In this article, BeInCrypto takes a look at the seven altcoins that increased the most over the past seven days (Feb. 26–March 5):

The biggest altcoin gainers are:

- Chiliz (CHZ) – 146%

- Enjin Coin (ENJ) – 106%

- Theta Fuel (TFUEL) – 92%

- Decentraland (MANA) 57.3%

- THETA (THETA) – 48%

- NEM (XEM) – 45%

- Basic Attention Token (BAT) – 43%

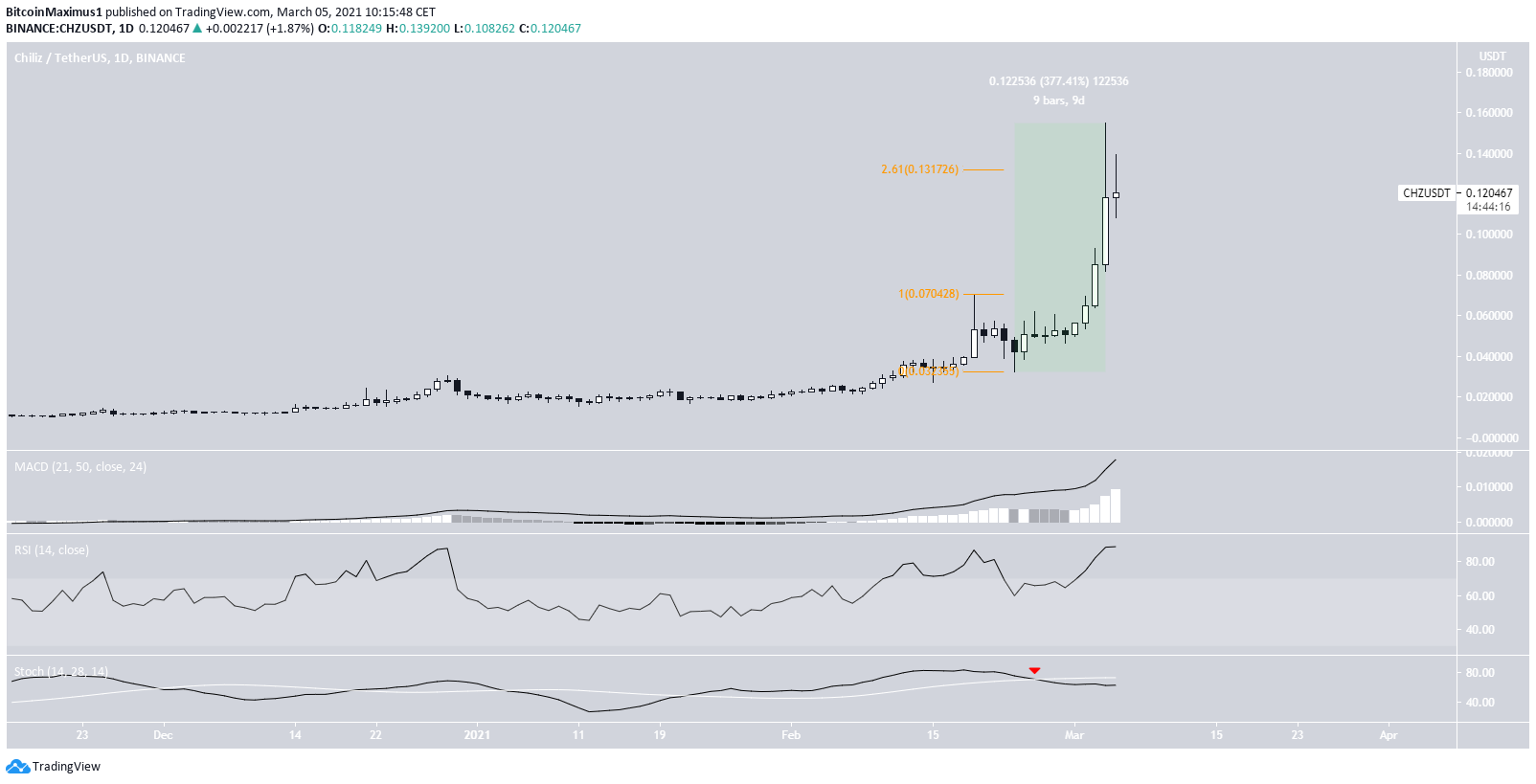

Chiliz (CHZ)

