As the Federal Reserve prepares to make a significant announcement, US stocks, treasuries and Bitcoin have have seen a noticeable shift in expectations around inflation data. There has been a hawkish drift ahead of the Fed meeting and the economic outlook in hopes of a decrease in interest rates cuts.

Upon reopening after the Lunar New Year holiday, Chinese markets opened higher but saw continuous selling throughout the day. Meanwhile, stocks in the US ended lower, following a pattern of overnight drifting and a panic-bid at the opening, which quickly dissipated and gave way to continued selling. The Dow Jones Industrial Average saw a decline of 0.8%, while the Nasdaq experienced a 2% decrease.

US Stocks, Treasuries, and Bitcoin Nosedive

Today’s market weakness erased all of the gains from last Friday’s market surge, and data from TICk showed very little positive news. Despite today’s dip, the Nasdaq remains on pace for its best start to a year since 2001, although it did close below its 200-day moving average.

The market activity was seen as a reload for shorts after last Friday’s short-squeeze, and the recent surge in the market has been described as a “dash for trash”.

In the bond market, Treasuries were sold across the curve, with the long-end outperforming and the belly underperforming. The US dollar rallied back to the upper end of its recent narrow range, while the price of Bitcoin was hit twice after falling just short of reaching $24,000. Oil prices saw a decline despite concerns over stability in the Middle East, and gold saw modest losses.

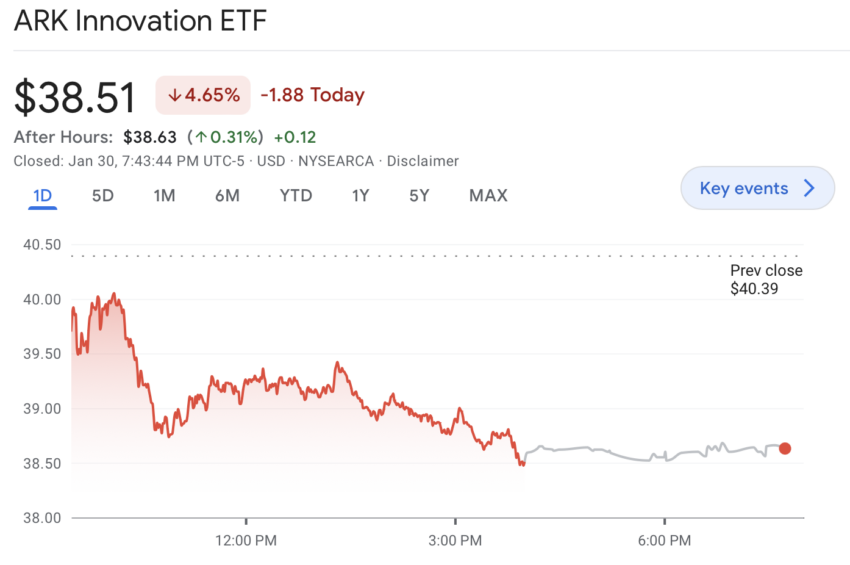

The Ark Innovation ETF (ARKK), which fell today, remains on pace for its best month ever with a 25% increase. This serves as a reminder of the current market fever and highlights the unusual market activity seen so far in January.

As the Federal Reserve prepares to make its announcement, the market will closely watch its impact on the current market frenzy.

When Is the Next Fed Meeting?

The Federal Open Market Committee (FOMC) holds eight meetings a year, each lasting for two days. At the conclusion of these meetings, the FOMC releases its monetary policy decision at 2 p.m. Eastern time, followed by a press conference with the Fed Chairman Jerome H. Powell at 2:30 p.m.

Market participants often pay close attention to the press conference, as the FOMC statement on the interest rate decision can often hold even greater significance than the official policy statement.

The next FOMC meeting is scheduled to take place from Jan. 31 to Feb. 1, with the policy statement to be released at 2 p.m. Eastern on February 1st.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.