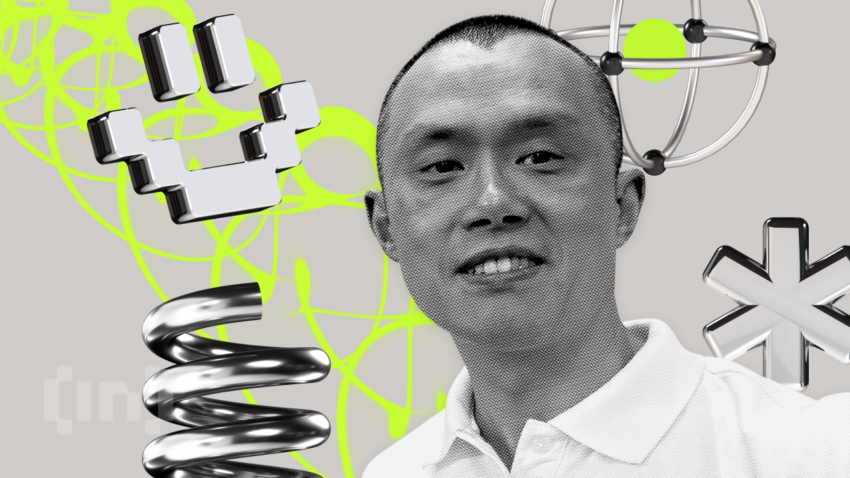

Updated 28 February, 12:00UTC: Binance CEO Changpeng Zhao took to Twitter dismissing the claims made by Forbes. In a rebuttal, he accused the news outlet of “lots of accusatory questions, with negative spins, [and] intentionally misconstruing facts.”

Forbes has accused Binance of the “backroom maneuver,” claiming the exchange transferred $1.78 billion in stablecoin to hedge funds.

Forbes, yet again, investigated the on-chain activities of Binance and discovered that the exchange transferred $1.78 billion in users’ funds to various hedge funds. The article reveals that the Changpeng Zhao-led exchange completely emptied its collateral for B-peg USDC without reducing its supply.

But, the community suspects Forbes of spreading Fear, Uncertainty, and Doubt (FUD) against Binance.

Binance Breaking its own Rules?

Binance issues a B-token to facilitate the usage of other blockchain tokens in the BNB chain. The exchange is supposed to issue B-token only after storing 100% collateral of the original token. For example, for every 100 B-USDC, it must have 100 USDC as collateral.

However, the exchange broke its rules on Aug. 17, withdrawing $3.63 billion from its peg wallet to the “Binance 8” cold wallet. It then returned $1.85 billion to the peg wallet but transferred the remaining $1.78 billion to a Binance 14 cold wallet. Later, the exchange distributed the funds to a trading firm, Cumberland, Amber Group, Alameda Research, and TRON founder Justin Sun.

A Binance spokesperson clarified in Jan. that the peg funds were mistakenly moved to cold wallets. Patrick Hillmann, the Chief Strategy Officer of Binance, told Forbes that “There was no commingling,” and it was normal business conduct.

B-USDC had Zero Collateral for Four Months

When Binance withdrew $1.78 billion USDC on Aug. 17, it did not decrease the supply of the B-USDC. The collateral fell to zero, and the exchange did not correct it for four months.

The article also states that B-USDC was deficient by over $1 billion on three different occasions. Forbes believes Binance is misusing customers’ funds, similar to the bankrupt exchange FTX.

Forbes vs. Binance?

But, on various occasions community has pointed out that the publication has a soft spot for Sam Bankman-Fried while triggering FUD against Changpeng Zhao. Last year, crypto lawyer Irina Heaver tweeted that Forbes is reporting “lies and misinformation.” Also, Zhao sued Forbes for defamation and later dropped the case in 2020.

Got something to say about this article or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.