Binance has been named a top counterparty of the now-seized Russian exchange Bitzlato. Reportedly, it facilitated transactions worth $346 million.

The world’s leading cryptocurrency exchange is in hot water for allegedly facilitating the transactions for Bitzlato. The Department of Justice (DoJ) recently arrested Bitzlato founder Anatoly Legkodymo for running illegal operations.

A Reuters report states Bitzlato used Binance for transacting over $346 million worth of Bitcoin.

Binance Facilitated Transactions of Over 20,000 Bitcoin for Bitzlato

Bitzlato made over 205,000 transactions using the exchange from May 2018 to Jan. 2023. Through these transactions, it transferred over 20,000 Bitcoin worth $345.8 million, as per the BTC market price at the time.

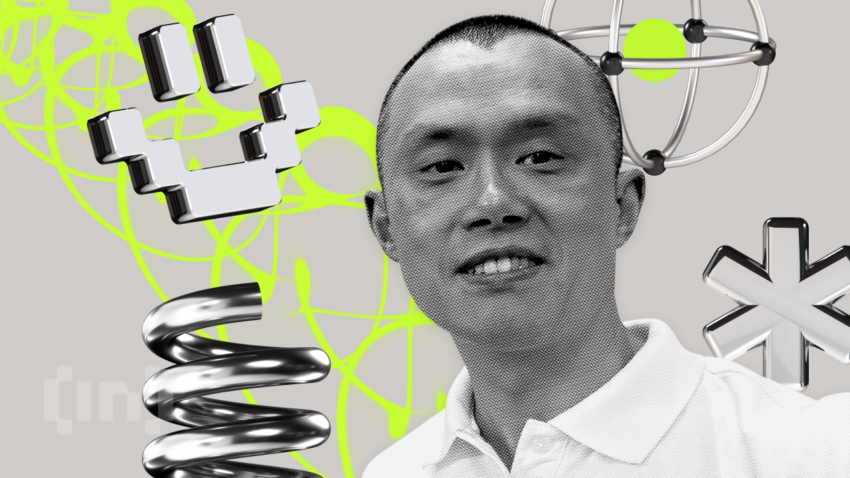

Binance is the largest receiving counterparty of Bitzlato, receiving Bitcoin worth $175 million. The report further reveals that the Changpeng Zhao-led exchange facilitated around $10 billion worth of transactions for criminals. However, the exchange slammed the reports as inaccurate, calling parts of Reuters’ findings obsolete and incorrect.

Last Dec., Forbes reported that a drug cartel with operations in several countries had funneled approximately $40 million through Binance.

Binance Acknowledges an Error in Storing Users’ Funds

And according to another Bloomberg article, Binance has admitted to mistakenly storing its reserves with customers’ crypto. The exchange kept B-tokens in a wallet classified as “Binance 8” in Etherscan, generally used to store users’ funds.

A Binance spokesperson told Bloomberg, “Binance 8 is an exchange cold wallet. Collateral assets have previously been moved into this wallet in error and referenced accordingly on the B-Token Proof of Collateral page.” They are working on transferring the collateral assets to their dedicated wallets.

Binance facilitates wrapping the token belonging to other blockchains so that users can transact in the BNB chain (BSC). It issues a new token native to the BSC with a 1:1 backing with the original token. They call such wrapped tokens B-token. For example, for every 100 BBTC that Binance issues, it should have 100 BTC as collateral. The price of the BBTC is pegged to BTC.

Charles Coste, a banker, identified other instances where Binance co-mingled its funds with clients’ assets. The community wonders if there are other unknown mistakes from the world’s largest exchange.

Got something to say about this article or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.