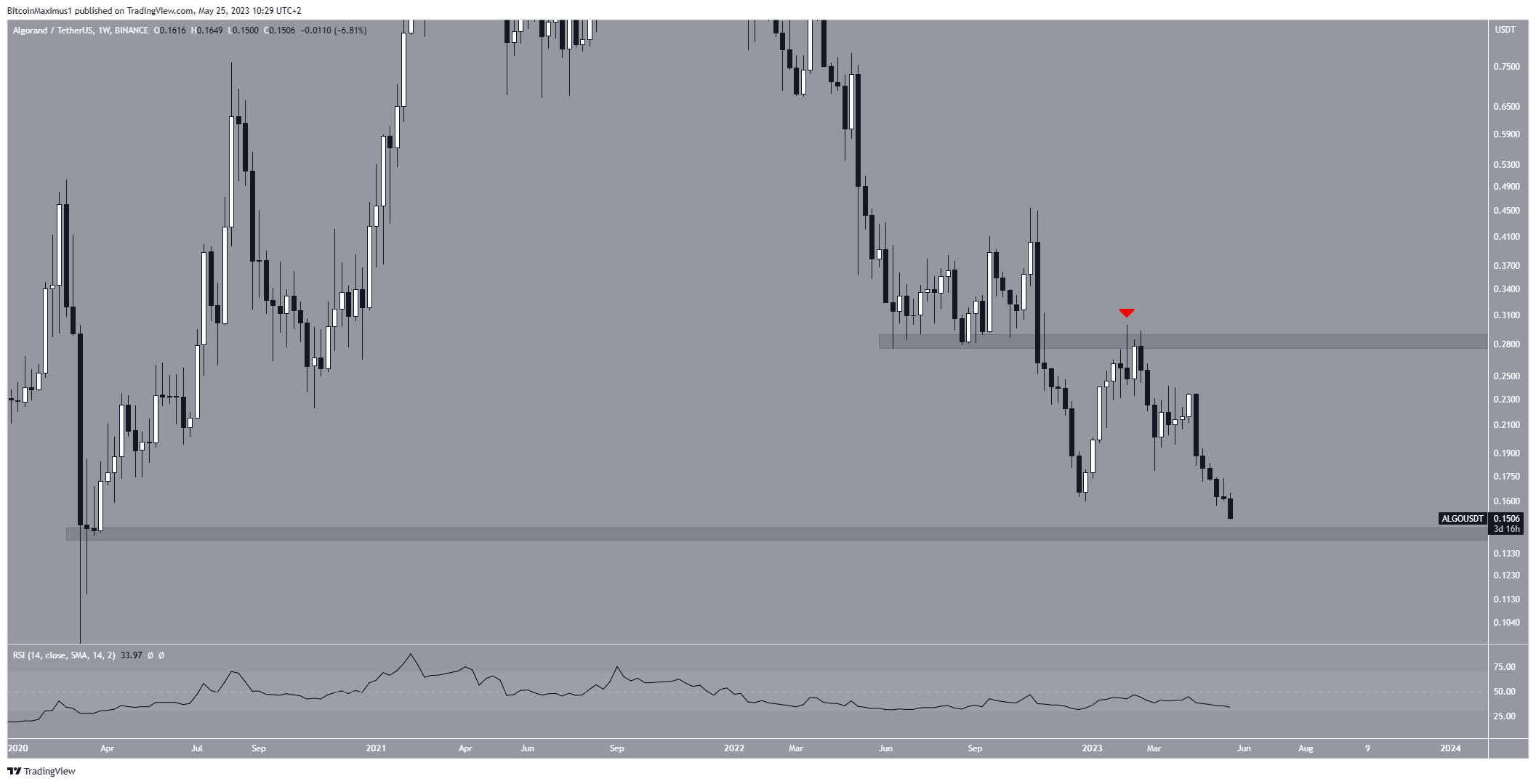

Algorand (ALGO) Price Falls to New Yearly Low

The ALGO price initiated a bounce at the beginning of the year but failed to clear the $0.28 resistance region. Rather, it was rejected (red icon) and began a sharp drop. The decrease led to a new yearly low of $0.15 in May 2023.

Now, the price is approaching the 2020 lows at $0.14. Due to the sharpness of the descent, there are no bullish reversal signs in place.

The price has created six consecutive bearish candlesticks with successively lower closes, a decisive sign of weakness.

Furthermore, the weekly RSI is below 50 and falling, a sign of a bearish trend.

Despite this bearish outlook, if the price were to close above $0.16 in the weekly time frame, it could initiate an upward movement toward the next resistance at $0.21.

