A few unsatisfied investors have proposed a lawsuit against Compound Finance to revoke sales of its native COMP token.

The lawsuit, filed by a handful of retail investors, also asks for a refund reward for investors while claiming that the offering was unregistered.

COMP Alleged to Be a Security

The filing stated,

“COMP is a security. Users purchase COMP to gain an ownership share in the Compound business, expecting to earn profits based on the efforts of the Partner Defendants and a handful of other people who together control and manage the business.”

The lawsuit claims that SEC received no registration statements regarding the offering of COMP tokens. Therefore, based on this, the plaintiffs are seeking damages in the class action suit.

The legal document also questions the advertisements for “community governance” despite Compound Labs allegedly ensuring that insiders remain in charge of the company. Compound uses what’s called ‘yield farming’ or ‘liquidity mining’ to incentivize users to deposit or borrow money. In return, it was used to pay fees by allocating “governance” tokens. But it didn’t allow retail token holders to have any real influence on the company, the document claimed.

In addition, the lawsuit claims that in a “speculative frenzy” of five days, the value of COMP increased from $93.30 to $335.82.

However, the document outlines that “about two weeks after COMP’s launch to the public, its price took a nosedive, dropping from about $372 per token to about $200 per token.”

It’s no surprise that many retail crypto traders have gotten burned in the past year. Cryptocurrencies across the board have continued to slip back further and further in value—many to multi-year lows. But it should be pointed out that three of the plaintiffs listed in the suit only invested $80 in total.

This makes the suit seem rather frivolous. Especially when you consider the billions of dollars lost by the recent collapses of FTX, Celcius, and Terra.

Price Nosedived Impacting Retail Investors

The ‘Coinbase effect,’ according to the lawsuit, also contributed to the price spike. This refers to the price boost that has consistently occurred when users find out a particular asset is getting listed on the exchange.

The case noted,

“Retail COMP purchasers generally have not fared well. The value of COMP peaked in May 2021 at nearly $500 per token. This equated to a total market capitalization of about $4 billion. It soon halved in value, and in the fall of 2021, COMP’s market capitalization was a little more than $2 billion.”

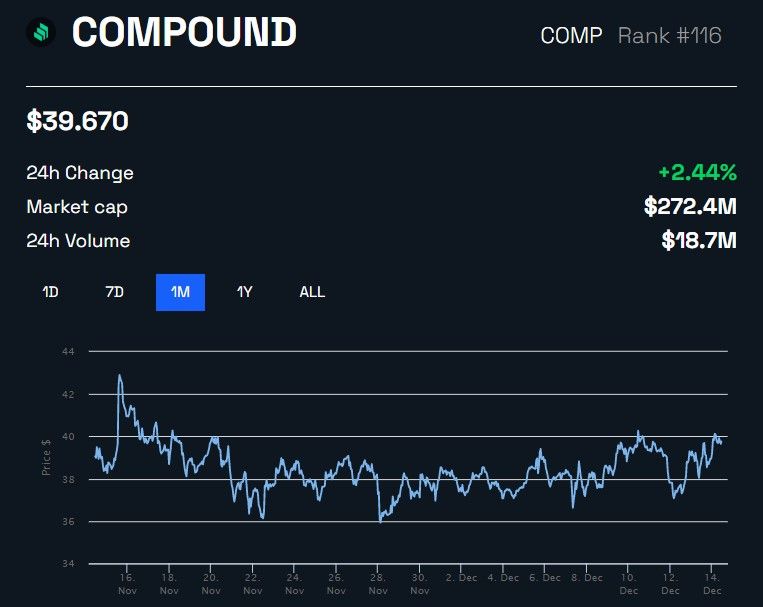

At the time of press, COMP is trading in the $38-$40 price range. Compared to its all-time high of $910 reached in May last year, the price has dropped by approximately 95%.

Notably, the document also claims that the venture arm of Coinbase had an existing interest in Compound Finance. Notably, the Compound protocol is one of the most prominent DeFi protocols, with a TVL of $1.78B.

To revoke the token sale as part of the class action lawsuit, the plaintiff includes individuals who acquired COMP on or after Dec. 8, 2021.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.