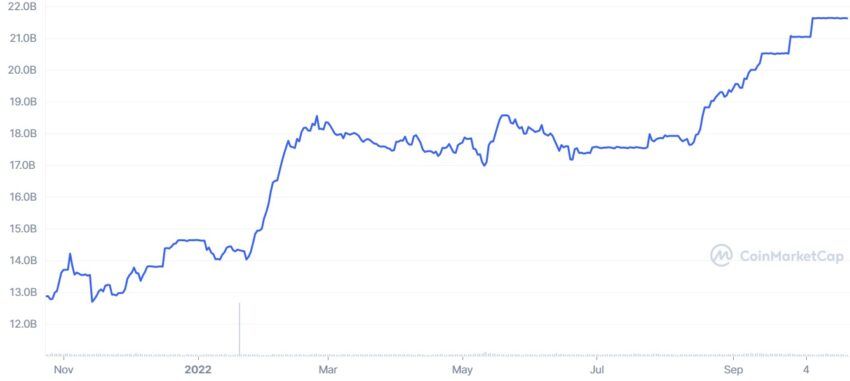

Binance USD (BUSD) market cap has been on the rise in the last 30 days. Thanks to Binance’s move to convert deposits of USDC, TUSD, and USDP into BUSD on the exchange.

Following the decision, the supply of BUSD crossed $20 billion for the first time last month. It hit another milestone with a market share of 15.48% of the stablecoin market. Based on CoinMarketCap data -the highest it has ever been.

USDC still controls around 28% of the stablecoin market. Its dominance as the second-largest stablecoin by market cap is gradually shrinking. USDC’s supply has shrunk from $55 billion in July to its current supply of $43.93 billion.

Meanwhile, USDT remains the most dominant stablecoin in the space. It controls around 48.03% of the market, and its supply is over $68 billion.

BUSD’s recent progress underscores the rapid increase in the supply of the stablecoin, which was less than $18 billion at the start of the year. This increase owes a lot to Binance status as the biggest exchange in the world. 22% of all trade volume by pair denominations also included BUSD.

FTX Founder Speaks of BUSD’s Rise

FTX founder Sam Bankman-Fried described BUSD current growth as the beginning of the “Second Great Stablecoins War.” According to him, the first war saw USDC and USDT emerge as market leaders in 2018.

SBF continued that this time is different because there are now positive interest rates which mean more revenue for stablecoins. He added that stablecoin issuers had learned the importance of always allowing redemption to maintain the stability of their stablecoins.

Given that FTX doesn’t have a stablecoin, he said, “At this point, we’re probably the largest unaligned players in the stablecoin ecosystem. Bybit, the various blockchains, tradfi, and market makers are as well.”

USDC Eyeing More Growth

USDC appears to be eyeing new markets after Binance’s BUSD decision, as Coinbase is trying to make the stablecoin more accessible outside the United States. According to the exchange, its efforts aim to “increase (the) economic freedom in the world.”

Meanwhile, Circle CEO Jeremy Allaire had said Binance’s decision would increase USDC utility. He tweeted this last month, backing the view of Wintermute CEO Evgeny Gaevoy, who believes it makes operational sense for Binance to delist other stablecoins.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.