Circle Internet Financial, the issuer of the USDC stablecoin, is accelerating growth plans despite recently putting its IPO plans on the back burner.

The paper quoted CFO Jeremy Fox-Geen, who confirmed Circle wants to increase its workforce by up to 25% this year.

Crypto Industry Continues Layoffs

Circle reportedly had 900 employees by the end of 2022. The executive stated that the business anticipates a 15% to 25% increase, or 135 to 225 more employees, by the end of 2023. This is a smaller year-on-year increase experienced by the company in 2022 when the head count nearly doubled from 2021.

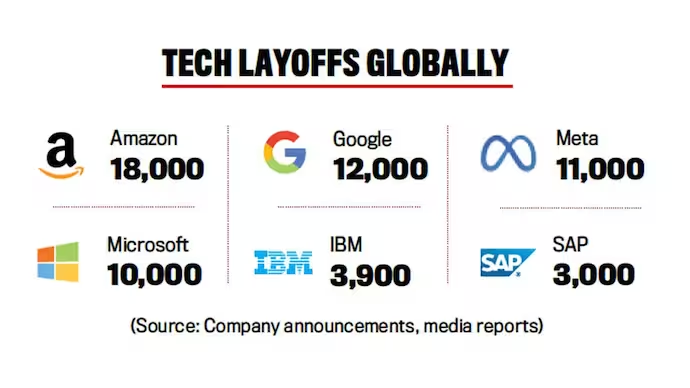

The news comes on the back of broader layoffs in the tech industry. The biggest names in technology, like Microsoft, Amazon, and Google, are aggressively optimizing human resources.

Immutable, Australia’s largest crypto gaming start-up, recently announced that it would be letting go of 11% of its workforce.

Ethereum scaling platform Polygon announced this week that it is laying off 100 employees, or 20% of its workforce, as part of a broader corporate restructuring. Non-fungible token (NFT) marketplace Magic Eden also announced that it would fire 22 employees. And it seems like Circle wants to swim against the wave.

“We are growing and investing and we are fortunate to be in a financial position to be able to sustain our investments,” Fox-Geen told the WSJ. “We have slowed down growth prudently and are focused on what matters most.”

Circle Focuses on Growth

According to Crunchbase, the Boston-based Circle has secured $1.1 billion in financing across 12 rounds. Their most recent $400 million in financing came from a private equity round on April 12, 2022. Industry heavyweights like BlackRock Inc. and Fidelity led this round. The company has eight lead investors and 46 total investors, per the platform.

Meanwhile, Circle’s dissatisfaction with the U.S. Securities and Exchange Commission also became public ever since its plans to get listed hit a roadblock. Circle had big intentions to go public with an estimated $9 billion initial public offering (IPO). The business asserts that the American financial regulator thwarted those plans.

In December, the Circle and Concord Acquisition Group boards terminated their Special Purpose Acquisition contract.

Nevertheless, the recent crypto market recovery after the protracted crypto winter and the FTX crisis raises hopes for a comeback. The market capitalization of all cryptocurrencies has surpassed $1.16 trillion, according to CoinGecko. It is a rise of 1.2% over the previous day. At press time, the price of bitcoin has surpassed $24,300 and is rising.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.