JPMorgan Chase said that the crypto industry would struggle to replace the services offered by collapsed banking partner Silvergate Capital Corp.

In a new report, a research team at the Wall Street titan said that crypto firms would be hard-pressed to replace the Silvergate Exchange Network’s 24/7 payment rails quickly.

Silvergate Competitors Face Mounting Pressure

With Silvergate going into voluntary liquidation, JPMorgan predicts customers will migrate to Signature Bank’s Signet payments network. Cryptocurrency firms can incorporate the Signet network into their platforms using application programming interfaces.

However, Signature also faces pressure to minimize crypto risks and recently announced that it would cut crypto deposits by $10 billion. Coinbase recently switched to Signature for its Prime customers.

Customers could also move to Customers Bancorp, which offers tokenized B2B settlements on its Tassat payments network using its CBIT token. JPMorgan also cites Metropolitan Bank as a potential destination.

To what degree Metropolitan Bank would be willing to assume new crypto business is unclear, as the bank recently announced the closure of its crypto vertical in 2023. It attributed the shutdown to “recent developments” in the crypto industry. Crypto-related firms made about six percent of all deposits.

Silvergate announced on March 8 that it would “wind down” operations and repay 100% of customer deposits. The bank was hit hard by several customer withdrawals at the end of last year.

Last week, it discontinued its Silvergate Exchange Network (SEN) payment rails for “risk” reasons following the departure of several major crypto firms, including Coinbase and Galaxy Digital Holdings. The bank emphasized that deposit-related functions are still operational. Crypto investors used SEN to move dollars between their bank accounts and crypto exchanges, provided both banked with Silvergate.

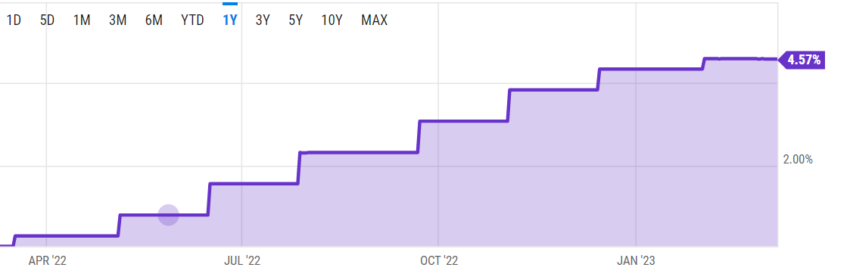

Rising Interest Rates Present Liquidity Risks to Smaller Banks

The collapse of Silvergate and the financial woes indicate a deeper problem with the Federal Reserve tightening policy.

The central bank raised interest rates by about 4.5% in the past year.

These hikes have made it challenging for banks to sell low-interest high-quality bonds quickly.

Faced with a bank run scenario, banks have been forced to find additional ways to raise capital to honor withdrawals.

Before its collapse, Silvergate Capital tried to do exactly this. It rushed to sell a boatload of securities at steep losses that tanked investor confidence.

Silicon Valley Bank, a company that has done business with top U.S. tech firms, announced a reported $1.8 billion realized tax loss from a recent preemptive sale of securities from struggling portfolios. It subsequently announced a hasty fundraiser to raise liquidity. The company’s stock has fallen 60% since Thursday.

Smaller institutions face the challenge of falling treasury yields and increasing pressure from the Fed to manage their risk adequately.

Notably, many of the Federal Reserve has, until recently, allowed them to operate with less scrutiny than titans like JPMorgan. But the failure of Silvergate could mean that these banks come under a stricter risk regime that could suffocate the crypto industry.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.