The Curve DAO Token (CRV) price has decreased by 58% over the past three weeks. The reason for this could be several large, short bets causing heavy selling pressure.

There seems to be a coordinated attack against CRV going on right now. The attack is happening on the Aave protocol. Well-known trader @Avi_eisen allegedly has an $8 million short bet on CRV.

On the other hand, the Curve Finance founder Michael Egorov has $48 million of CRV supplied on Aave, which has a liquidation price of $0.259. While this is still a long way from the current price, it is worth keeping an eye on if CRV continues to fall.

CRV Faces Liquidation Cascade

Triggering the liquidation level could cause a further cascade of the price decrease. Additionally, a whale address borrowed 30 million CRV from Aave protocol today, possibly with the intention of shorting it and then afterward profiting if the CRV price continues to fall.

Finally, another CRV shorter borrowed $20 million worth of CRV tokens from Aave and is currently dumping it in the OKX exchange. All in all, there seems to be a selling pressure of $58 million in the Aave protocol from just three traders.

With these in mind, let’s take a look at the price movement and try to determine if the CRV price will trigger this liquidation level.

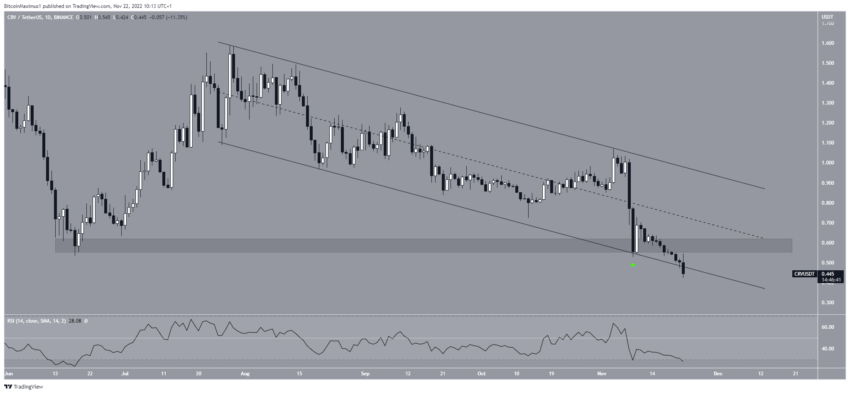

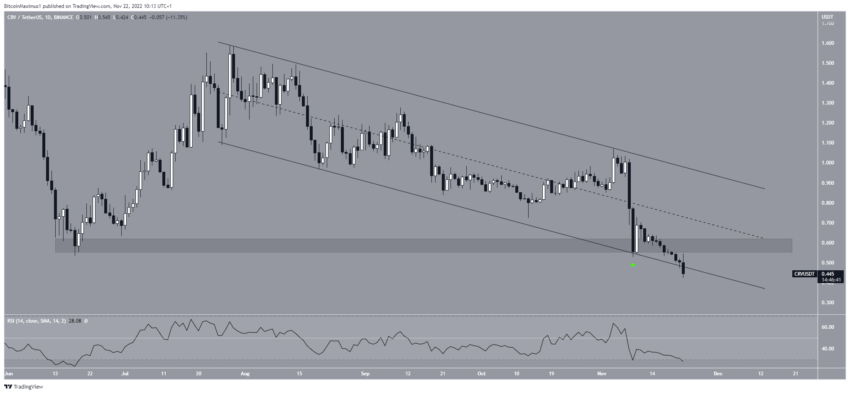

While doing so, it reached a minimum price of $0.42 on Nov. 22. While this seemingly caused a breakdown from the channel, the CRV price has not reached a close below the channel since. Hence, the breakdown is not confirmed.

However, CRV also broke down from the $0.58 horizontal support area, which is now expected to provide resistance. There are no close price levels that can act as support.

Finally, the daily RSI is falling and yet to generate any bullish divergence. As a result, the CRV price prediction is bearish.

A drop below it would take the price to a new all-time low. Then, the 1.27 external Fib of the most recent drop is at $0.25, which would trigger the liquidation level. So, liquidation seems likely if a breakdown from the final support area at $0.35 occurs.

This is also supported by the weekly RSI, which is below 50 and is decreasing. A significant bounce at the $0.35 area would invalidate this bearish CRV price prediction.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date news and information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.