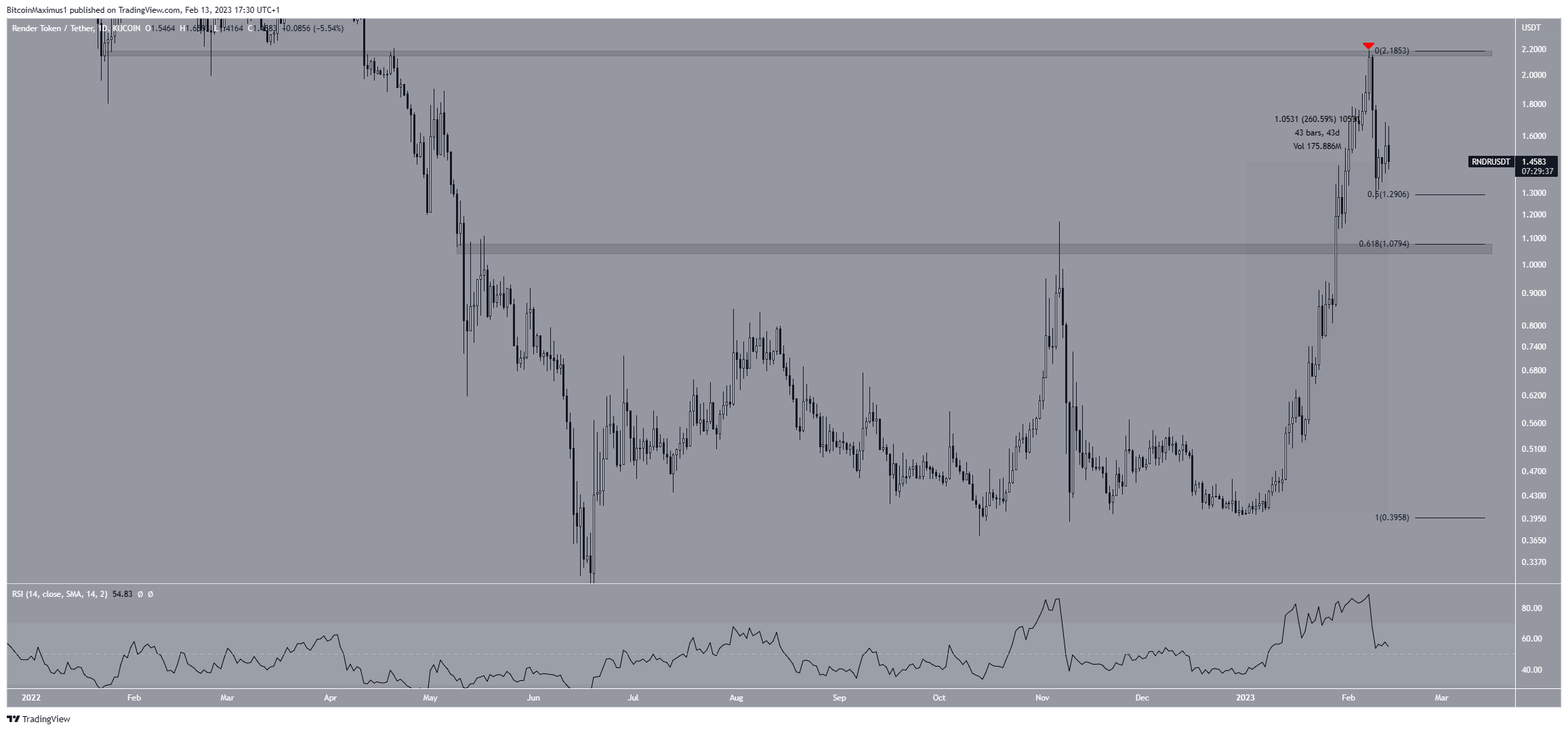

Despite a massive increase, the Render Token (RNDR) price was rejected by the $2.18 resistance area and could be mired in a correction.

The Render Token price has increased by 260% since the beginning of the year, when it traded at a minimum price of $0.40. On Feb. 7, the price reached a high of $2.90, the highest since April 2022.

Despite the increase, the main resistance area rejected the price at $2.18 (red icon). The level acted as support between Jan. and April 2022 before turning to resistance. As a result, it acted as resistance on Feb. 7.

Since then, the price has fallen, reaching a low of $1.27 the next day. The ensuing bounce validated the 0.5 Fib retracement support level at $1.29. However, RNDR is threatening to break down from it again. If that occurs, the price can fall to the next support area at $1.08. Since this is both the 0.618 Fib retracement support level and a horizontal support area, it is a more important level.

The daily RSI is trading right at 50, a sign of a neutral trend.

