Bitcoin (BTC) and other cryptocurrencies are known to be an extremely volatile asset class that can lead to either substantial gains or catastrophic losses, depending on when you invest. What if there was a simple way to predict significant price movements just before they occur?

In a recent research piece from SFOX, the team examined connections between public holidays and Bitcoin price action during a bull run.

If you would like to trade Bitcoin (BTC) safely and securely on our partner exchange, follow this link to get all set up on XCOEX.

If you would like to trade Bitcoin (BTC) safely and securely on our partner exchange, follow this link to get all set up on XCOEX.

Bitcoin on Holiday

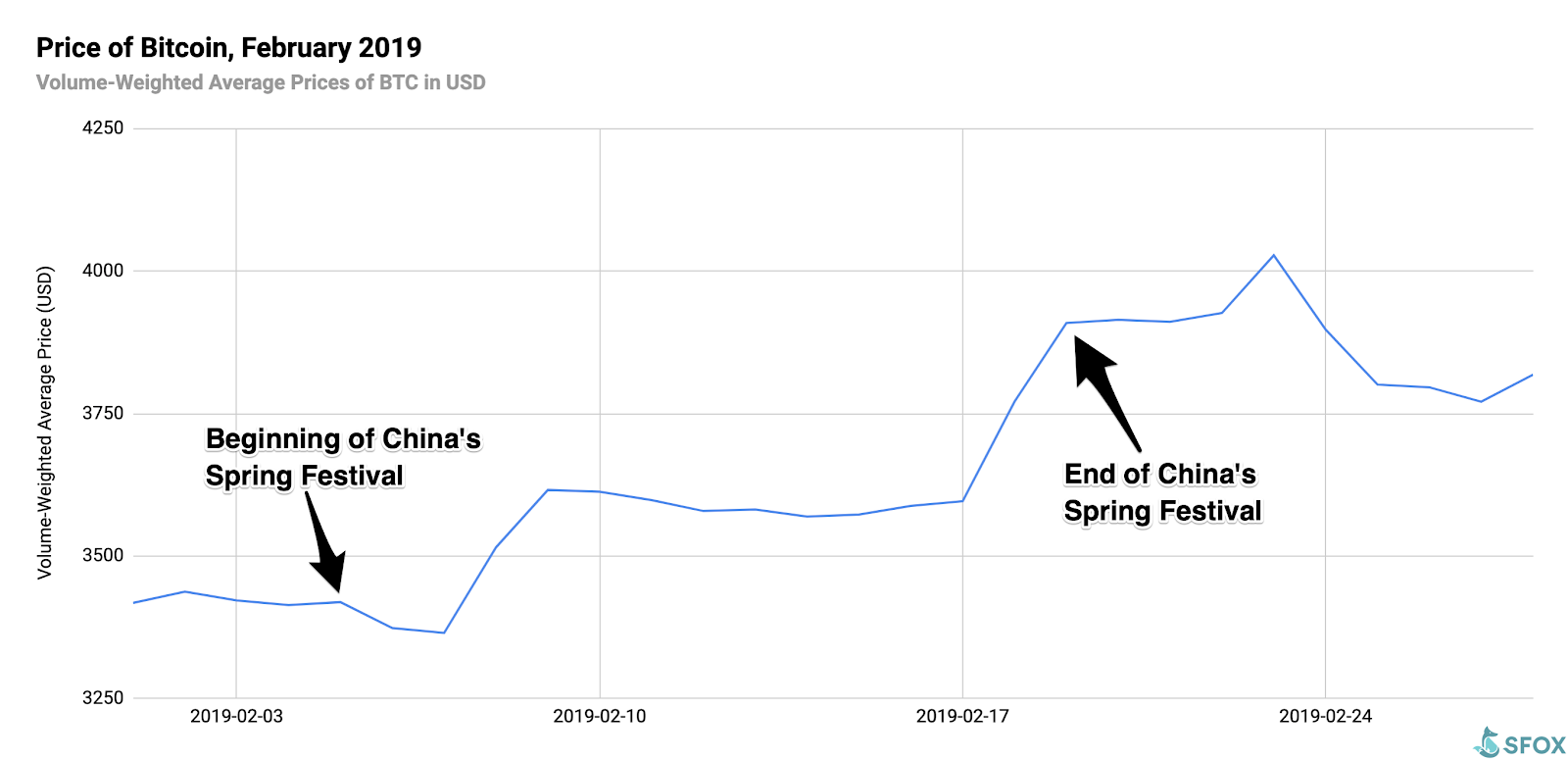

When correlating the price action of Bitcoin (BTC) during the 2017 bull run with major public holidays in the United States, a clear trend was observed. In the weeks surrounding Thanksgiving 2017, BTC experienced a tremendous upswing, climbing from $6,031 to $19,206 between Nov 12 and Dec 17 that year. Similar patterns were seen surrounding the Christmas and New Years holidays when Bitcoin briefly gained more than 20 percent in the following weeks on both occasions. However, it appears that the improved price action during these periods is typically short-lived, oftentimes experiencing a partial or complete reversal shortly after. The same trends can even be seen more recently as well. When looking at the Bitcoin price action during the two week Chinese Spring festival that occurred between Feb 5 and 19 of 2019, Bitcoin climbed 14 percent before again cooling off. Reason for the Season

Reason for the Season

During holiday periods, people tend to socialize more, the topic of Bitcoin and cryptocurrencies might be raised at a social gathering. Understandably, one of the major topics of conversation is the impressive price growth Bitcoin has witnessed since its inception, which is attractive to new investors.

Beyond this, SFOX also found that these holiday periods also overlapped with increased Google search volume for Bitcoin, indicating that people are turning to their search engines for more information on how to buy and use BTC.

The increased chatter about Bitcoin may be one of the main drivers of the FOMO (Fear Of Missing Out) that occurs during times of significant growth. These periods often see new and inexperienced investors purchase Bitcoin after hearing about recent price movements with the hopes of making a quick profit.

Conversely, since Bitcoin is an extremely volatile asset, many of these newfound Bitcoin holders are unable to tolerate the sometimes significant losses that they might incur. This can lead the weaker hands to sell their holdings shortly after buying in, explaining the typical dips seen after a short run.

That being said, the influx of new investors due to an increased amount of discussion is just one of the numerous factors that determine the price. So, before you rush to buy Bitcoin this next holiday season, consider the market as a whole before going all in.

Will you be keeping a close eye on the Bitcoin price movement this holiday season? Let us know your thoughts in the comments below!

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Daniel Phillips

After obtaining a Masters degree in Regenerative Medicine, Daniel pivoted to the frontier field of blockchain technology, where he began to absorb anything and everything he could on the subject. Daniel has been bullish on Bitcoin since before it was cool, and continues to be so despite any evidence to the contrary. Nowadays, Daniel works in the blockchain space full time, as both a copywriter and blockchain marketer.

After obtaining a Masters degree in Regenerative Medicine, Daniel pivoted to the frontier field of blockchain technology, where he began to absorb anything and everything he could on the subject. Daniel has been bullish on Bitcoin since before it was cool, and continues to be so despite any evidence to the contrary. Nowadays, Daniel works in the blockchain space full time, as both a copywriter and blockchain marketer.

READ FULL BIO

Sponsored

Sponsored

Reason for the Season

Reason for the Season