The Aave (AAVE) price prediction is bullish due to a reclaim of a long-term horizontal support area and a short-term breakout. The Compound (COMP) price is trading inside a descending parallel channel and is approaching a crucial horizontal support area.

AAVE Price Prediction: Has Long-Term Correction Ended?

AAVE is one of the most well-known decentralized finance (DeFi) platforms. It allows users to lend and borrow. The AAVE price has decreased inside a long-term descending parallel channel since reaching an all-time high price of $527.80 in May 2021. The decrease led to a minimum price of $45.60 in June 2022.

Initially, this decrease seemed to cause a breakdown below the $72 horizontal support area (red circle). The area had previously provided support since early 2021 (green icons). However, the AAVE price regained its footing shortly afterward and reclaimed the area. It validated it as support in Oct.

Therefore, as long as the price is trading above this area, an eventual breakout seems to be the most likely scenario. A weekly close below it would invalidate the bullish hypothesis and suggest that new lows are expected.

Technical analysis indicators are neutral. This is visible in the weekly RSI, which is increasing, but is still below 50.

Short-term Catalyst for Upward Movement

The outlook from the daily time frame is mostly bullish. The AAVE price broke out from a descending resistance line on Oct. 16. It reached a high of $98.4 on Nov. 5. However, the $95 resistance area (red icon) has been rejected and has been decreasing since.

Currently, the price is trading between the 0.5-0.618 Fib retracement support levels at $77.80-$88.10 This is a likely area for a bottom. Furthermore, the daily RSI is still above 50.

If the upward movement continues, the AAVE price could increase to $135.30, giving both part of the increase a 1:1 ratio.

A decrease below the wave B low of $64.7 (red line) would invalidate the bullish AAVE price prediction and indicate that a lower future price is expected.

Compound Price Reaches Ideal Bounce Zone

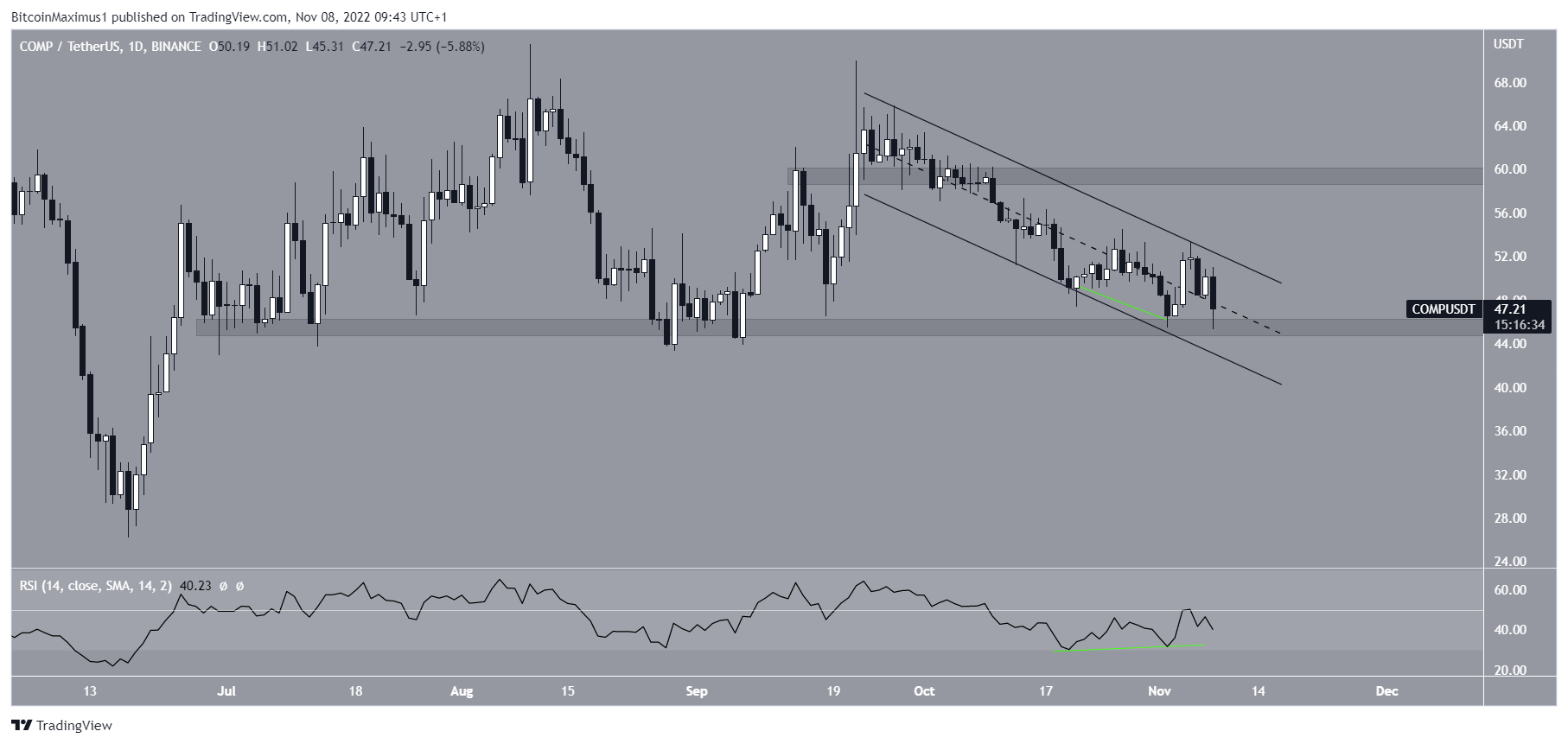

The COMP price has decreased inside a descending parallel channel since Sept. 22. The downward movement has led to a low of $45.31 on Nov. 8.

Despite the decrease, there are three reasons why a breakout is expected.

Firstly, the price has bounced at the $45.50 horizontal support area.

Secondly, the daily RSI has generated bullish divergence (green line).

Thirdly, the descending parallel channel is considered a bullish pattern.

If a breakout from the channel occurs, the closest resistance area would be at $59. On the other hand, a daily close below the $45.50 support area would invalidate the bullish forecast and lead to lower prices.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.