Fundstrat researcher Tom Lee says positive inflation news can overturn prevailing bearish market sentiments.

An AAII survey says about 40% of institutional investors expect stocks to decline over the next six months despite bullish market indicators.

Short-Term Sentiment is Contrarian

The AAII sentiment survey is contrarian, meaning that investors have earned higher-than-expected returns after periods of low optimism. Sentiment surveys often inform short-term trading.

Lee believes that cooling inflation aided by falling housing costs should ease investor concerns. He predicted that the S&P 500 would rise 14% in the next year rather than fall 15% as investors expect.

Stocks seesawed on Monday morning as markets prepared for President Joe Biden’s debt ceiling talks.

Bitcoin (BTC) recovered to $27,400 after falling to $26,500 on Friday, with Ethereum (ETH) up 1.45% to $1,830. It has not consolidated any gains above $30,000 since breaking above that level in April.

Lee’s last prediction that the S&P 500 would hit a record high last year failed to materialize as the index had its worst year since 2008.

Previous Market Sentiment Response Suggests Correct Prediction

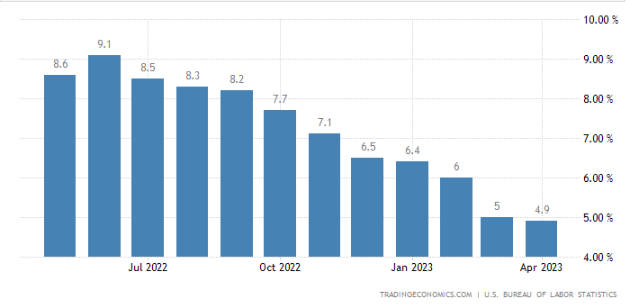

Headline inflation fell to 4.9% annually in April after around 5% of interest rate hikes in the last 14 months.

Falling inflation suggests that the Federal Reserve (Fed) may pause increases which could be a boon for equities and crypto given their recent correlation.

Stocks and crypto defied expectations and rallied after the April U.S. jobs report revealed an increase in hourly wage growth.

A decrease in the three-month employment average drove the rally. The Fed views decreasing job numbers as signs that interest rate hikes are cooling the economy.

Despite bullish indicators, Bank of America recently predicted that the American economy could enter a recession this quarter.

Oil prices have recently stabilized after four bearish weeks as investors contemplated the U.S. debt ceiling and slowing economic growth in China.

Fed chair Jerome Powell suggested that a U.S. recession was avoidable earlier this month.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.