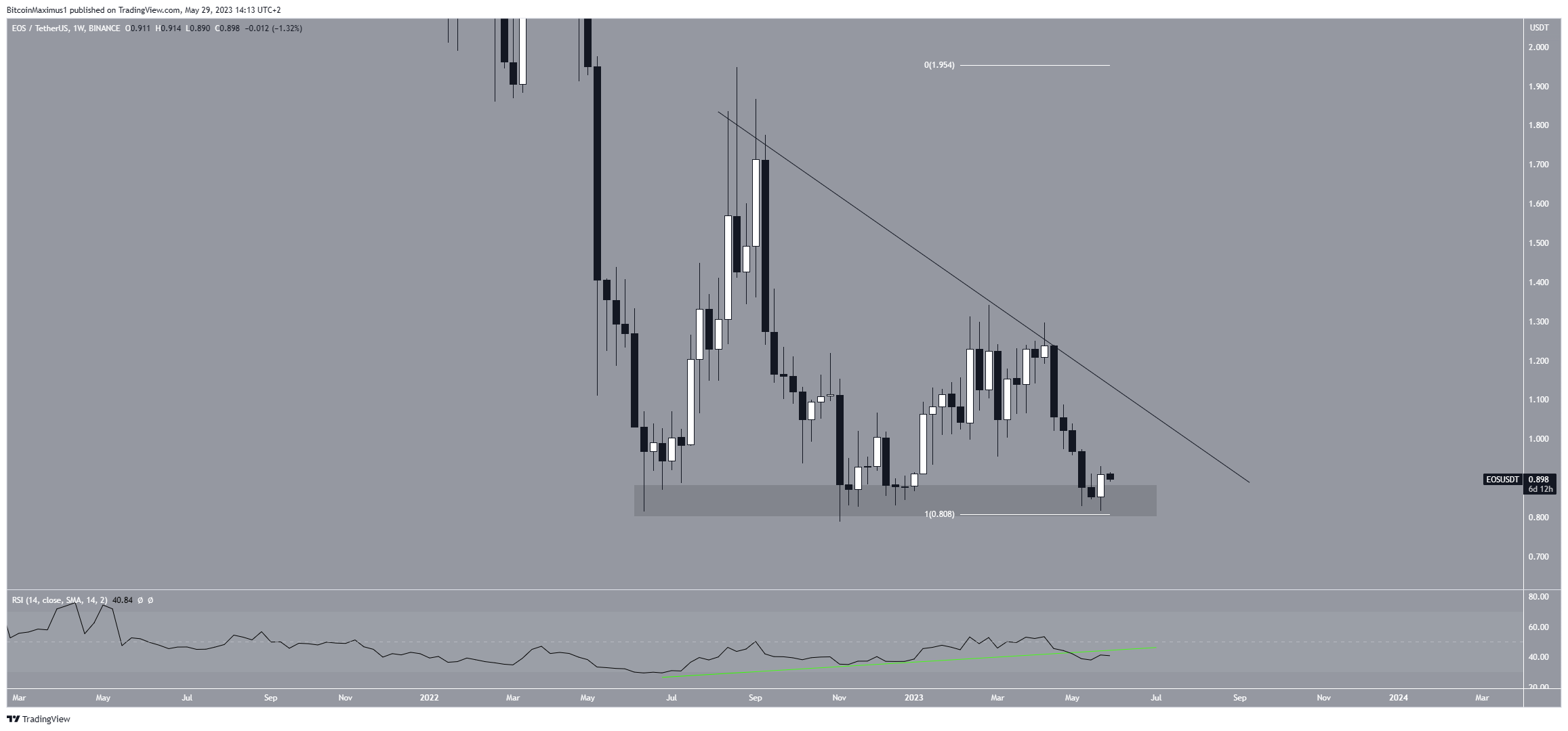

EOS Price Risks Fall to 2017 Lows

The EOS price has fallen since August 2022. It created a lower high in January 2023 (red icon), creating a descending resistance line in the process. Afterward, the price fell to the $0.85 horizontal support area.

This is the third time the price has fallen to this level during the past 12 months.

Since lines get weaker each time they are touched, an eventual breakdown from this area seems to be the most likely scenario. This possibility is supported by the RSI, which is below 50, decreasing, and has already broken down from its ascending support line.

If the price breaks down, the next support will be at $0.45. The level has not been reached since late 2017.

However, a strong bounce and breakout from the descending resistance line will invalidate this bearish EOS price prediction. In that case, an increase to $1.80 could transpire.

