These two crypto analysts made inaccurate predictions for the crypto market in April, particularly relating to the Bitcoin (BTC) price.

Forecasting the direction of the cryptocurrency market is challenging because of its significant fluctuations and occasional lack of correlation with broader economic trends.

These two analysts made predictions about the crypto market in April that turned out to be untrue.

Crypto Capo And “Capriltulation”

Notoriously bearish crypto analyst @CryptoCapo suggested that the monthly candlestick for April will be the biggest bearish candlestick in history, reaching the $12,000 area.

The bearish analyst further elaborated on his trade idea, when asked if he was trolling, by stating:

“Not really. It’s what I truly think, but with a touch of humor. What makes people bullish and confident is the price action but they don’t stop to think beyond that”

Needlessly to say, the BTC price did not reach this area. In fact, the monthly candlestick was bullish, albeit by a very small amount.

However, it is worth mentioning that the price did not break out from the long-term $31,000 resistance area (red icon). So, despite the bullish close, the price movement allows for the possibility that a local top has been reached.

The Relative Strength Index (RSI) accentuates the indecisiveness of the trend.

By using the RSI as a momentum indicator, traders can determine whether a market is overbought or oversold and decide whether to accumulate or sell an asset.

If the RSI reading is above 50 and the trend is upward, bulls have an advantage, but if the reading is below 50, the opposite is true. The current reading of 50 is a sign of an undetermined trend.

In the monthly timeframe, the next resistance is at $46,000, while the closest support area is at $23,000.

TheMoonCarl’s Failed Inverse Head and Shoulders

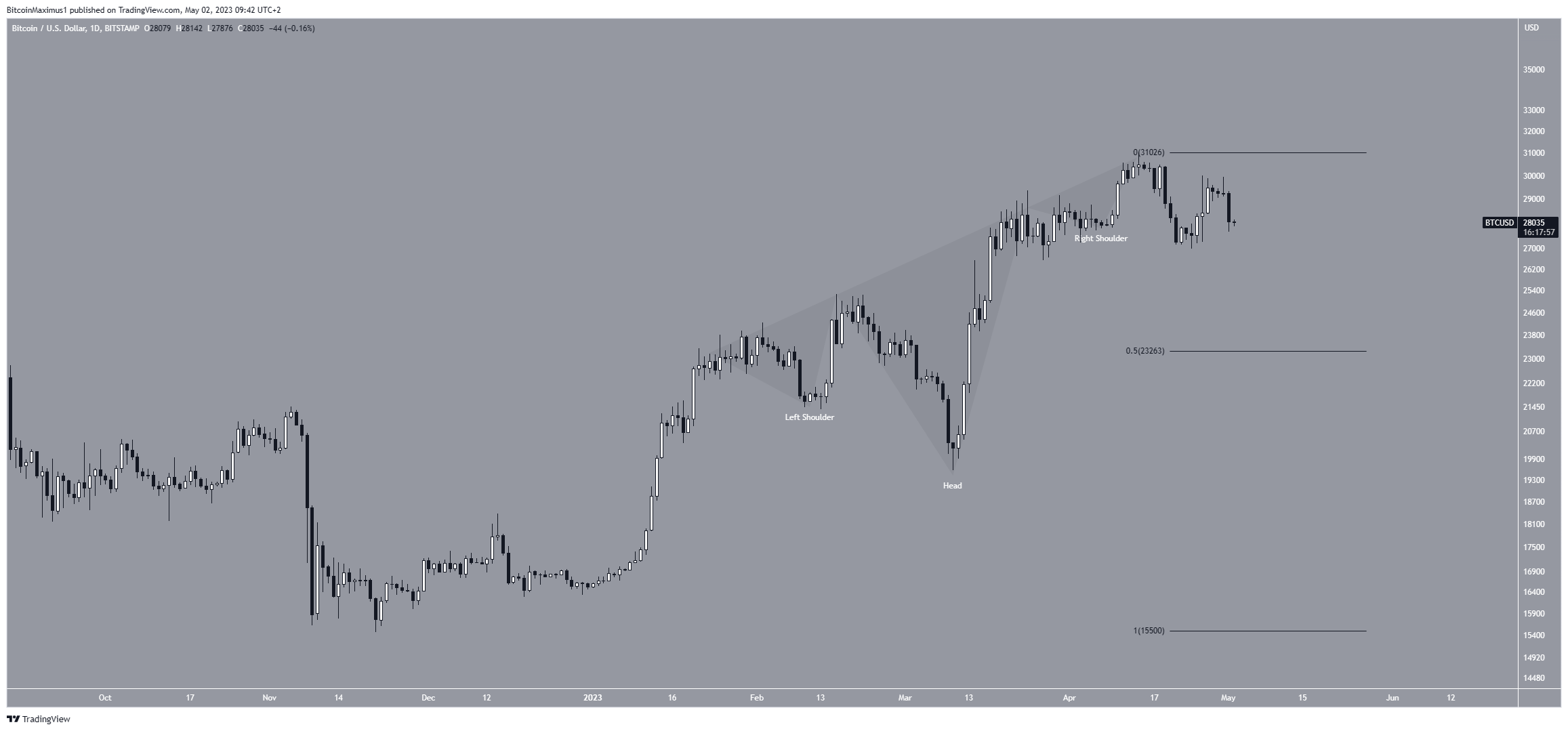

Well-known crypto analyst @TheMoonCarl tweeted a chart of an inverse head and shoulders pattern in the Bitcoin price chart with a target of $40,000. The pattern was extremely unusual, with a steep, upward-sloping neckline.

The Bitcoin price did not break out from it. Rather, a decrease followed after the RSI generated a bearish divergence. This is a type of occurrence in which a momentum increase does not support the price increase.

Afterward, the Bitcoin price created a lower high (red icon).

If the decrease continues, the closest support area will be at $23,250, created by the 0.5 Fib retracement support level (black). Fibonacci retracement levels operate on the principle that after a significant price change in one direction, the price will retrace or revisit a previous price level, partially, before resuming in its original direction.

On the other hand, moving above the previous high of $31,000 will mean that the trend is bullish, leading to a possible increase toward $40,000.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.