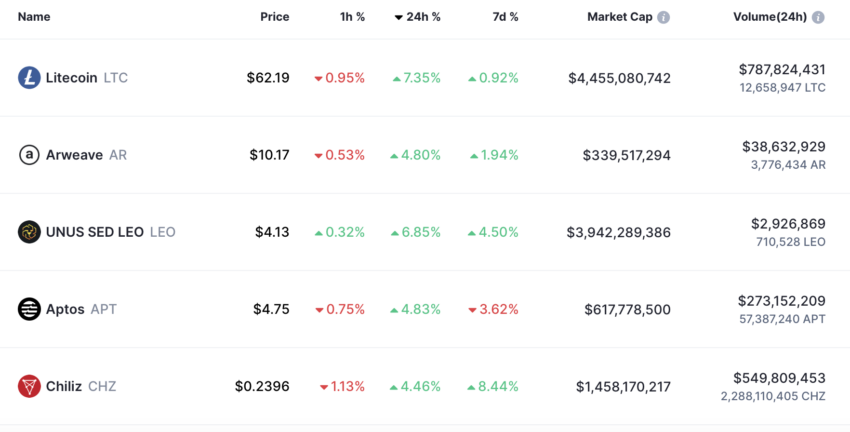

After staying quiet for a long time, Litecoin (LTC) has finally woken up, taking the top spot on CoinMarketCap’s gainer list, rising 8% in 24 hours.

Litecoin has been in the crypto market for more than most of the top altcoins. In fact, many in the market believe that, unlike other projects that have bitten the dust, LTC has managed to evade many bear markets and could continue to do so.

While predicting the future isn’t something that’s recommended in the crypto market, especially with the massive volatility, LTC short-term future seemed bright.

Litecoin Back in Action

For the last few months, LTC price action has maintained a steady stance, mostly following the larger market momentum or rising on certain ecosystem-centric hype. Yet, at the time of writing, Litecoin was the top gainer in the market, with LTC price rising by 7.24%

This year, Litecoin will complete 11 years in the market. Just ahead of its anniversary, LTC price charted a 12% recovery after the FTX collapse price fall.

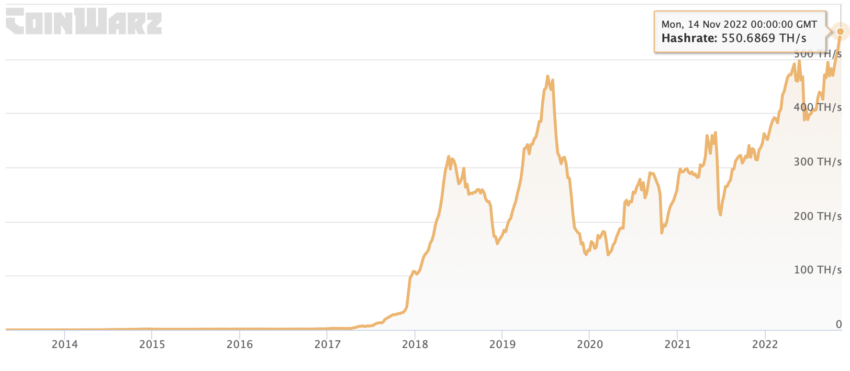

A recent update from Litecoin also highlighted that the Litecoin hashrate was near its all-time high, which was good for the network’s stability and security.

Additionally, the network claimed that LTC could process about eight times more transactions per second than BTC. Litecoin also has a transaction fee of just a few cents, which makes it good for payments.

Updates from the Litecoin Foundation painted a decent picture of the coin and network; what did on-chain metrics say about price?

LTC On-chain Health Improves

Following the recent FTX-induced crash, LTC price dipped to a low of $47.60. However, it made a quick recovery over the coming days. Data from Santiment showed that LTC saw a rise in trade volumes as its weighted sentiment flipped to positive.

