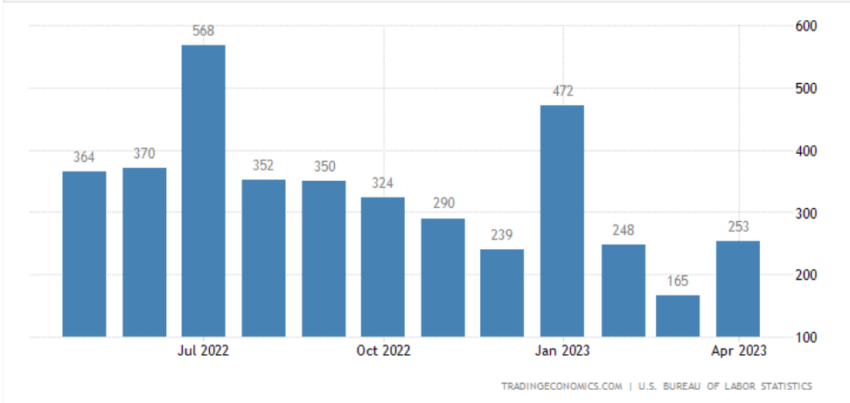

According to the U.S. Bureau of Labor Statistics’ jobs report, nonfarm payrolls rose 253,000 in April, while the three-month average dropped to 222,000, increasing the chances of a Fed rate pause.

Unemployment came in at 3.4%, 0.2% lower than estimates in a jobs report that should have sent markets south.

Bitcoin Rallies to $29,300 Despite Labor Data

However, equities rallied, with the S&P 500 index and the Dow Jones Industrial Average rising 1.4%. The Nasdaq composite also rose 1.8%. Bitcoin (BTC) traded at $29,322 at press time.

ETH rose marginally from $1913.78 to $1945.69, with the rest of the top 10 cryptos largely indifferent. Spot gold was also muted at $2014.00 per ounce, shedding record gains from earlier this week.

According to Steve Rick from CUNA Mutual Group:

“It is encouraging to see a strong jobs report amid recession concerns, instability in the banking sector, and ongoing layoffs.”

The news barely moved the CME Group’s prediction that the Federal Reserve (Fed) will soon introduce rate cuts. The CME Group’s inflation tool suggests that markets are pricing in a rate pause, with only an 8.5% probability of further increases.

Fed chair Jerome Powell hinted at a rate pause earlier this week after announcing a 25 basis point rate hike.

Jobs Report Actually Reveals Slowdown

A closer look beneath the surface suggested the bullish moves considered revised job numbers for February and March, both of which came in 149,000 lower than previously estimated.

Overall, the average number of jobs added in the last three months came down to 222,000 from 295,000 at the end of March.

Matt Peron from Hanus Henderson Investors argues that the best conclusion is that job growth has, on average, been coming down, but he expects more market volatility.

However, hourly wage growth, which the Fed considers a key driver of inflation, rose half a percent in April. Annually, wages grew by 4.4%, marginally increasing the chances of a future rate hike.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.