Coinbase Pro will list ADA, opening inbound transfers of the assets before launching full trading on March 18.

Coinbase announced on March 16 that it had opened inbound transfers for ADA, taking the first step in the multi-stage process to list the token.

Full trading will begin on March 18, once sufficient liquidity has been established. It currently supports only withdrawals to Shelley addresses, with Byron addresses to be supported soon.

Once liquidity has been established, order books will move through post-only, limit-only, and full trading phases. This will likely take a few days.

Listings on Coinbase Pro are usually followed by a listing on the retail exchange. This would be a major step up for ADA, giving it exposure to a whole new swathe of investors. Coinbase has a strong presence in the United States.

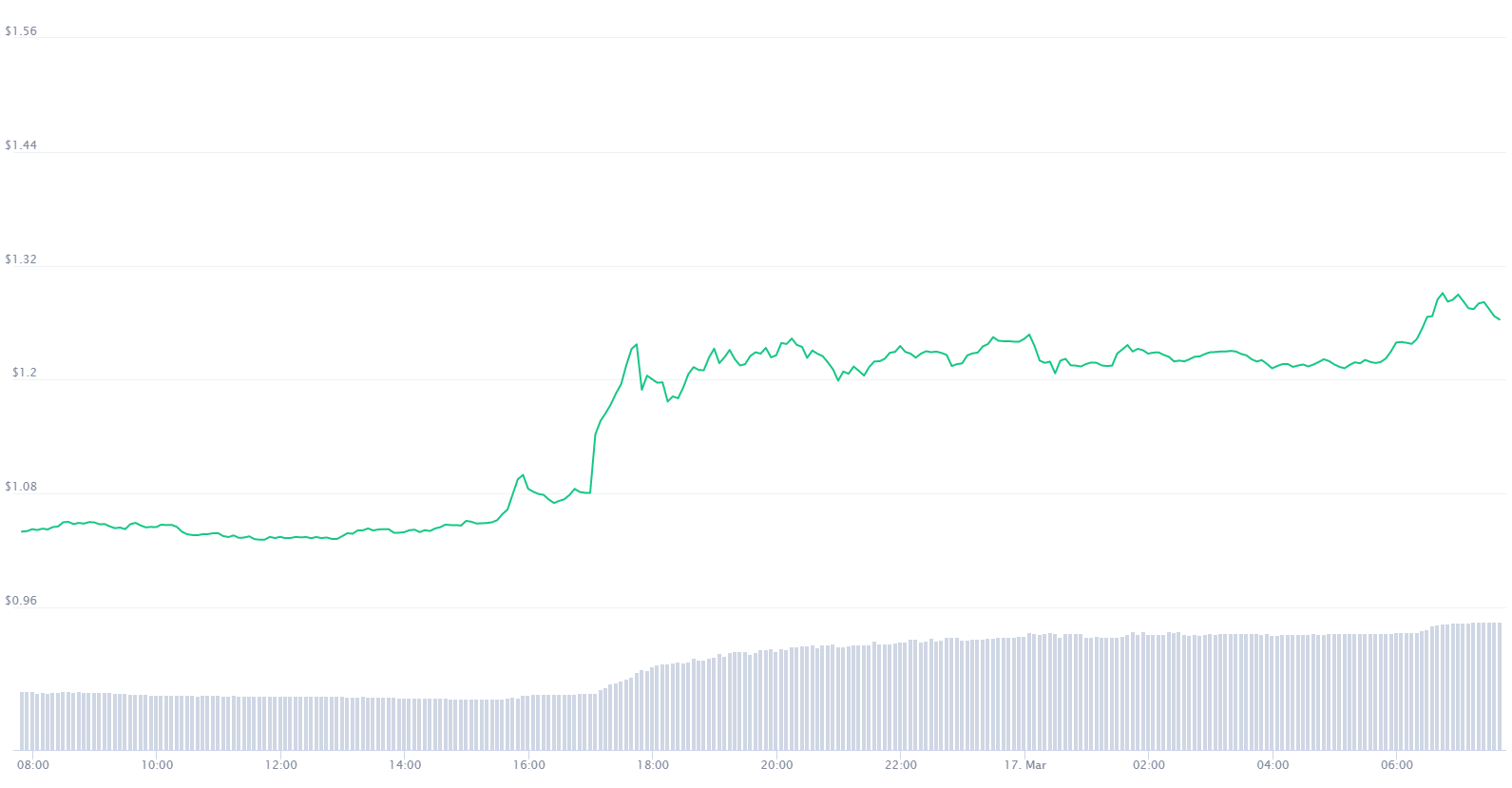

Cardano recently underwent a major upgrade to its network, which has helped boost its price to new highs. In the past 24 hours alone, it has risen by 22% — and investors are expecting further rises with the Goguen upgrade slated for release soon. It was also recently added to the Bloomberg Terminal.

Goguen intends to make the Cardano network a haven for dApps, something it currently lacks. Ethereum, on the other hand, has several dApps with major user bases. This has been one of the primary criticisms of Cardano, though it looks like these doubts could be put to rest soon.

Coinbase Lists More Assets, Prepares to Go Public

Coinbase has listed several assets in the past few months, including many from the DeFi space. Among these include SushiSwap (SUSHI), Aave (AAVE), The Graph (GRT), and Bancor (BNT).

Coinbase will directly be listed on stock exchanges this month, opting for a direct listing as opposed to an IPO. Direct listings are cheaper, faster, and avoid share dilution. This comes at a time when multiple cryptocurrency companies are looking at going public.

The exchange has been valued at $90 billion after the latest round of private auctions, putting it well and above the rest. When listed, it will go under the ticker of ‘COIN’. The exchange is capitalizing on the heightened interest in the crypto market, which continues its massive rally with Bitcoin recently crossing $61,000.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.