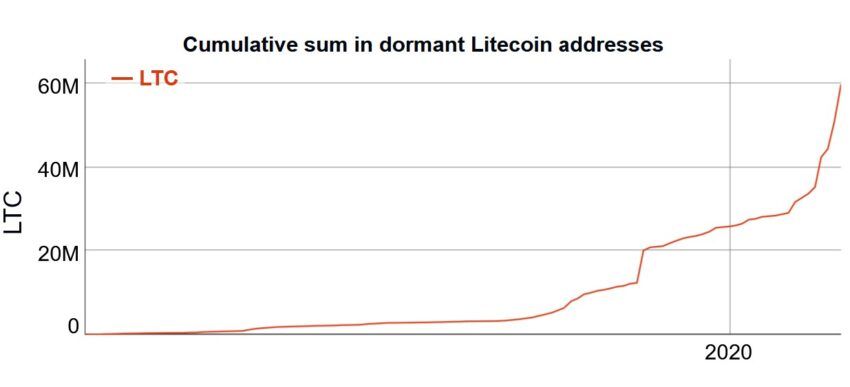

With price action turning green, social sentiment for Litecoin also turned positive in the larger bear market. That said, recent data highlighted that over 60 million Litecoin has been in cold storage for more than one year, which presented investor confidence to HODL.

Furthermore, $44,077,724 worth of LTC or 765,770.045 Litecoin was moved on Nov. 17 from multiple addresses to an unknown wallet. This movement in coins could be another reason for the recent price pump.

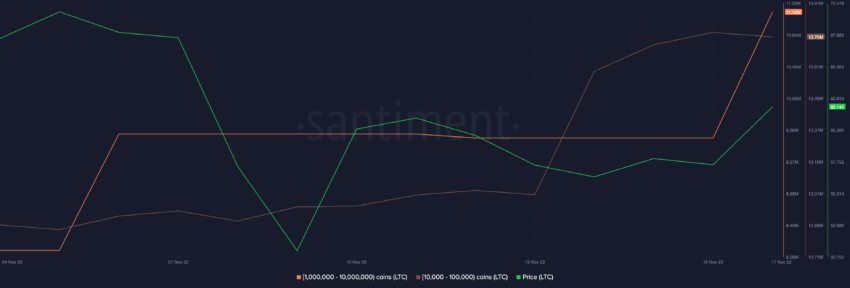

Data from Santiment further suggested that two of the biggest LTC whale cohorts added over five million LTC to their bags since Nov. 5.

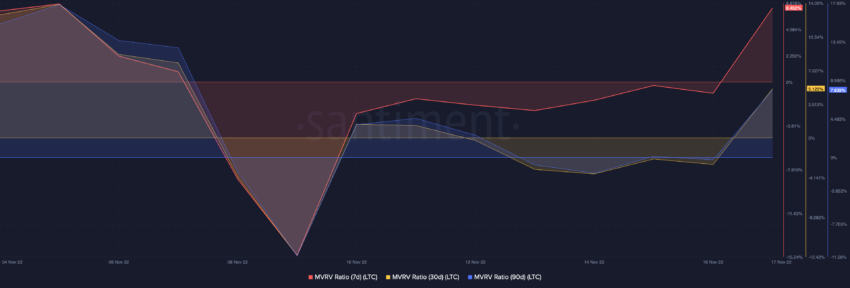

Additionally, with Litecoin short-term and long-term MVRV treading the positive zone, the same meant participants were in profit.

For Litecoin, if bulls continue to lead the way, a push to the higher $70 mark could be expected in the short term. In case of a bearish overturn, price could revisit the $55 range.

Nonetheless, the long-term prospects for Litecoin looked bright, with LTC set for its third halving in 2023. The next halving event could give Litecoin price a major boost. So, is it possible that whales were stacking up for the halving event?

Whether the halving event could generate similar returns as it did in the previous two cycles is something that still remains to be seen.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.