More Latin American (LATAM) countries are considering Bitcoin adoption as they follow in the footsteps of El Salvador. However, a surge in BTC transaction fees could make daily usage impractical.

El Salvador was the first country to adopt Bitcoin as legal tender, but a number of others in the region could follow.

According to strategist Samson Mow, Ecuador and Peru are among the nations that could adopt Bitcoin as legal tender.

“Many countries in Latin America will be adopting Bitcoin,” he told Reuters last week. El Salvador was first, but “we know that many other countries in the region are starting to look towards it,” he added.

Bitcoin adoption advocacy group JAN3 commented:

“It’s undeniable that countries with rampant inflation see the most adoption out of people’s sheer necessity to protect their income and savings.”

Bitcoin into LATAM

Mexico is another country that could adopt BTC, according to Mow, who said:

“There is a potential for Bitcoin to transform not only Mexico but the entire Latin American region and to bring more prosperity.”

Furthermore, Argentina is also on that list because a pro-Bitcoin Presidential candidate is leading the polls.

Libertarian Javier Milei was quoted as saying, “The Central Bank is a scam. It is a mechanism by which politicians cheat the people with the inflation tax.”

Meanwhile, back in El Salvador, President Nayib Bukele enacted legislation removing taxes on technological innovations on May 4.

The Innovation and Technology Manufacturing Incentives Act eliminates all taxes on software and app programming, AI, computer and communications, and hardware manufacturing.

America, on the other hand, remains hell-bent on quashing the crypto industry. The U.S. government’s latest anti-crypto move was a proposed 30% tax on crypto mining operations.

Transaction Fees Spike

Using BTC for daily spending may not be practical at the moment as transaction fees have surged. According to Mempool Space, the average transaction fees are around $10, having spiked to $20 a few hours ago.

Instasize CEO Hector Lopez tweeted about the pain points of using BTC to pay for his lunch in El Salvador on May 8.

“4 Pupusas = $3.00

Bitcoin Fee = $9.00

TOTAL = $12.00How is VISA going to compete?”

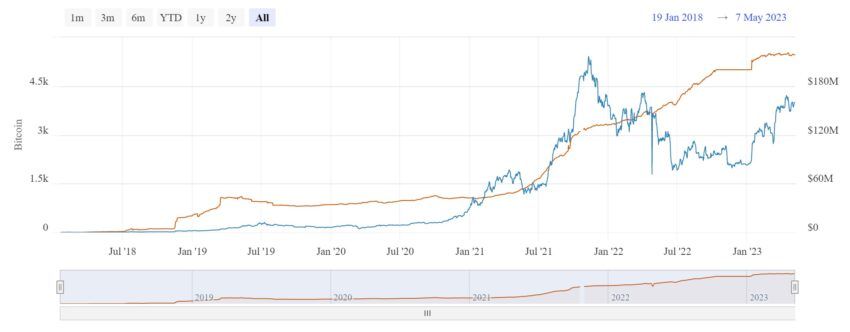

The answer is to use the Lightning Network, which dramatically reduces transaction fees. According to Bitcoin Visuals, LN usage has surged 77% over the past 12 months in terms of channels. Furthermore, the current LN network capacity is at a record high of 5,463 BTC.

The memecoin madness-induced demand will only push up the need for payment channels such as the Lightning Network. This would go a long way in solving the transaction issue for countries that adopt it.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.