Therefore, whether the RNDR coin price bounces or breaks down from the $1.29 support area can determine the future trend’s direction. A bounce could cause a retest of the $2.18 level, while a breakdown could initiate a fall to an average price of $1.08.

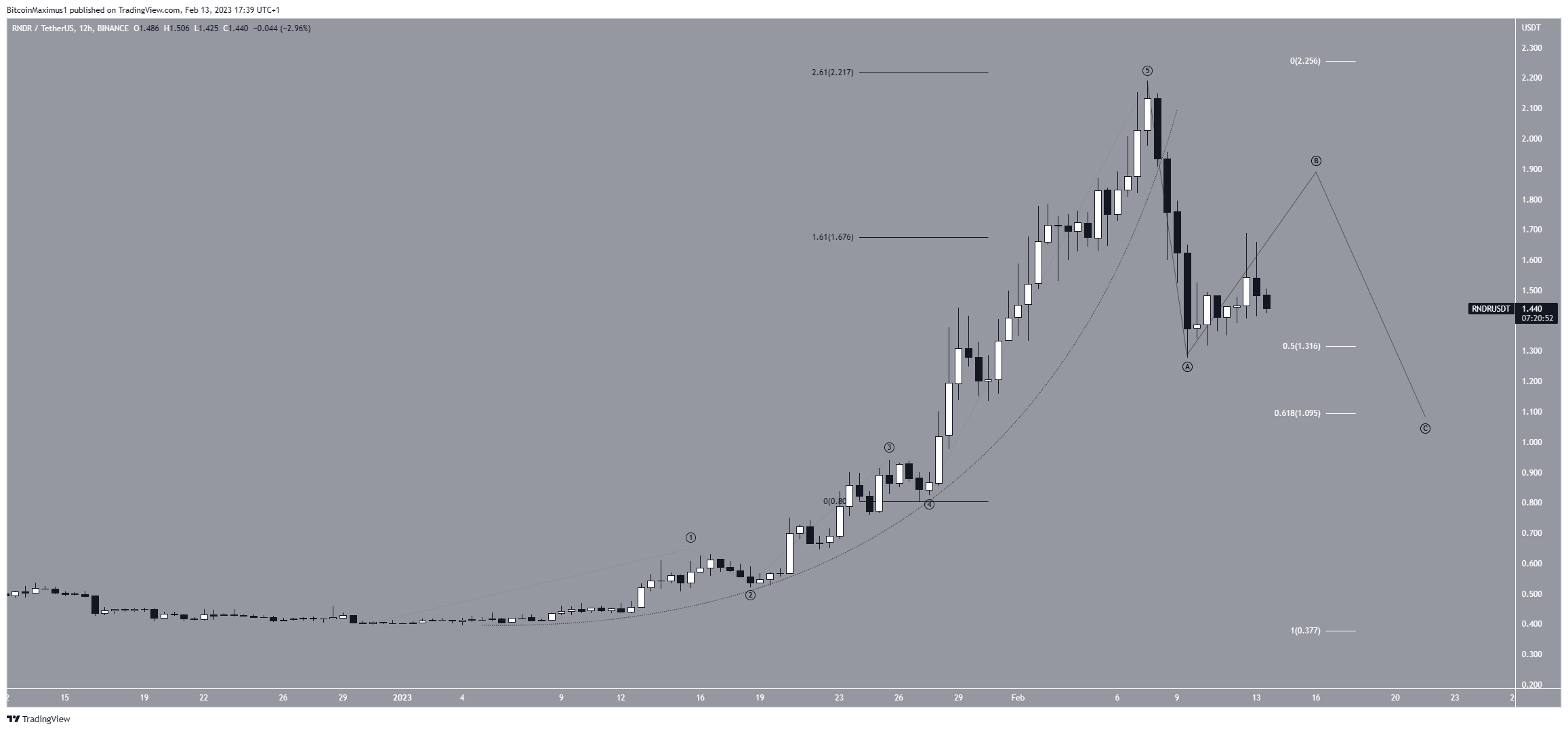

Render Token Price Prediction for Feb: Parabola Could Break Down

The price history from the short-term 12-hour time frame shows that the increase was completely parabolic. Such increases are unsustainable in the long term, and the price broke down from the parabola on Feb. 9.

Moreover, it seems that the RNDR price also completed a five-wave upward movement, in which wave five extended massively, reaching the 2.61 Fib extension of waves one and three combined.

So, the price is now likely in an A-B-C correction which could end at the 0.618 Fib retracement support level at $1.08. An increase above $2.18 would negate this bearish RNDR price forecast and could send the price to $3.10.

To conclude, the most likely RNDR price prediction for Feb. is the continuation of the correction toward $1.08. On the other hand, an increase above $2.18 would negate this bearish price prediction. In that case, the RNDR price could increase toward $3.10.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.