Decentralized finance (DeFi) tokens are leading today’s market push which has increased total cryptocurrency market capitalization to over $1.5 trillion once again.

Crypto markets are starting to show signs of recovery today as the total capitalization gains 2%, or $70 billion, over the past 24 hours.

DeFi related assets are leading the charge with some surging double figures after the past eight weeks of mostly bearish trading.

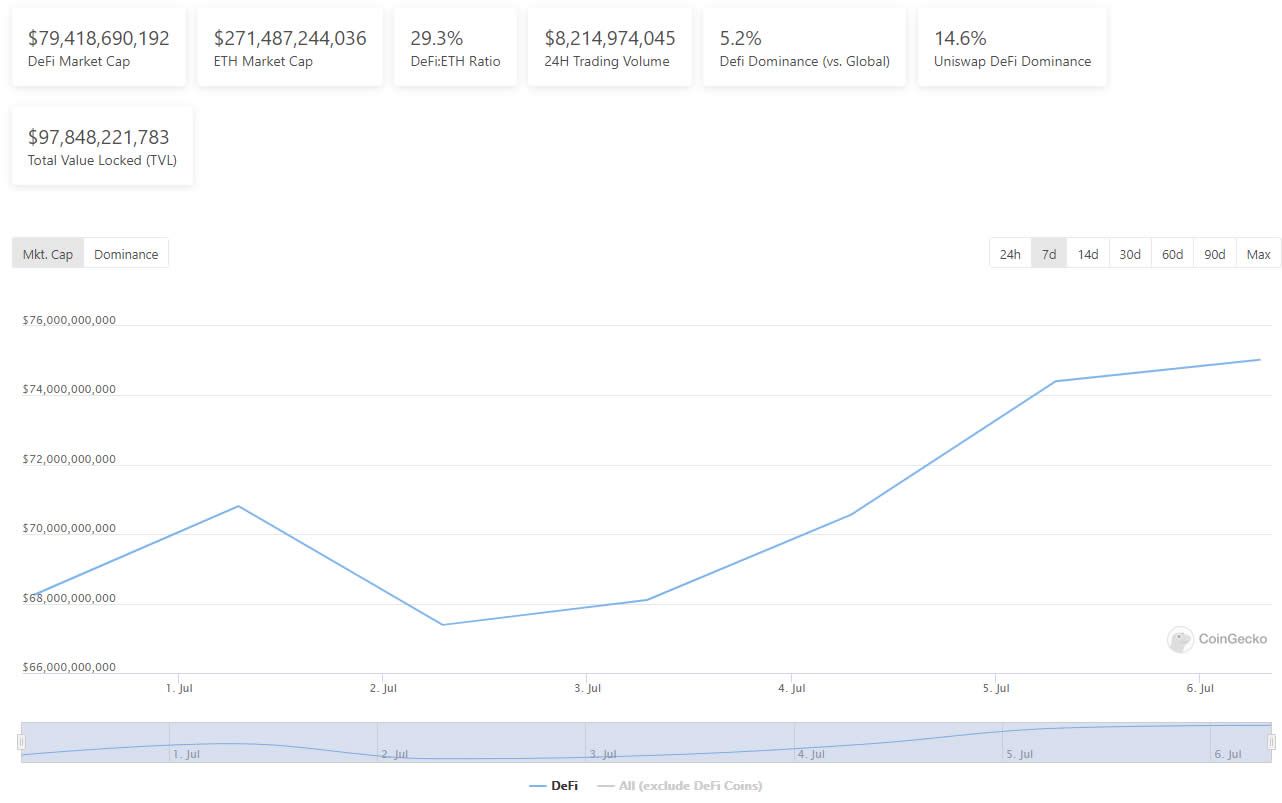

CoinGecko’s top-100 DeFi tokens by market cap index reports a market cap of $79 billion which represents around 5.3% of the total. This has increased by almost 7% over the past 24 hours suggesting DeFi tokens are in the lead today.

Top performers and TVL

The top-performing DeFi asset in that list is Instadapp’s newly launched governance token INST. The token has surged a whopping 62% over the past 24 hours to reach $5.22.

The Alpha Finance ALPHA token has pumped 50% on the day to reach $0.758. Meanwhile, Enzyme Finance’s MLN token takes third place with a 38% surge following a Yearn Finance partnership and Binance listing.

Other DeFi tokens performing strongly today from that list include Synthetix (SNX), Aave (AAVE), Linear (LINA), Perpetual Protocol (PERP), and Compound Finance’s COMP.

In terms of total value locked (TVL), DappRadar is reporting a total of $81 billion across all platforms listed. DeFiLlama, which lists a lot more, puts the total TVL at $112 billion.

The leading protocol at the time in terms of TVL is Aave with around $8.7 billion locked up. Uniswap is a close second with $8.4 billion in collateral lockup while Curve Finance comes in third with $7.3 billion according to DappRadar.

The total amount locked into Binance Smart Chain-based projects is $18.9 billion according to BSCproject. The PancakeSwap DEX leads the pile here with a TVL of $7.5 billion.

All TVL figures are down between 20-30% from their mid-May peaks, but they have been making solid gains over the past week or two.

Bloomberg DeFi index

In a related development, a new DeFi Index has been spied on the Bloomberg Terminal. Screenshots were posted by Bloomberg TV’s Joe Weisenthal on July 6.

The index is sourced from the MVIS CryptoCompare DeFi 20 Index which includes the top-20 assets in the sector, accordingly weighted.

DeFiPulse has its own index called the DPI, which was trading up 15% on the day, and IndexCoop launched a Metaverse Index for NFTs in April.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.