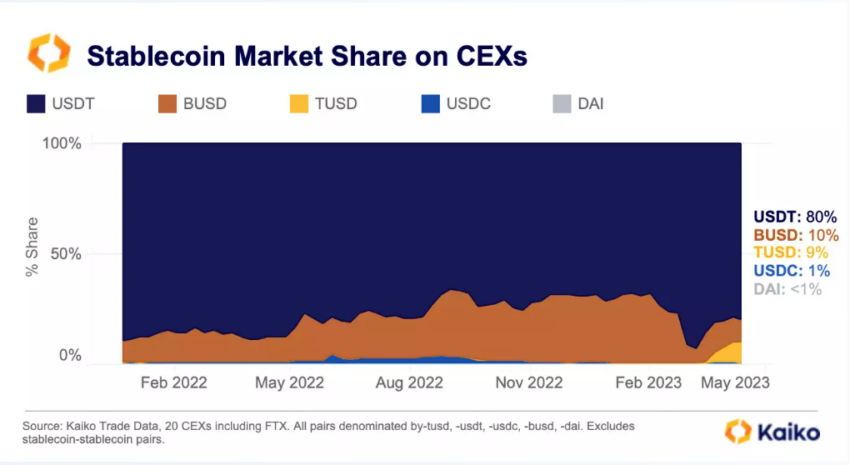

Binance’s BUSD/TrueUSD (TUSD) pair dominates Bitcoin (BTC) volume, accounting for 50% of all BTC trading as reintroduced fees tank other pairs’ trading volumes.

Research firm Kaiko revealed that Binance’s BTC/TUSD trading volume grew to $60 million per hour shortly after the exchange reinstated fees for other pairs in late March.

Switch to TUSD Comes Despite Scant Reserve Data

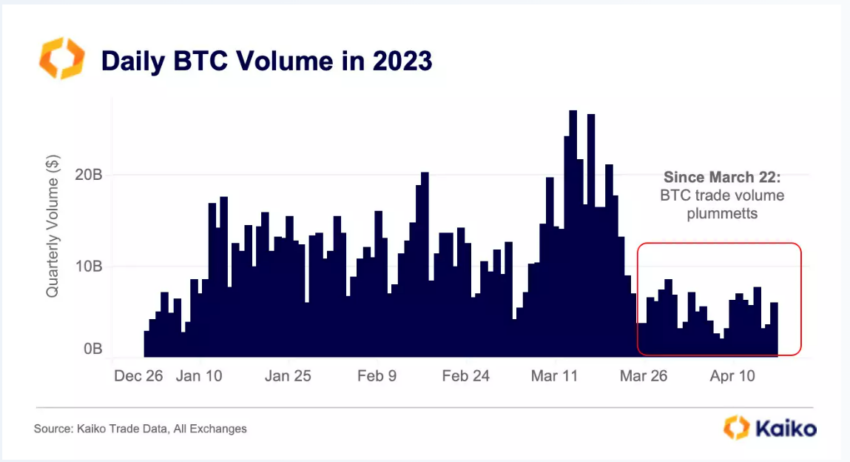

The exchange’s emphasis on TrueUSD resulted in BTC trading volumes commensurate with a bear market.

However, TUSD still trails BUSD and Tether, which make up 90% of trading volume on centralized exchanges. It will likely overtake BUSD after a New York prudential regulator ordered BUSD issuer Paxos to stop minting the coin.

TUSD is a stablecoin, a cryptocurrency meant to track the value of a fiat currency like the dollar. Crypto traders buy stablecoins to move in and out of crypto trading positions faster than with fiat.

According to its website, TrueUSD is “the first independently-verified digital asset redeemable 1-for-1 for U.S. dollars.” It runs natively on Ethereum, BNB Smart Chain, TRON, Avalanche, and BNB Beacon Chain.

A real-time snapshot of TrueUSD’s reserves reveals over $2 billion backing all minted coins. The makeup of the reserves is not clear. Techteryx Ltd, a firm with a base in Singapore, bought the intellectual property for TrueUSD from Archblock in 2020.

The Commonwealth of Dominica has authorized the coin as a digital currency and medium of exchange since October 2022.

TrueUSD competitor Tether recently announced that it would no longer use commercial paper for its USDT reserves.

Brazil Accuses Binance of Bypassing System to Prevent Derivative Trading

Brazilian news outlet Valor reports that the Federal Public Prosecutor’s Office and the Federal Police are investigating Binance. The exchange faces financial crime allegations by the Securities and Exchange Commission and the Attorney General of the State of São Paulo.

According to the securities watchdog, a Binance representative instructed users to access the foreign version of its online Futures platform because the Brazilian version did not offer derivatives. Binance CEO Changpeng Zhao is allegedly a partner in the firm B Fintech Serviços de Tecnologia, the firm implicated in the filing.

If found guilty, the person who approved this instruction could face six months to two years in jail.

Brazilian authorities previously issued a cease-and-desist order after Binance offered residents derivatives in violation of securities laws.

Binance faces civil charges in the U.S. for offering derivative products to big firms without registering with the Commodity and Futures Trading Commission. Zhao called the charges “disappointing.”

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.