Bear market blues couldn’t weigh down Litecoin price action for long as LTC charted over 25% daily gains on Nov. 23.

Litecoin (LTC) price gains outperformed most cryptocurrencies, despite the FTX-induced doom in the crypto market. While many top cryptocurrencies saw a surge in price as the market regained bullish momentum, LTC gains had a different backstory.

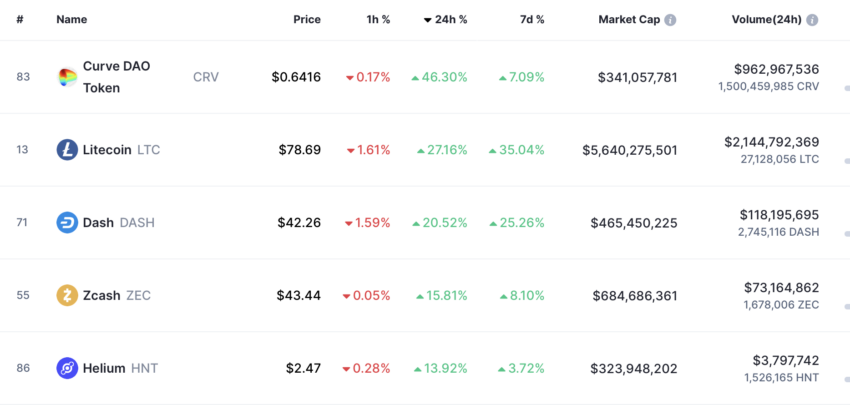

Litecoin took the second spot on the CoinMarketCap gainers’ list, up 27.16%, preceded only by CRV with over 45% daily gains. With LTC back on track and reaping some interesting gains for holders, Litecoin deserves a deep dive.

Litecoin Overshadows Top Cryptos

While top cryptocurrencies only managed to gain short-term price momentum, LTC price tested its highest level since Nov. 14, 2021.

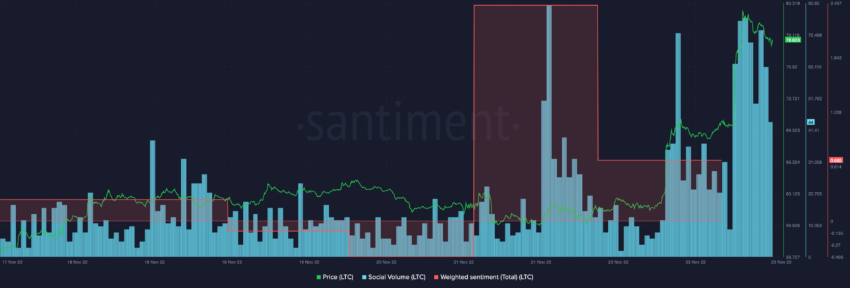

A look at the LTC short-term trajectory suggested that Litecoin rallied on freshly gained retail sentiment as 24-hour trade volumes spiked to over $2.18 billion, appreciating by 188.80%.

The recent bullish run that LTC has charted could be partly credited to the upcoming mining reward halving scheduled in eight months. This would be the third halving event for LTC and is set to have a positive change in the coin’s supply dynamics.

Amid rising prices, LTC also saw a return of weighted sentiment in the positive territory alongside spiking social volumes.

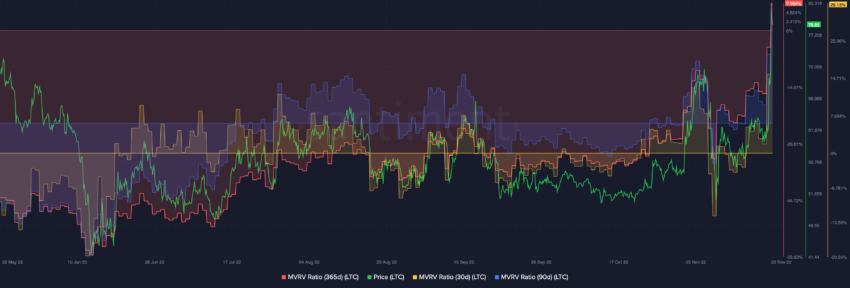

A key reason behind the recently gained positive sentiment was also that LTC holders saw a massive uptick in profits. The 365-day MVRV making it back to the positive zone showed that long-term traders were finally back in profit for the first time since Dec. 2, 2021.

The trend change marks a key turning point signaling some short-term optimism that could keep fueling a price action.

However, the 30-day MVRV at over 31%, i.e., in the danger zone, could lead to some short-term price pullback. Notably, 90-day MVRV had also witnessed a spike. With 365-day, 90-day, and 30-day MVRV in the positive zone, the same pointed towards a healthy profit for long-term as well as mid-short-term LTC holders.

Whales and Sharks Stacking LTC

In the last two weeks, addresses holding 1,000 to 100,000 LTC accumulated $43.4 million in coins. A look at the coin’s supply distribution suggested that LTC whales and sharks started to accumulate at the beginning of Nov.

Furthermore, since Nov. 2, one of the largest LTC whale cohort holding one million to 10 million coins increased their bags from 2.7 million LTC coins. This cohort adding 2.4 million LTC to their bags could’ve been a key catalyst to price.

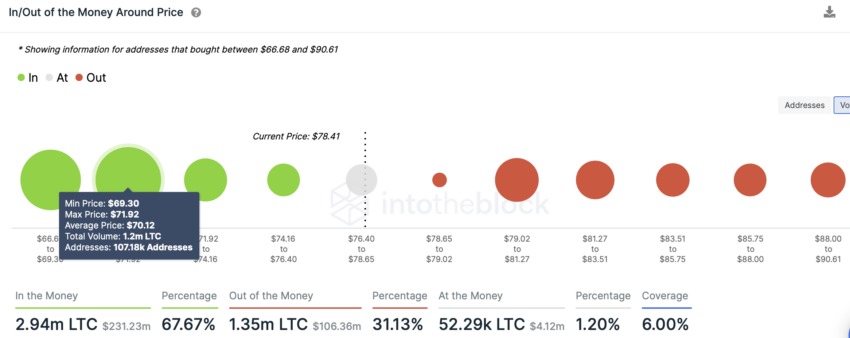

With the market looking slightly overheated at press time while LTC gains could continue, a short-term pullback wouldn’t come as a surprise. In/Out of Money Around Price for Litecoin suggested no major resistance for price till the $89 level.

In the short term, however, in case of a bearish overturn, the price could revisit the lower range dropping below $75. Nonetheless, the $70 mark would act as strong support in case of a pullback since 107,180 addresses were holding over 1.2 million LTC at the price level.

The long-term prospects for Litecoin still looked bright, with LTC set for its third halving in 2023.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.