CHZ was the biggest gainer from last week, increasing by a massive 377% over the past nine days. On March 4, it reached an all-time high price of $0.155 but failed to sustain it.

Moreover, it has left a very long upper wick in place — nearly the entire height of the body.

The all-time high was made above the 2.61 external Fib retracement of the most recent downward movement, which often acts as the top in such patterns. The failure to close above this level is a sign of weakness.

Nevertheless, while the Stochastic oscillator has made a bearish cross, the RSI and MACD are increasing. This allows for the possibility that the parabolic increase will continue in the short-term, though it’s unsustainable in the long-term.

Enjin Coin (ENJ)

ENJ has been moving upwards since breaking out from and validating the previous all-time high resistance as support. This occurred on Feb. 23. ENJ has increased rapidly since.

This led to an all-time high price of $1.58 on March 4. At that point, ENJ had increased by a massive 375% in less than two weeks.

Despite weekly technical indicators being bullish, it’s possible that a short-term retracement could occur.

This is because similarly to CHZ, ENJ has moved above the 2.61 external retracement level, though it has failed to close above it.

Therefore, despite the long-term trend being bullish, the parabolic rate of increase and failure to close above an important Fib resistance suggests that a short-term retracement could occur.

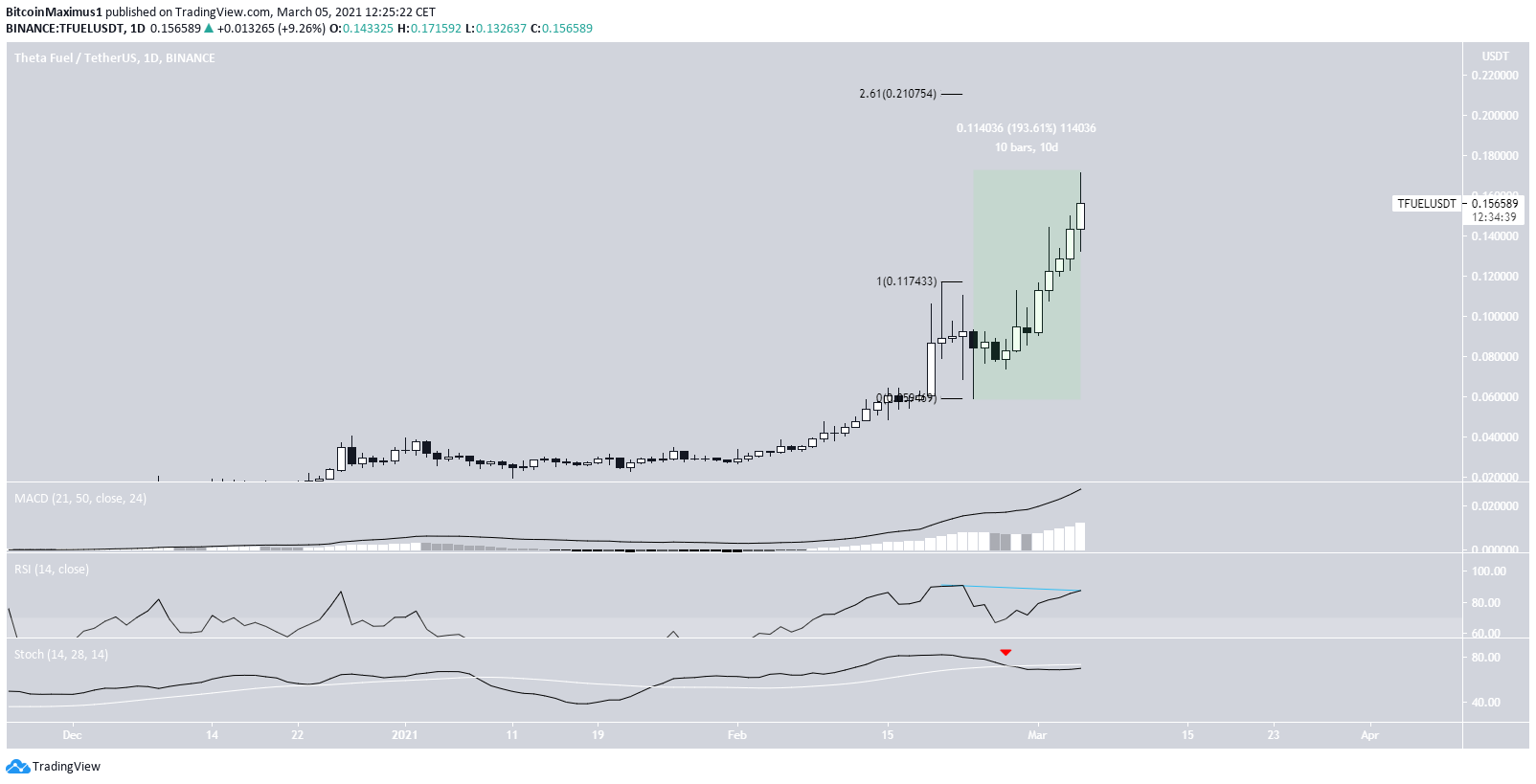

Theta Fuel (TFUEL)

TFUEL has been moving upwards since Feb. 23, when a low of $0.059 was reached. The increase continued until a new all-time high price of $0.171 was reached on March 5. This amounted to a near 200% increase in only ten days. TFUEL has decreased slightly since.

Technical indicators are showing weakness, as evidenced by the bearish divergence in the RSI and the bearish cross in the Stochastic oscillator. Both are signs of an impending decrease.

If TFUEL were to continue increasing instead, the next closest resistance area would be found at $0.21.

Decentraland (MANA)

MANA broke out from the previous all-time high resistance area of $0.235 at the beginning of February. After retesting the level as support, it initiated a bounce. This led to an all-time high price of $0.468 on March 4.

The ongoing bounce was preceded by a hidden bullish divergence in the RSI.

Both the MACD and Stochastic oscillator are increasing. Therefore, if MANA were to continue its bullish trend, the next closest resistance area would be found at $0.69.