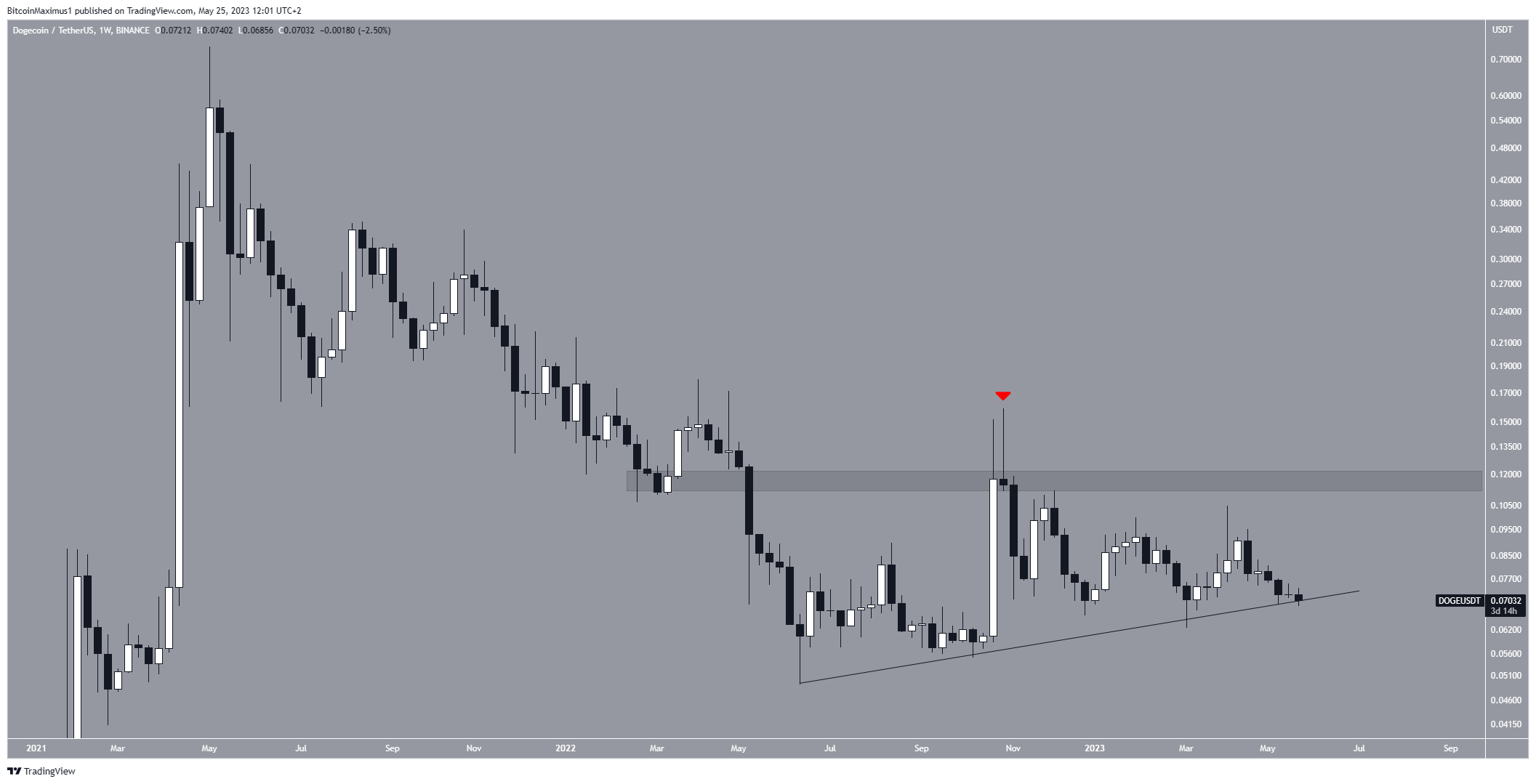

DOGE Concludes Bearish Cryptos

The DOGE price has fallen since it was rejected by the $0.12 horizontal resistance area in October 2022 (red icon). The decrease took the price back to an ascending support line that has been in place since June 2022.

Since the line has been in place for such a long period of time, a breakdown from it could catalyze a sharp fall.

This is the fourth time that the price revisits this line. Lines get weaker each time they are touched. Thus, an eventual breakdown from it is the most likely outlook.

If that occurs, the DOGE price could return to its 2022 lows near $0.05.

However, a sharp bounce would invalidate this bearish hypothesis and could lead to an increase toward the $0.12 resistance area.

For BeInCrypto’s latest crypto market analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.