The Solana (SOL) price was rejected by its range high despite reaching a new yearly high on April 17. What does this mean for the future price of SOL?

The SOL price failed to break out on April 17 and fell considerably, creating a bearish candlestick in the process. The readings from the short-term six-hour chart align with the daily rejection. Anatoly Yakovenko, the co-founder and CEO of the Solana network announced that Saga, the web-3 android phone will start shipping on April 20.

SOL Reaches Range High

The technical analysis from the daily time frame shows that the SOL token price is trading in a range between $20.50 and $26.00. The price reached a yearly high of $26.00 on April 16 but has decreased since. It created a bearish shooting star candlestick (red icon) during the next 24 hours.

The shooting star is considered a bearish candlestick and is characterized by a long upper wick. This means there was considerable selling pressure at the highs, causing the price to fall. The fact that the candlestick was created at the range high further increases its significance. However, the failure to close below the prior day’s lows makes it less significant.

However, the daily relative strength index (RSI) is still increasing and is above 50. The RSI is a momentum indicator used to determine overbought or oversold conditions. An upward trend and a reading above 50 suggest that bulls still have momentum.

Therefore, readings in the daily time frame are still undetermined. The closest support area is at $20.50, while the next long-term resistance is at $36.50.

Solana Price Prediction: Correction Before Continuation

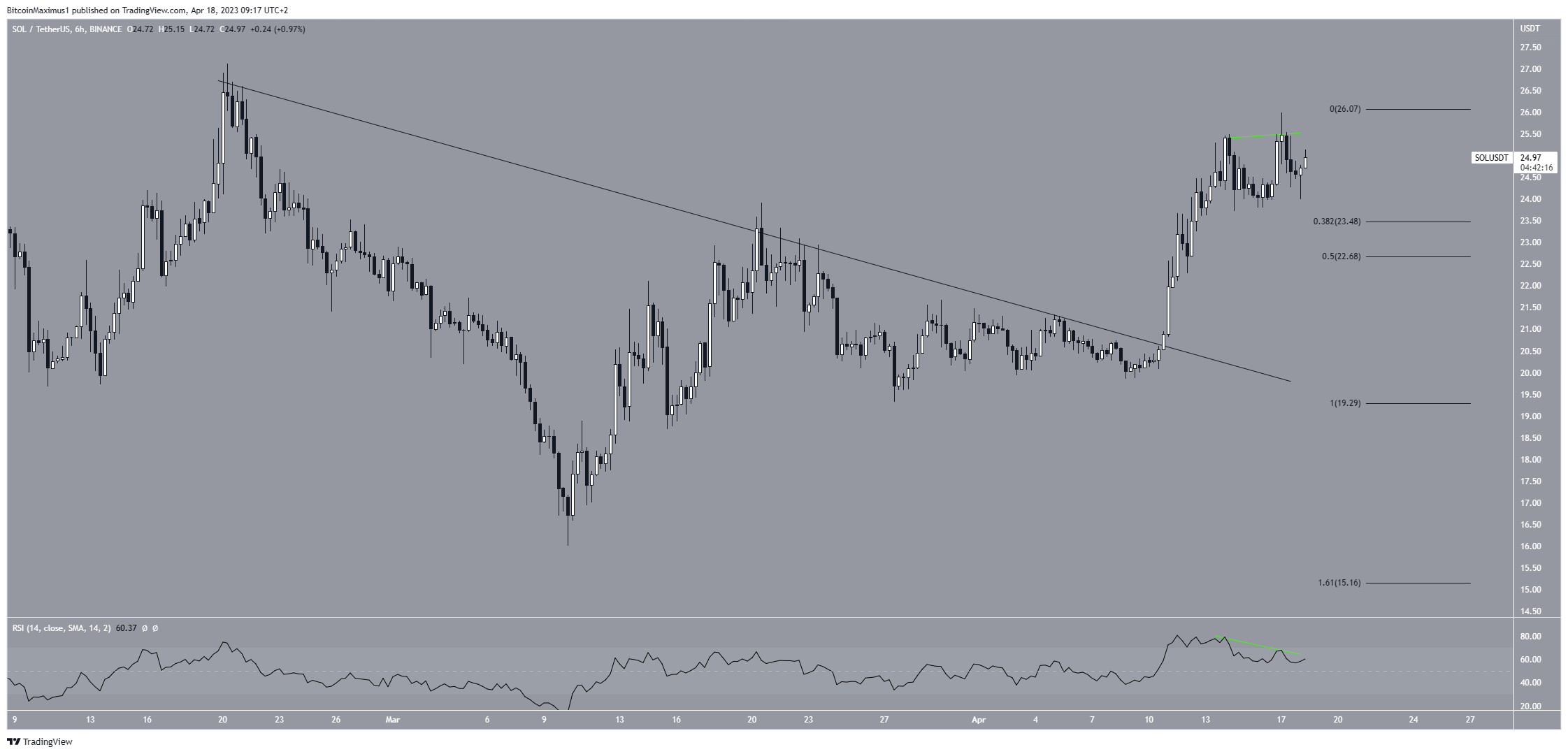

The short-term six-hour technical analysis indicates that an initial correction is expected before the upward movement can resume.

The main reason for this is the bearish divergence in the six-hour RSI (green line). A bearish divergence occurs when the price creates a higher high while the RSI indicator creates a lower high. This means that a similar increase in momentum does not support the price increase. This is often followed by a sharp fall.

If that occurs, the Solana price could fall toward the $22.70 horizontal and Fib support level. Fibonacci retracement levels work on the theory that after a big price move in one direction, the price will retrace or return part of the way back to a previous price level, before resuming in the original direction.

To conclude, the most likely Solana price prediction is a fall toward the $22.70 support area followed by another upward movement toward $26. A six-hour close below $22.70 would mean that the correction will deepen and lows near $20 could be reached. On the other hand, an increase above $26.00 will confirm that the drop is complete, and an increase toward $36.50 is expected.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.