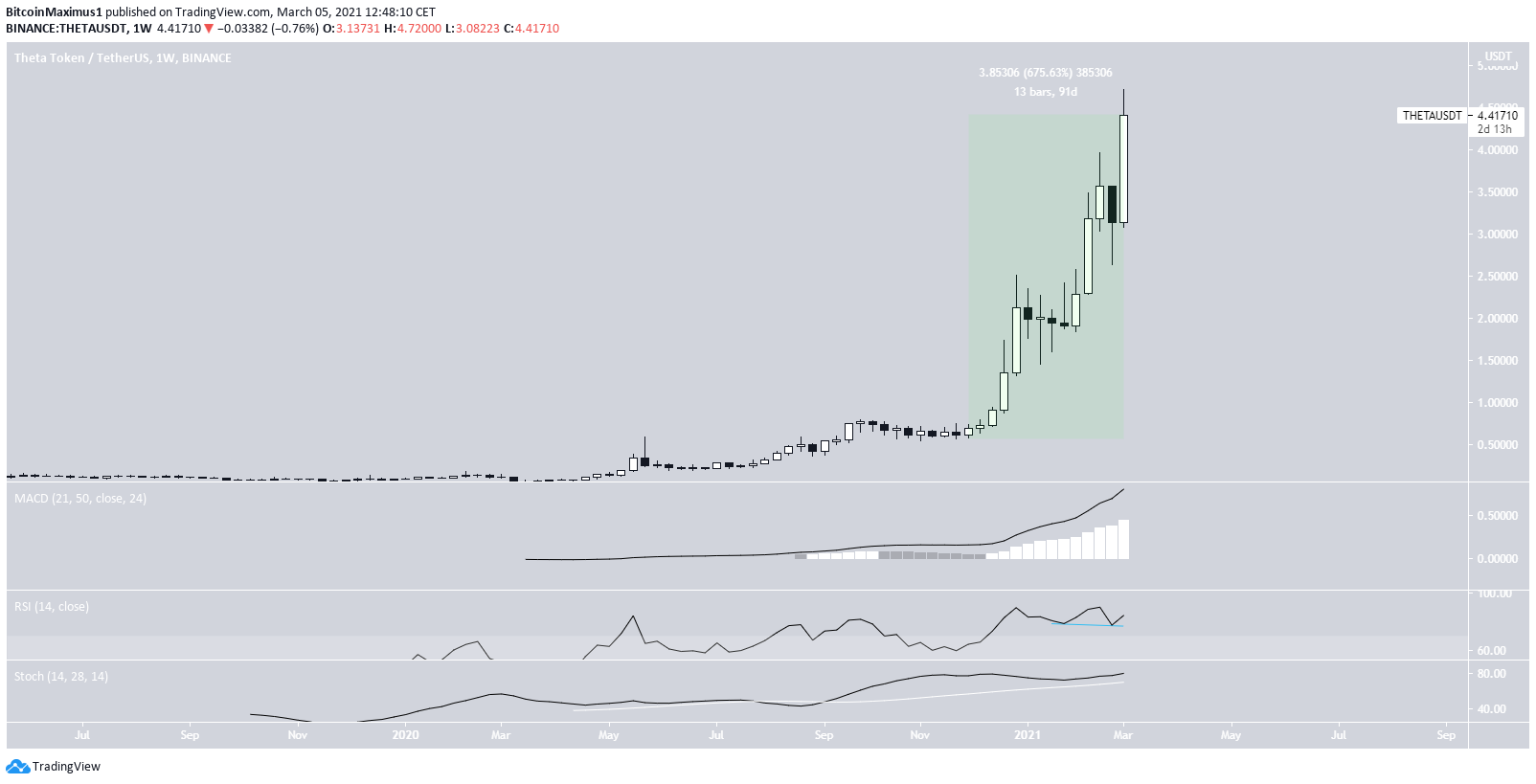

THETA (THETA)

THETA has been on an extended upward movement since November 2020. It has increased by 675%.

Today, it reached a new all-time high price of $4.72.

The MACD, RSI, and Stochastic oscillator are increasing. The RSI has generated a hidden bullish divergence.

However, the rally is completely parabolic and THETA has moved above all targets from prior to the breakout.

NEM (XEM)

XEM reached a local high of $0.93 on March 3, but created a shooting star candlestick and has been decreasing since.

Technical indicators are also showing weakness. The RSI has generated a bearish divergence, the Stochastic oscillator has made a bearish cross, and the MACD has generated a lower momentum bar.

Out of the coins presented in this article, the outlook for XEM seems the most bearish. This is due to the long-term bearish divergence on top of the parabolic rate of increase.

Basic Attention Token (BAT)

BAT has been moving upwards since breaking out from a long-term descending resistance line and validating it as support after. This occurred last week. BAT bounced considerably afterward, leading to a high of $0.87 this week.

However, BAT has failed to close above the $0.75 long-term resistance area, leaving a long upper wick instead.

Nevertheless, technical indicators are bullish. This is evidenced by the bullish cross in the Stochastic oscillator and the increasing MACD and RSI. This indicates that BAT is likely to move higher — potentially towards the previous all-time high of $1.086.

This theory is also supported by the six-hour chart that shows a breakout and retest of the $0.066 support area.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.