Danish inflation has hit a 37-year high and economists are warning it will rise further, impacting millennials and young adults the most.

Denmark’s largest bank, the Danske Bank, published a report on general market conditions and says that the future is highly uncertain.

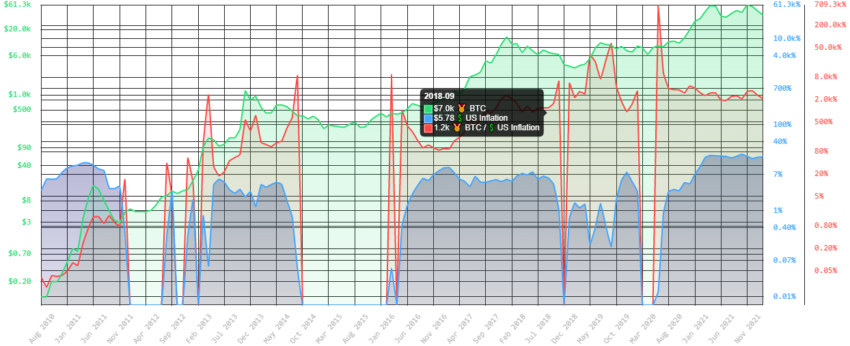

Denmark is experiencing inflation levels that have not been seen since the mid-1980s. The inflation rate is currently at 5.4%, which could have an impact on the crypto market as well.

The report covers the economic outlook for four Nordic countries: Denmark, Sweden, Norway, and Finland.

The rise in inflation is partly risen because of the conflict in Ukraine, which has led to an increase in food and commodity prices. And limited access to oil and gas from Russia could further impact inflation in the near future.

Danish millennials impacted the most

The young and less wealthy people will be impacted the most and will probably have to get used to worse, Bjorn Tangaa Sillemann, senior analyst at Danske Ba told Bloomberg.

Many will have to learn to get by with less discretionary spending, such as vacations, cars, and fine dining since prices on food products are rising as well, said Helge Pedersen, chief economist at Nordea Bank Abp.

Other countries are also experiencing high inflation rates, and there is some concern in the United States that the country will experience an inflation shock, or that the country is on the road to a recession.

As a result of these larger economic trends, the crypto market could benefit. The asset class could see a surge in market cap, and bitcoin’s price could rise as a consequence of high inflation rates.

Inflation is increasingly becoming a matter of concern for investors across the world. Nigerian investors are ditching the Naira in favor of crypto, and with inflation rates reaching 7%, some believe the U.S. could follow suit.

Cryptocurrencies have long been considered a solution to inflation despite bitcoin dropping significantly from its high last year.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.